Join our fan page

- Views:

- 7404

- Rating:

- Published:

- 2011.06.24 13:02

- Updated:

- 2016.11.22 07:32

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Author: Andrey N. Bolkonsky

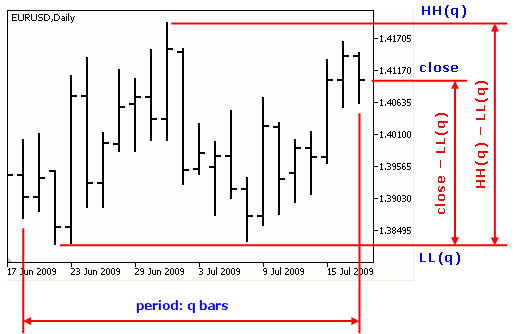

Stochastic Indicator (smoothed q-period Stochastic) by William Blau is based on Stochastic Indicator (see Momentum, Direction, and Divergence: Applying the Latest Momentum Indicators for Technical Analysis).

It shows the distance between the close price and lowest price of the q bars. The numerical value of Stochastic shows the price position relative to the lowest price of the period (q bars), the values are >=0.

- WilliamBlau.mqh must be placed in terminal_data_folder\MQL5\Include\

- Blau_TStoch.mq5 must be placed in terminal_data_folder\MQL5\Indicators\

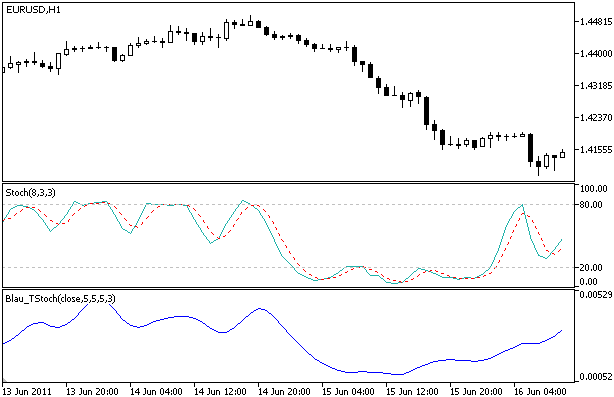

Stochastic Indicator Blau_TStoch

Calculation:

The following formula is used for the calculation of q-period Stochastic:

stoch(price,q) = price - LL(q)

- price - close price of the current timeframe;

- q - number of bars, used in calcualtion of Stochastic;

- LL(q) - lowest price of the q bars.

The smoothed q-period stochastic is calculated as follows:

TStoch(price,q,r,s,u) = EMA(EMA(EMA( stoch(price,q) ,r),s),u)

where:

- price - close price;

- q - number of bars, used in calcualtion of Stochastic;

- stoch(price,q)=price-LL(q)- q-period Stochastic;

- EMA(stoch(price,q),r) - 1st smoothing- exponentially smoothed moving average with period r, applied to Stochastic;

- EMA(EMA(...,r),s) - 2nd smoothing - EMA of period s, applied to result of the 1st smoothing;

- EMA(EMA(EMA(...,r),s),u) - 3rd smoothing - EMA of period u, applied to result of the 2nd smoothing.

Input parameters:

- q - period, used for the calculation of Stochastic (by default q=5);

- r - period of the 1st EMA, applied to stochastic (by default r=20);

- s - period of the 2nd EMA, applied to result of the 1st smoothing (by default s=5);

- u - period of the 3rd EMA, applied to result of the 2nd smoothing (by default u=3);

- AppliedPrice - price type (by default AppliedPrice=PRICE_CLOSE).

Note:

- q>0;

- r>0, s>0, u>0. If r, s or u =1, smoothing is not used;

- Min. rates =(q-1+r+s+u-3+1).

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/363

Blau_Ergodic

Blau_Ergodic

Ergodic Oscillator by William Blau.

Blau_TSI

Blau_TSI

True Strength Index (TSI) indicator by William Blau.

Stochastic Index Blau_TStochI

Stochastic Index Blau_TStochI

Stochastic Index Indicator (normalized smoothed q-period Stochastic) by William Blau.

Stochastic Oscillator Blau_TS_Stochastic

Stochastic Oscillator Blau_TS_Stochastic

Stochastic Oscillator by William Blau.