Join our fan page

- Views:

- 9110

- Rating:

- Published:

- 2016.11.15 14:31

- Updated:

- 2017.05.02 17:18

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

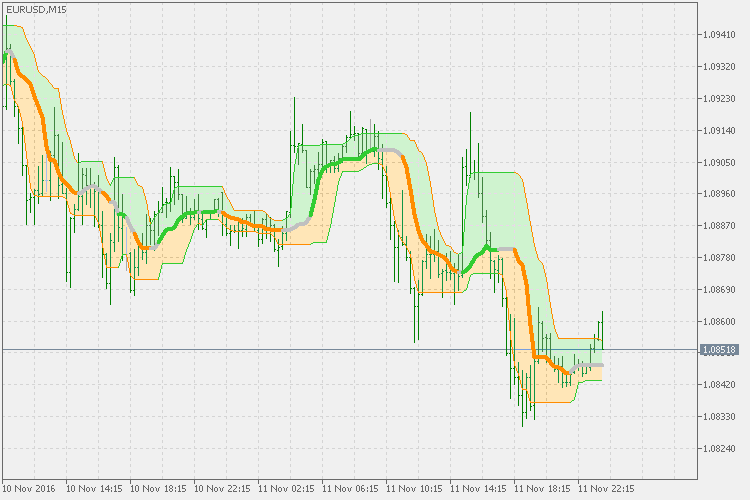

Quantile bands - that are using the following quantile(s) for calculation.

In statistics and the theory of probability, quantiles are cutpoints dividing the range of a probability distribution into contiguous intervals with equal probabilities, or dividing the observations in a sample in the same way. There is one less quantile than the number of groups created. Thus quartiles are the three cut points that will divide a dataset into four equal-size groups (cf. depicted example). Common quantiles have special names: for instance quartile, decile (creating 10 groups: see below for more). The groups created are termed halves, thirds, quarters, etc., though sometimes the terms for the quantile are used for the groups created, rather than for the cut points.

q-Quantiles are values that partition a finite set of values into q subsets of (nearly) equal sizes. There are q − 1 of the q-quantiles, one for each integer k satisfying 0 < k < q. In some cases the value of a quantile may not be uniquely determined, as can be the case for the median (2-quantile) of a uniform probability distribution on a set of even size. Quantiles can also be applied to continuous distributions, providing a way to generalize rank statistics to continuous variables. When the cumulative distribution function of a random variable is known, the q-quantiles are the application of the quantile function (the inverse function of the cumulative distribution function) to the values {1/q, 2/q, …, (q − 1)/q}.

But wit a deviation and "generalized".

All the "bands" version of quantile

bands are using 3 prices. This version is not. It is suing only one

price, and for having an option to make a (substantial) difference

between high and low, you can chose the period for finding out high and

low value(s). But even without that (when the high/low period is set to

<=1) the bands calculation itself does the job OK, and in most of the

cases there is no need at all to have high/low period activated at all.

The reason for the "generalized in the name:

This indicator can be applied to any other indicator too. So, it does not necessarily need to be applied to prices. And some of the usage like that (just a quick example of quantile bands applied to rsi and stochastic) can give quite interesting results.

Double smoothed stochastic

Double smoothed stochastic

Double smoothed stochastic - extended

Swing line - extended version

Swing line - extended version

Extended swing line indicator

MACD using QWMA

MACD using QWMA

MACD that uses QWMA for calculation

QWMA - quadratic weighted moving average

QWMA - quadratic weighted moving average

QWMA - "quadratic weighet moving average" new generation