Vibe Trading with NervaTradeAI

1 • Why another trading tool?

I love algorithmic trading, but I’m tired of “AI” buzzwords that never work on MetaTrader. So I built N.E.R.V.A. — Neural Enhanced Real‑time Vision Analytics: a free REST API that lets any language (including MQL5) plug straight into a multimodal generative‑AI engine. The idea is simple:

Describe the trade in plain English → the AI reads your chart(s) → opens & manages the position.

I call this Vibe Trading. Forget coding 1 000 lines — just write a prompt.

2 • What makes Vibe Trading different?

| Typical algo EA | Vibe Trading EA |

|---|---|

| Needs strong MQL5 skills | Needs one prompt |

| Runs inside MT5 single thread | Heavy AI runs off‑terminal |

| Fixed rules | Update strategy by editing text |

| Broker freeze‑level often blocks HFT | Works best on H1+ charts |

The EA you download is just the messenger; the heavy lifting happens on our servers, so MT5 never freezes.

3 • Getting started in 3 minutes

- Download EA: NervaTrade‑Metatrader.zip

- Create an account: app.nervatrade.com → copy your API key.

- Attach EA → paste key → paste your prompt.

- Select timeframe (H1 recommended) & magic number.

- Telegram alerts + manage trades with Position Manager.

Images

4 • Sample FREE strategy

“SMC + 4 EMA H1” — favourite template:

Look for the last SMC bullish BOS on H1. Confirm with EMA‑5 , EMA‑10 , EMA‑60 , EMA‑223.

The EA hedges and averages on key S/R; human intervention when Telegram pings. Indicator “SMC” from LuxAlgo is free.

<strategy>

<general_instructions>

• Time-frame: M5 execution, M15-H1 context

• EMAs: 5 / 10 / 60 / 223

• Chart-cleanliness rule → output "NEUTRAL" if tangled ≥5× in 12 candles

• AI returns LONG / SHORT / NEUTRAL on each new M5 candle

</general_instructions>

<buy_conditions>

1. Market structure → bullish BOS / CHoCH on M5

2. EMA alignment → EMA-5 > 10 > 60 > 223 **or** sweep below 223

3. Order block → re-entry into demand OB with volume spike

4. Liquidity sweep → stop-run below low + reversal engulfing/pin-bar

5. Fair-Value Gap → unfilled bullish FVG

</buy_conditions>

<sell_conditions>

1. Market structure → bearish BOS / CHoCH on M5

2. EMA alignment → EMA-5 < 10 < 60 < 223 **or** sweep above 223

3. Order block → re-entry into supply OB with volume spike

4. Liquidity sweep → stop-run above high + reversal

5. Fair-Value Gap → unfilled bearish FVG

</sell_conditions>

<neutral_conditions>

• “Dirty” chart (EMA rule)

• Low volatility (ATR20 < ATR50)

• Conflicting bias between M15/H1 and M5

• Lack of valid OB / FVG / sweep

</neutral_conditions>

<data_sources>

@{@SYMBOL,OHLC[M5,500]}

@{@SYMBOL,OHLC[M15,300]}

@{@SYMBOL,OHLC[H1,200]}

@SCREENSHOT[@SYMBOL,M5,TEMPLATE(SMC_4_1.tpl)]

@SCREENSHOT[@SYMBOL,M15,TEMPLATE(SMC_4_1.tpl)]

@SCREENSHOT[@SYMBOL,H1,TEMPLATE(SMC_4_1.tpl)]

</data_sources>

</strategy>

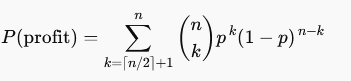

5 • Math behind many small edges

Allocate only R % of equity to each strategy and the worst-case daily drawdown is ≤ n × R. More legs → lower variance → smoother equity curve.

6 • Toolbox

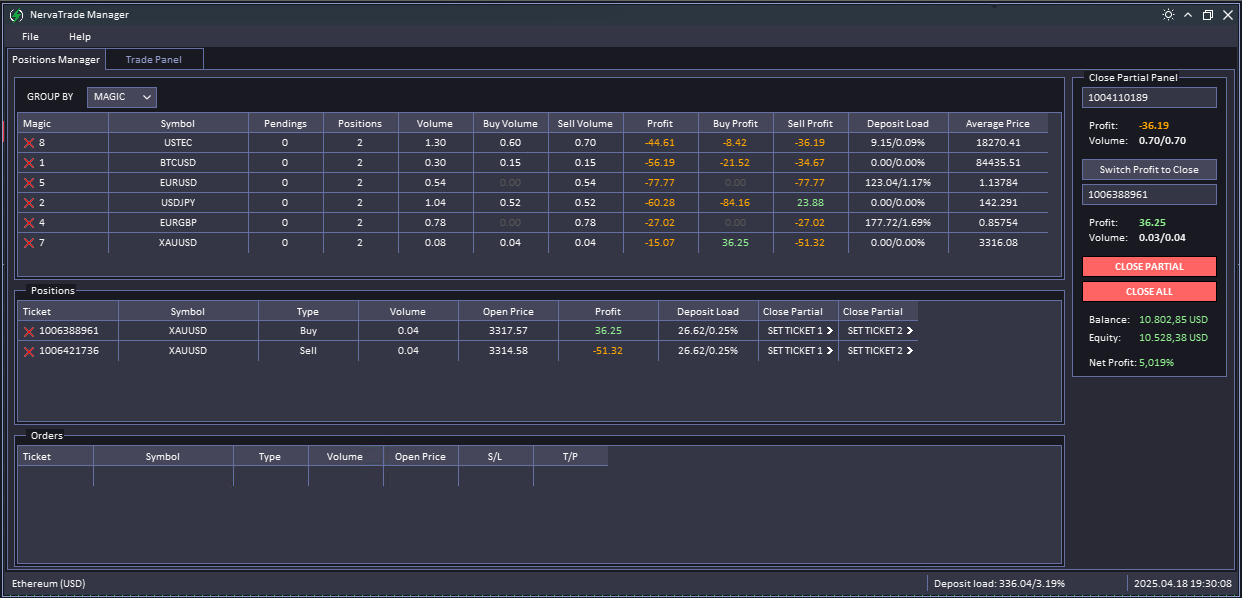

- Position Manager — live risk, partial closes, exposure load.

- Trade Panel — quick entries by symbol or magic number.

- Works on hedging accounts (Bybit crypto, any MT5 FX/CFD).

7 • Road‑map

| Feature | ETA |

|---|---|

| COT report auto‑prompt | Q2 2025 |

| News & sentiment fusion | Q3 2025 |

| Python/JS SDK | On demand |

| Early‑bird price lock | Now |

8 • Join the project

- Star us: GitHub repo

- Want a branded EA? DM me for a custom endpoint.

- Everything above is free; paid plans only cover servers.

Vibe Trading is just the start. Plug in, experiment, and let’s push algo trading forward together!