THE SECRET TO PRECISE ENTRY: HOW TO INCREASE TRADE PROBABILITY TO 85%

![]()

Want to know when and where is the best time to enter a trade?

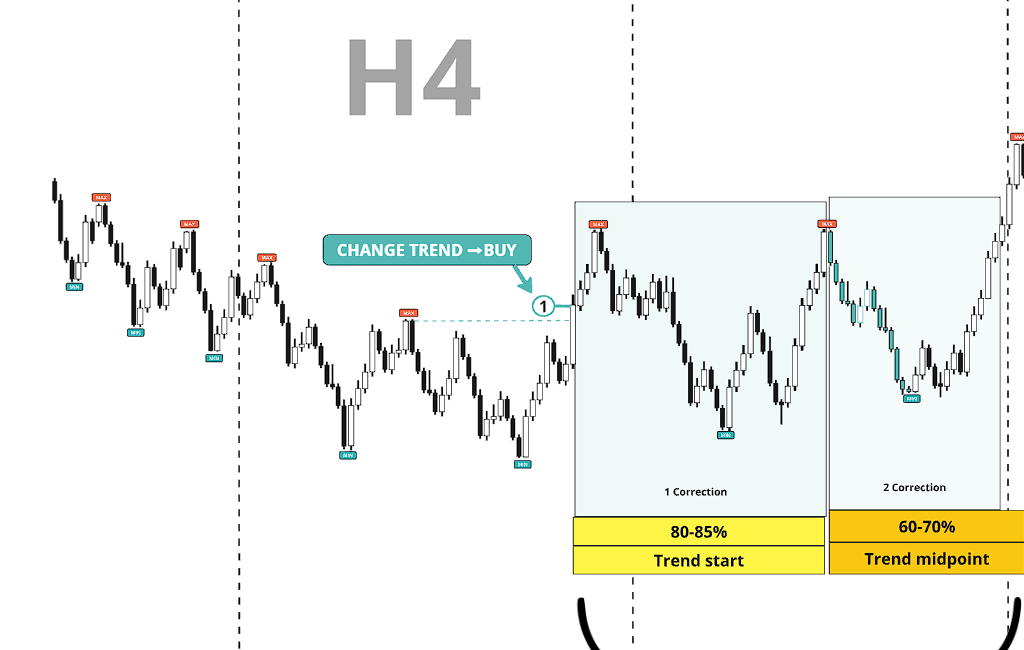

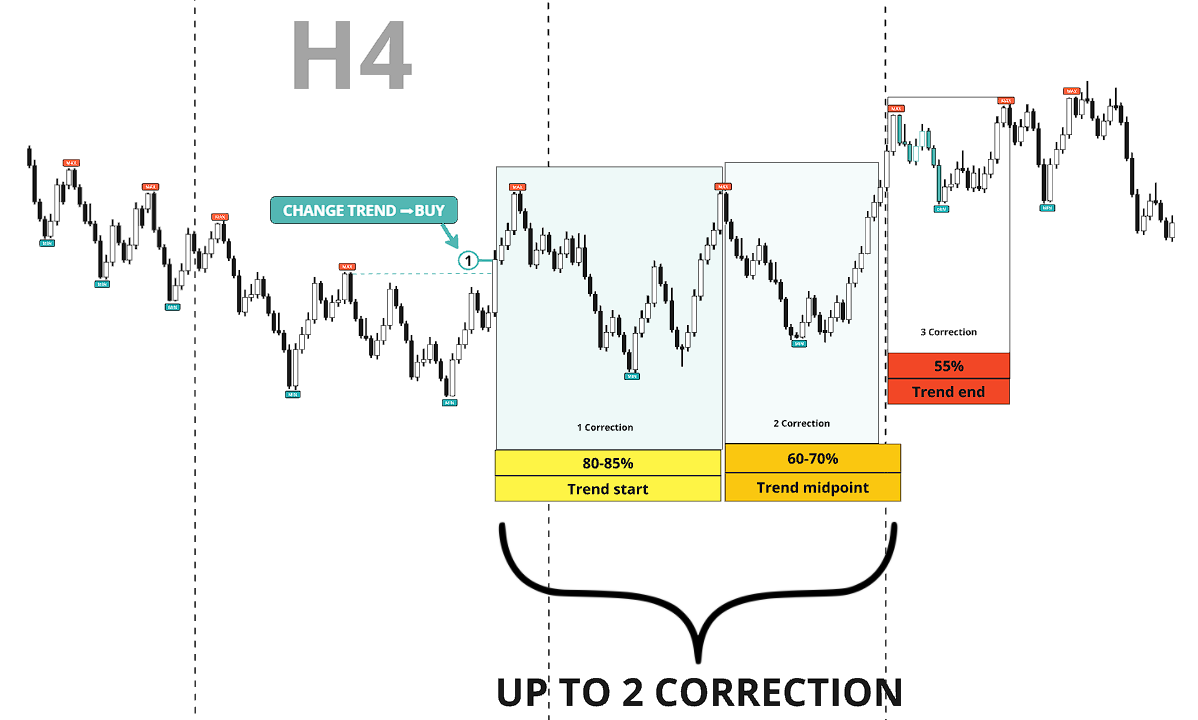

In the world of trading, the key to successful trading is not just following a trend, but understanding its structure and subtleties. One of the most powerful tools for making the right decisions is correction analysis. It is corrections that allow traders to find the best entry points with high accuracy and minimize risks.Interesting fact: in most cases, trends do not exceed two corrections, which opens up unique opportunities for traders to analyze and enter the market.Statistics show that in 50% of cases, a trend consists of no more than two corrections. This knowledge gives traders a significant advantage, allowing them to predict further price movement with a high degree of accuracy. Using this information, you can build an entry strategy in such a way as to minimize risks and maximize potential profits.

At the first correction, the probability of profitable trades is 80-85%. This is the best moment to enter a trade, since the trend is still strong, and the correction provides an opportunity to enter at a favorable price before the trend continues its movement. The first correction often attracts experienced traders who seek to take advantage of the price movement with minimal risk. This is where you can see the activity of large players who use the correction to gain positions. It is important to remember that when entering at the first correction, you need to consider additional factors such as volumes, candlestick patterns, and support and resistance levels.

During the second correction, the probability of profitable trades decreases to 60-70%. The trend may already be losing strength, and after the second correction, traders face greater risks than when entering during the first correction. However, the second correction can still provide an opportunity for successful trading, especially if the trend is strong enough and supported by fundamental factors. Entering during the second correction requires more careful analysis. It is necessary to take into account the trading volume, price behavior and indicator signals. The risk is higher than during the first correction, and it is important to be confident in the continuation of the trend. Using additional confirmation signals will help to ensure that the trend will continue and the correction is complete. Although the probability of successful trades is lower, with the right analysis, the second correction can still bring profit.

After the third correction, the probability of profitable trades drops to 50-55%. This is an important signal about the possible end of the trend or its significant weakening. Entering a trade on the third correction is associated with high risk, as the price may start moving against the main trend. Many traders prefer to refrain from trades on the third correction, waiting for confirmation of the continuation of the trend or its change. Here it is important to take into account macroeconomic factors, news and the behavior of large players that can influence further price movement.

Knowing how a trend behaves at various stages of corrections allows traders to better navigate the current state of the market. Experienced traders use this data to fine-tune their strategies, minimize risks, and increase profitability. The TPSpro TREND PRO indicator can greatly simplify this process by helping to pinpoint exactly where the price is in the trend and highlighting the extremes (minimums and maximums) for each correction. This tool automatically analyzes the market, reducing the subjective factor and increasing the accuracy of trading decisions.By using the TPSpro TREND PRO indicator, traders can easily identify potential entry and exit points, manage their positions effectively, and make informed decisions. The indicator is suitable for both beginners and experienced traders, helping them adapt to changing market conditions and trade with a high degree of confidence.Thus, successful trading is based on understanding the trend structure and competent analysis of corrections. Using modern analysis tools, such as TPSpro TREND PRO, allows you to significantly increase your chances of success and make trading more predictable and profitable.

![]()