The market doesn’t move randomly—it respects levels of significance, and the Gann Levels Indicator is here to help you uncover them. In this post, we analyze the EUR/GBP pair, starting with the weekly chart’s crucial support zone and diving into the precision of the M15 timeframe. Discover how the Gann Levels Indicator not only identifies these pivotal zones but also empowers traders to make informed decisions. Whether you’re managing risks or maximizing profits, this tool is your ultimate trading edge. Let’s explore how it can transform your trading strategy!

💡 Crucial Support Identified on the Weekly Chart:

The EUR/GBP weekly chart highlights a key support zone that has held firm since 2016, demonstrating the market’s repeated respect for this level over the years. Now, in 2024, the price is once again testing this critical support, making it a pivotal moment for traders. This level has proven to be a pivotal zone in the past, acting as a strong barrier against further price declines in 2016, 2017, 2020, 2022, and now once again in 2024. Such consistency highlights the importance of this level, as it reflects a zone where buyers have historically stepped in to regain control.

-

Historical Significance: Each time the price has approached this support, the market has witnessed a reversal or significant price recovery. This indicates that market participants closely watch this level for potential buying opportunities.

-

Possible Outcomes:

- Bounce Scenario: If the support holds, traders may see a rebound toward higher levels, aligning with previous patterns of price action.

- Breakdown Scenario: If the market breaks below this level with strong momentum, it could signal a major bearish shift, opening the door for further declines. The breakdown could trigger aggressive selling as traders react to the breach of this multi-year support.

-

Confirmation is Key: A confirmed breakout below this support should include higher-than-average volume and clear weekly candle closures beneath 0.8232. Without these confirmations, the level may still act as a reliable support.

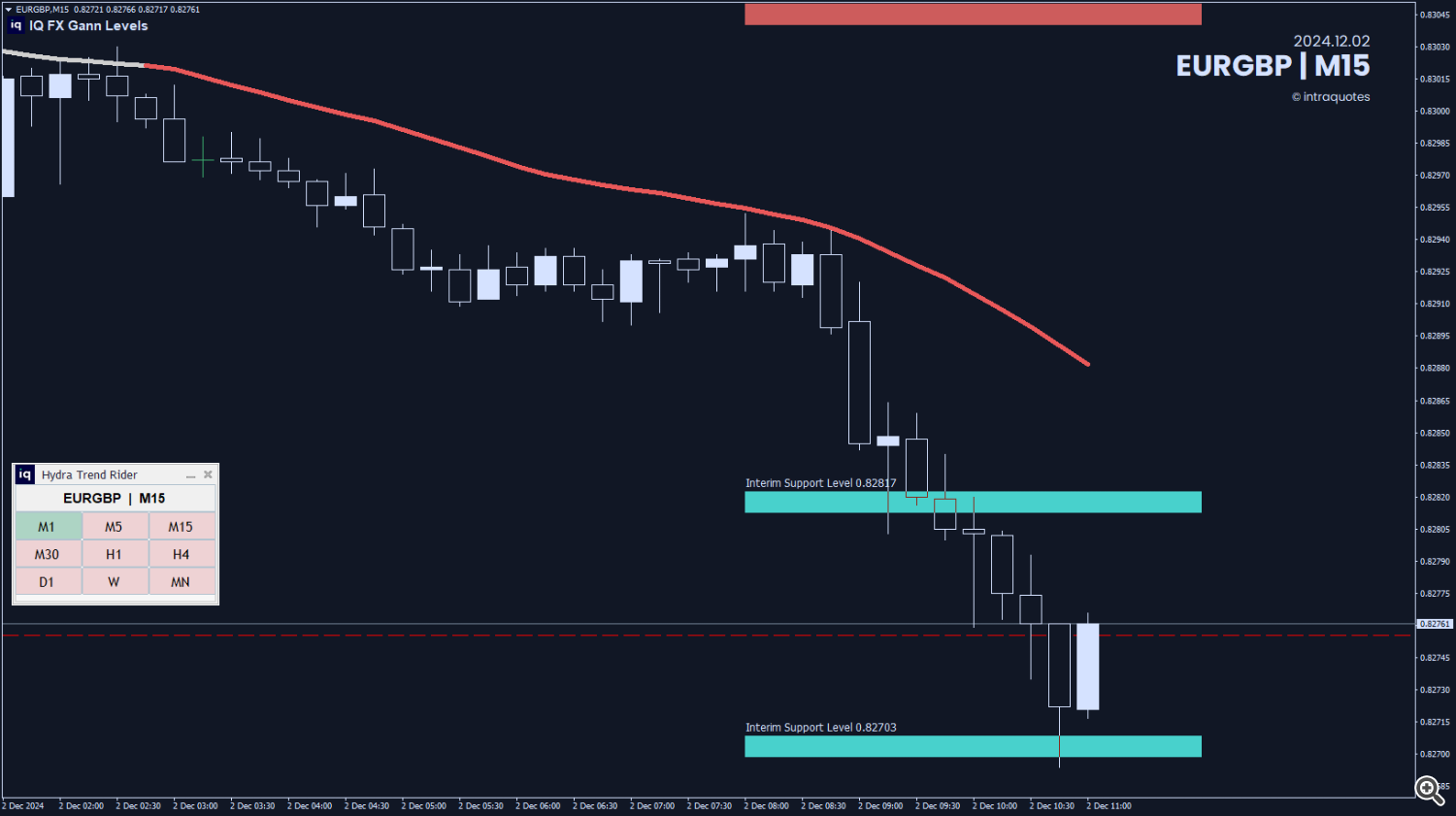

📈 Precision on the M15 Chart:

Zooming into the 15-minute timeframe, the Gann Levels indicator shows how the market precisely reacted to interim support levels at 0.82817 and 0.82703. These levels were not random—they were systematically identified by the Gann Levels, giving traders clear zones to anticipate potential reversals or breakouts.

💪 Empower Your Trading Decisions:

With the Gann Levels indicator, you’ll never second-guess your trades. It tells you when to go long or short, ensuring you’re trading with the trend, not against it. For instance, when paired with the Hydra Trend Rider, it beautifully aligns bearish signals with Gann levels, helping you avoid risky entries and capitalize on profitable ones.

👉 Why You Need This Tool:

This indicator is not just about identifying levels; it’s about making the right decisions at the right time. Whether you’re a scalper or a swing trader, the Gann Levels indicator is your guide to avoiding losses and maximizing gains.

If you're serious about maximizing your trading potential and minimizing risk, the Gann Levels Indicator is your ultimate ally. Start using it today and take control of your trading decisions with confidence!

⏬ IQ FX GANN LEVELS:

✅MT4- https://www.mql5.com/en/market/product/120026

✅MT5- https://www.mql5.com/en/market/product/119707

➡️ Get a FREE Strategy Guide with the purchase of our indicators. Message us directly after your purchase!

➡️Find other indicators here:

https://www.mql5.com/en/users/somfx/seller

➡️ MQL5 Channel for important market analysis posts:

https://www.mql5.com/en/channels/intraquotes/

Happy Trading! 😎

©intraquotes | DO NOT COPY THIS CONTENT

![[$9,496] in 5 Days Using 'Supply Demand EA ProBot' (Live Results) [$9,496] in 5 Days Using 'Supply Demand EA ProBot' (Live Results)](https://c.mql5.com/6/965/splash-preview-761070-1740062258.png)