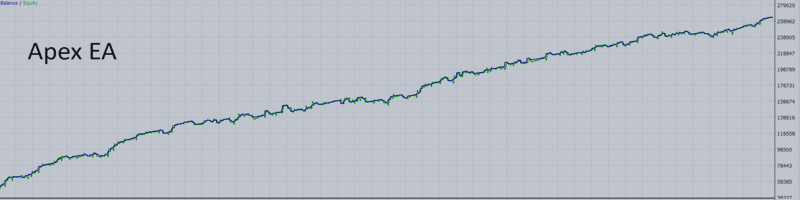

Philosophy Behind the Apex Trading Robot

This trading robot is designed to embody a disciplined, data-driven approach to market participation, rooted in the belief that successful trading is achieved through a balance of rigorous risk management, trend-aligned strategies, and adaptive exit mechanisms.

Check out the EA: https://www.mql5.com/en/market/product/122633?source=Site+Profile+Seller

I have been developing this EA for a year and I plan to further develop it, so you can expect multiple updates and improvements along the year.

Core Philosophy:

-

Stress Testing and Walk-Forward Testing: The robot is thoroughly tested under various market conditions to ensure robustness and reliability. This meticulous process helps identify potential weaknesses and optimize strategies before they are deployed in live trading.

-

Stop-Loss as a Lifeline: Capital preservation is the cornerstone of this trading philosophy. The robot employs a strict stop-loss mechanism to ensure that every trade is protected against excessive losses, maintaining the integrity of the overall portfolio.

-

Complex Entry and Dynamic Exit Strategies: The robot's entry strategies are designed to only engage in trades that align with the prevailing market trend, supported by confirmation indicators. This ensures that trades are made with the highest probability of success. Additionally, dynamic exit strategies are employed to adapt to changing market conditions, optimizing both profit-taking and risk management.

Robot Parameters Breakdown:

-

Risk Management:

- Volume Control: The robot adjusts trade volumes conservatively, reflecting a careful approach to managing risk and ensuring that exposure is kept within safe limits.

- Spread Filter: Trades are filtered to avoid entry during periods of high volatility, ensuring that trades are only executed under optimal conditions.

- Max Drawdown: A strict drawdown limit is set to halt trading activity if equity falls below a certain threshold, preventing significant losses.

-

Entry Strategy:

- Trend Alignment: The robot uses a combination of price action analysis and trend confirmation indicators to ensure that trades are placed in the direction of the overall market trend. This alignment increases the likelihood of profitable trades.

- Time Filters: Trading is restricted to specific hours when market conditions are typically more favorable, avoiding periods of low liquidity or high volatility.

-

Dynamic Exit Strategy:

- Flexible Exits: The robot’s exit strategies are dynamic, taking into account both time-based and price-based conditions. This flexibility allows the robot to adapt to market changes, ensuring trades are closed at the most opportune moments.

-

Profit and Loss Management:

- Take Profit and Close-Out Strategies: The robot is programmed to optimize profit-taking while maintaining a favorable risk-to-reward ratio. It also has the capability to close all trades at a predetermined time on certain days, aligning with overall market conditions and specific trading strategies.

Conclusion: The trading robot reflects a carefully crafted, systematic approach to trading. By integrating rigorous risk management, trend-following strategies, and dynamic exit mechanisms, the robot is designed to navigate the complexities of the financial markets effectively. The underlying belief is that consistent, disciplined application of these principles will lead to sustainable long-term trading success.

Below you can find the additional set files that you can use with the EA and its test results.

Have a great trading!