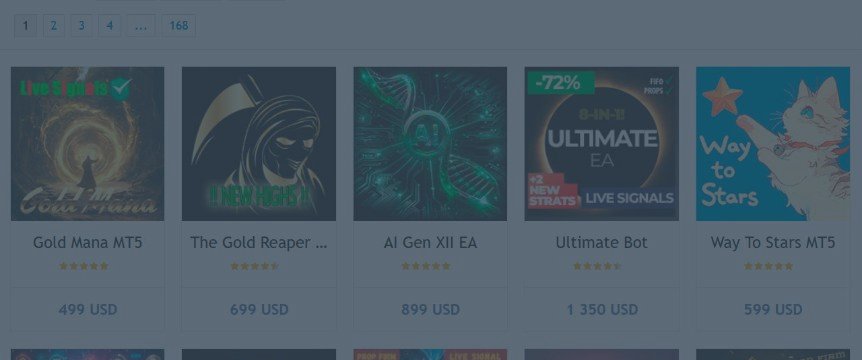

Top 10 Expert Advisors in the market - Will users find anything better in August?

I do it again! This is a new assessment of the top 10 strategies competing in the market. The previous assessment of July 1st is here.

I do this series of posts because I want to stay informed about what users buy and whether there is a good strategy after all.

NB: My assessment in this blog post may be totally wrong. I will recheck the top 10 after one month.

Biggest loser from the previous assessment: Ultimate Bot which made a 53% drawdown in July on its high-risk signal and canceled the 3-month profit on its low-risk signal.

Biggest discovery in this assessment: Users are stuck on Gold trading strategies. Right now Gold is in a channel. But what happens to these strategies when Gold enters its usual bumpy cycle in Autumn?

| As of August 1st | As of July 1st |

|---|---|

| 1/ Gold Mana MT5 bad | |

| 2/ The Gold Reaper MT5 bad | 1st position (was bad) |

| 3/ AI Gen XII EA good with restrictions | 9th position (was good) |

| 4/ Ultimate Bot bad | 5th position (was bad) |

| 5/ Way To Stars MT5 bad | 3rd position (was good with restrictions) |

| 6/ Golden Taipan FX bad | |

| 7/ Gold Trade Pro MT5 bad | |

| 8/ Diamond Titan FX bad | |

| 9/ Eternal Engine EA MT5 bad | 6th position (was good with restrictions) |

| 10/ Quantum Emperor MT5 bad | 8th position (was bad) |

Out of the top but still in the 1st page: Hercules AI, Quantum Queen MT5

Below the 1st page: FT Gold Robot MT5, Ai Multi Trend MT5

1/ Gold Mana MT5

74 purchases in the last month

5 reviews (approx. 50-75 total purchases)

Max revenue of the seller approx. 37K USD

Pros:

- It trades on a volatile Gold.

Cons:

- The historical test shows quick ups and downs of the equity line. There is no time for a drawdown.

- It is one symbol but it tests very slowly even on 1-minute OHLC data. I doubt the programming expertise of the author.

- The signal trades 0.75 for 10K USD while it should be 0.1 max.

Conclusion: It has no time for a drawdown. Prices fluctuate, right? You have to wait in order to win on Forex. You do not expect it to either quickly make a profit or cut a loss. Because in the end, when it misses a series of trades, it will be cutting losses like crazy. The ridiculous risk-to-profit ratio of this strategy will ruin the account.

2/ The Gold Reaper MT5

46 purchases in the last month (down from 59)

66 reviews (approx. 660 total purchases)

Max revenue of the seller approx. 375K USD

Pros:

- It trades on a volatile Gold.

- The signal has recovered from the June loss.

Cons:

- It is still betting mostly on a buy trend according to its signal history!!

- Average holding time 13 hours. It should be very choppy on Gold, and it is.

- You may want to check my previous assessments for more features.

Conclusion: Still not clear how this strategy trades. I looked at its historical test, I assume it is a grid. Gold is now in a channel. I believe it will fail you all guys as soon as Gold enters its usual bumpy cycle this Autumn.

3/ AI Gen XII EA

71 purchases in the last month (up from 66)

16 reviews (approx. 160 total purchases)

Max revenue of the seller approx. 80K USD

Pros:

- It uses the innovative ATFNet method.

- It trades on a volatile Gold.

Cons:

- A bad risk-to-profit ratio. 0.02-0.03 for 500 USD of deposit, while it should be at least 0.01 for 1000 USD.

Conclusion: I marked it good in the previous assessment. This is what I think now. I still believe it is good, but we expect Gold to make larger moves in Autumn. So it may still be good in August, while Gold honors the limits of a channel. But we'll see what happens next. My concern is that this kind of risk-to-profit ratio may ruin the account on Gold which may be very volatile.

4/ Ultimate Bot

38 purchases in the last month (up from 9)

21 reviews (approx. 210 total purchases)

Max revenue of the seller approx. 150K USD

Pros:

- Many symbols. Diversification is good.

Cons:

- It is a Martin strategy. It keeps increasing the volume, and then restarts the cycle.

Conclusion: As I noted in the previous assessment: you should stay away from Martin-based strategies. This strategy made a 53% drawdown in July on its high-risk signal. And it canceled the 3-month profit on its low-risk signal.

5/ Way To Stars MT5

27 purchases in the last month (down from 58)

14 reviews (approx. 140 total purchases)

Max revenue of the seller approx. 84K USD

Pros:

- Nothing.

Cons:

- It is a grid with a ridiculous risk-to-profit ratio.

- You may want to check my previous assessments for more features.

Conclusion: I marked it good in the previous assessment for small deposits. I change my mind now. It is bad. Forex is for serious people, not for grid-stuck gamers.

6/ Golden Taipan FX

35 purchases in the last month

3 reviews (approx. 30-35 total purchases)

Max revenue of the seller approx. 17.5K USD

Pros:

- Incredibly beautiful icons of the strategies by this author.

Cons:

- No signal for any of the multiple strategies sold by this author. You should never trust a historical test.

Conclusion: I think it is totally a scam. It is meant to seduce inexperienced users who think a nice historical chart is what you may expect from the live trading.

7/ Gold Trade Pro MT5

15 purchases in the last month

35 reviews (approx. 350 total purchases)

Max revenue of the seller approx. 175K USD

Pros:

- Nothing.

Cons:

- A bumpy signal with a 28% drawdown over 43 weeks.

- It is a lot of the same strategies from this author, all of which try to trade Gold.

Conclusion: Users seem to get stuck on Gold strategies this year. It is because Gold is very volatile. Some users get profits quickly and write their "true" adoring reviews. This motivates more users to get by. And after a while, no one understands why this strategy has become popular in the first place.

8/ Diamond Titan FX

18 purchases in the last month

11 reviews (approx. 110 total purchases)

Max revenue of the seller approx. 55K USD

Pros:

- It may be able to trade on stock indices, which is smth new for MetaTrader users.

Cons:

- I did a historical test for 2024, and I got 4 trades and a -1% profit.

- Signals are very bumpy. One of the signals shows a 24% drawdown over 18 weeks.

- A deposit of 200 USD for a volume of 1.0??

- No description of the strategy.

Conclusion: No desciption of the strategy. So let's suppose it is another grid system from an author who discovered how profitable it might be to sell scam to inexperienced users on this market.

9/ Eternal Engine EA MT5

24 purchases in the last month (up from 14)

12 reviews (approx. 120 total purchases)

Max revenue of the seller approx. 70K USD

Pros:

- A signal for 58 weeks.

Cons:

- It bumped in to a 18% drawdown in July after almost a year of good profits.

- It is a Martin strategy with a straight-line historical test.

- You may want to check my previous assessments for more features.

Conclusion: It is a Martin. Considering the huge 18% drawdown in July, I change my opinion from good to bad.

10/ Quantum Emperor MT5

8 purchases in the last month (down from 27)

293 reviews (approx. 2930 total purchases)

Max revenue of the seller approx. 2.5M USD

Pros:

- It trades on a volatile Gold.

Cons:

- The drawdown in the signal went to 85% (from 70% in the previous assessment).

Conclusion: The author keeps printing identical strategies that never recover from huge drawdowns. Interestingly, it is still in the top 10 of the market. This means users could not believe it was bad.