Definition of Order Book and Position Book

The Order Book is a fundamental component in financial trading that lists buy and sell orders for a particular asset. It organizes these orders by price level, showcasing the market's supply and demand dynamics. In the context of Forex trading, the Order Book comprises pending or limit orders, such as buy stops, buy limits, sell stops, and sell limits, alongside traders' position stop losses and take profits. This structured overview provides traders with insights into where market participants intend to execute their trades.

The Position Book, distinct from the Order Book, records opened positions held by traders. It includes both buy and sell positions, reflecting the current trading activity within the market. By visualizing open trades, the Position Book allows traders to identify prevailing trends and situational sentiment based on the distribution of these active positions across various price levels.

You can download & purchase this greatt tools here: Ziwox Live OrderBook

Why its important to trades?

The Order Book is vital for traders as it provides real-time insights into market sentiment and behaviors. By analyzing the Order Book, traders can detect both support and resistance levels, which can significantly influence their trading strategies.

Furthermoe, the Order Book acts as a leading indicator, offering early signals of potential price movements that enable traders to make informed entry and exit decisions.

And the Position Book is equally crucial, as it provides a comprehensive view of traders' current positions in the market. By studying these open trades, traders can gauge overall market sentiment and predict future price movements based on active positions. This information helps traders manage their risk effectively while aligning their strategies with existing market dynamics.

Advantages of OrderBook and PositionBook

The advantages of the Order Book include enhanced market transparency, as it displays the volume and price of placed orders. This transparency allows traders to identify prevailing demand and supply dynamics that help inform their trading decisions. Additionally, the Order Book enables traders to quickly respond to changing market conditions, optimizing their trading actions to manage their optimal position stop loss and take profits.

And about the the Position Book, It offers significant advantages by showing active trading positions that reflect the real-time attitudes of market participants. This insight allows traders to identify trading trends and make informed decisions regarding their strategies. Moreover, the Position Book aids in risk management by providing a clear depiction of currently held positions, which helps traders gauge potential market movements and analyse the future moves by checking the amount of position in profit or loss. Amazing.

Traders can forecast upward or downward pressure by analyzing the accumulations within both the Order Book and Position Book. For instance, significant clusters of Stop Loss orders often indicate potential price targets, while concentrations of limit orders near the current market price suggest support or resistance levels. Furthermore, the Position Book can reveal clusters of open buy or sell positions that could influence future price movements, offering a glimpse into potential directional pressure.In summary, you get these:

- Market Sentiment, The market is in the hands of buyers or sellers?

- find the probability support resistance levels (Supply and Demand)

- Find the traders Stop loss and take profit levels, So you know where and how they can be stop hunting!

- Determined the number of traders and positions that are in profit or in loss to predict the next market movements

Let's dive into the details.

How to Read the OrderBook

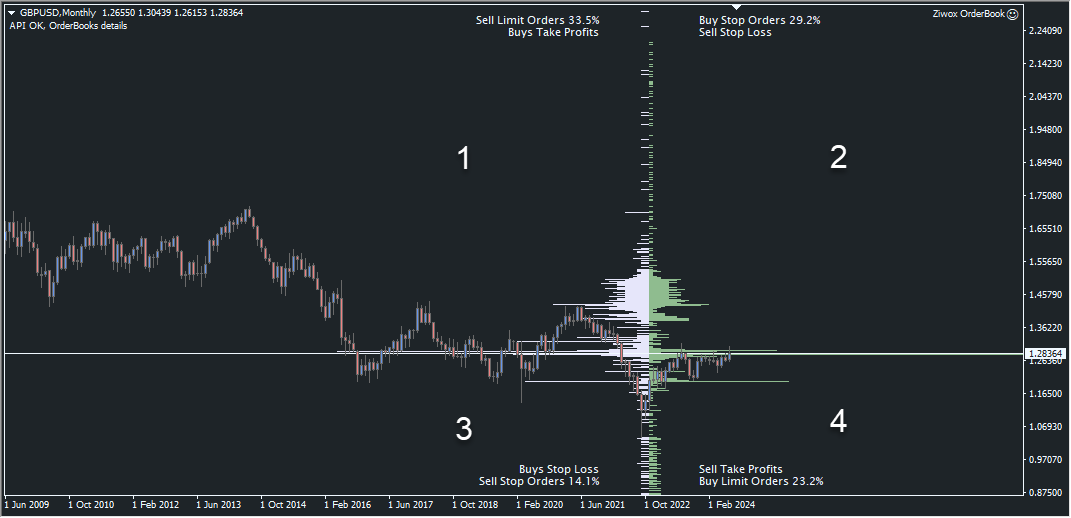

Image 1, GBPUSD OrderBook

Look at the image 1

Order Book, devide the market limit orders in 2 side, left side histogram (White bars) reflects sell orders. right side (Green) are buy limit orders. traders can benefit from its dual histogram representation. Traders can see in which areas there is significant compression of orders to indicating potential support or resistance levels. The relationship between these two histograms provides a comprehensive picture of market dynamic and general market trend.

So, we seperate this 2 side histogram with deeper details.

- Area 1, Sell Limit orders including the Buy positions Take profits.

- Area 2, Buy Stop orders including the Sell positions stop losses

- Area 3, Sell Stop orders including the Buy position stop losses.

- Area 4, Buy limit orders, including Sell position take profits.

By looking deeper you can find important levels for traders. Peaks consist of more volumes and placing orders and valleys consist of fewer orders set by traders. levels with longer lengths have more placed orders.

Particular, all peaks correspond to price peaks on the chart. You shoul search, like a detective to find clues!

Look at the image 1, and focuse to the 1.16555 price area. A huge number of order have been placeds in this levels. Is it interesting that this number is exactly in the levels that is observed on February 1st with a very strong shadow??

Is this interesting that this huge amount of buy limit orders is exactly at the same level of February 1st? looking at the big shadow tha pulled up with a strong demand?

These huge number of orders, could be our Support and ressistance levels. They are liquidity and acte like a magnet for price.

The attractive advantage of this part is that you know where are lots of other people's stoplosses. And this point will help you to know when and at what price you may be stop hunting :) Try not to

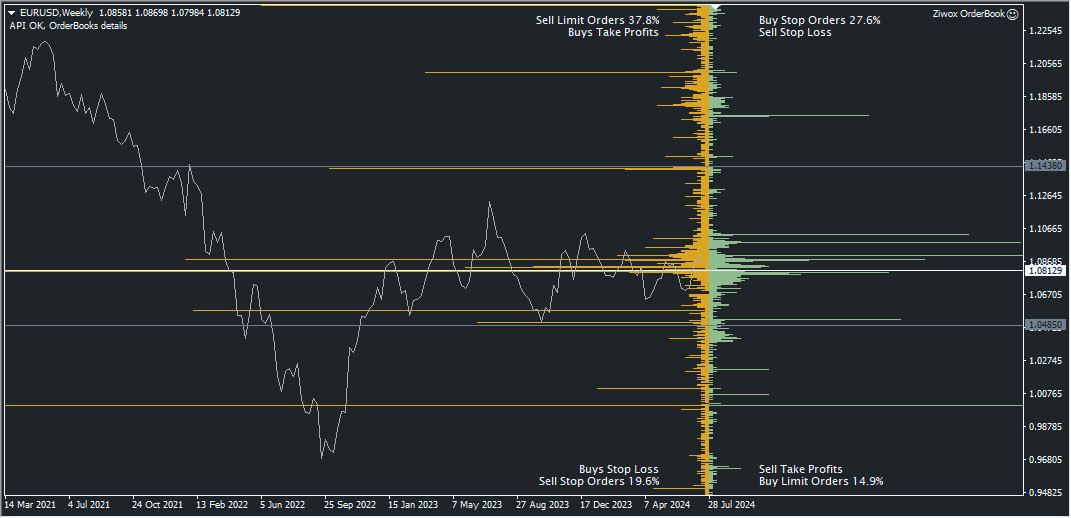

Image 2, EUYRUSD OrderBook

Lets describe it, by more example. look at the image 2. Accumulation of buying orders from 1.08129 to the 1.0485 levels along with it placing these buy orders stop loss on the 1.0485 area. There is a beautiful match with the price ceiling and floor in the chart. or find the 1.14380 price levels. If you are familiar with the ICT trading method, you will find the Drop,base,Dropp trend on that levels. It is exactly equal to huge sell limit orders there.

Now Lets dive deep into thee PositionBook.

How to Read the PositionBook

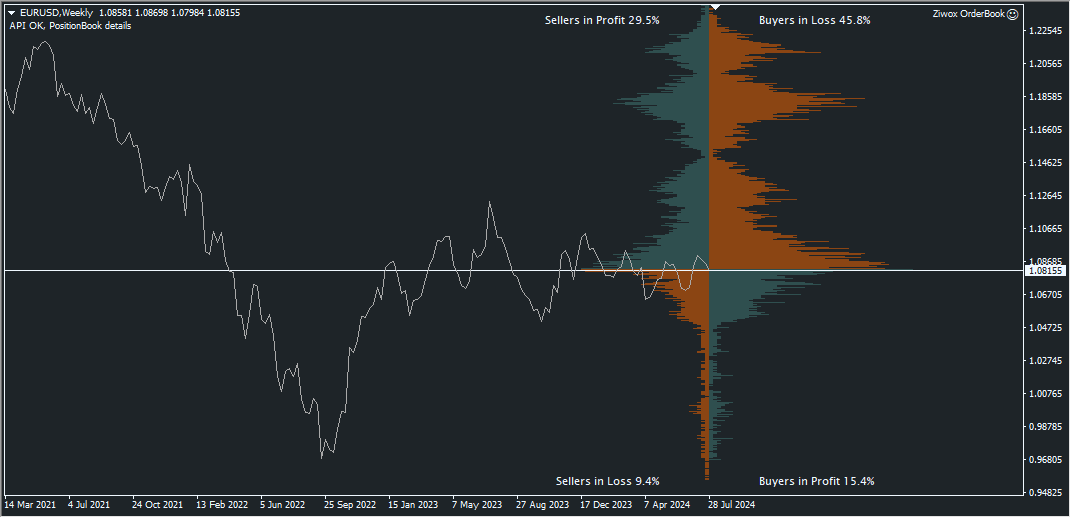

Image 3, EURUSD PositionBook

In the PositionBook, you don't just see the number of positions. What does it mean when there are many buyers, bellow the current market price? it showing you, how many buyers are profitable and all buy positions above the market price are in loss. How does this help us? Think that all these losses are going to be closed soon, or on the contrary, If there are many selling positions in profit. Sell positions are closed in profit and increase the price becasue close a sell position equal to a new buy position. You get the point? Right?

So, in PositionBook histogram, you have 4 area base on left (Sell) and righ (buy) position and positions upper or bellow tha current market price.

- Top left area, Sellers in profit

- Top right area, Buyers in loss

- Bottom left area, Sellers in loss

- Bottom right area, Buyers in profit

How to use, How to trade?

Market Sentiment

To derive market sentiment from the Order Book, traders can analyze the volume of buy and sell orders. An increased volume of buy orders typically indicates bullish sentiment, while greater volumes of sell orders suggest bearish sentiment. Additionally, by examining key clusters of pending limit orders, traders can determine significant support and resistance levels, indicating where prices may stabilize or reverse in the market.

Find Support and Resistance levels

Image, AUDUSD OrderBook, Support and resistance levels

Support and resistance levels can be identified using the volume of pending orders within the Order Book. For instance, substantial clusters of buy limit orders at specific price points may indicate strong support, suggesting that the price is less likely to fall below that level. Conversely, clusters of sell imit orders indicate resistance, where prices may struggle to rise above that point. These levels help traders establish where they might enter or exit trades based on anticipated price behavior.

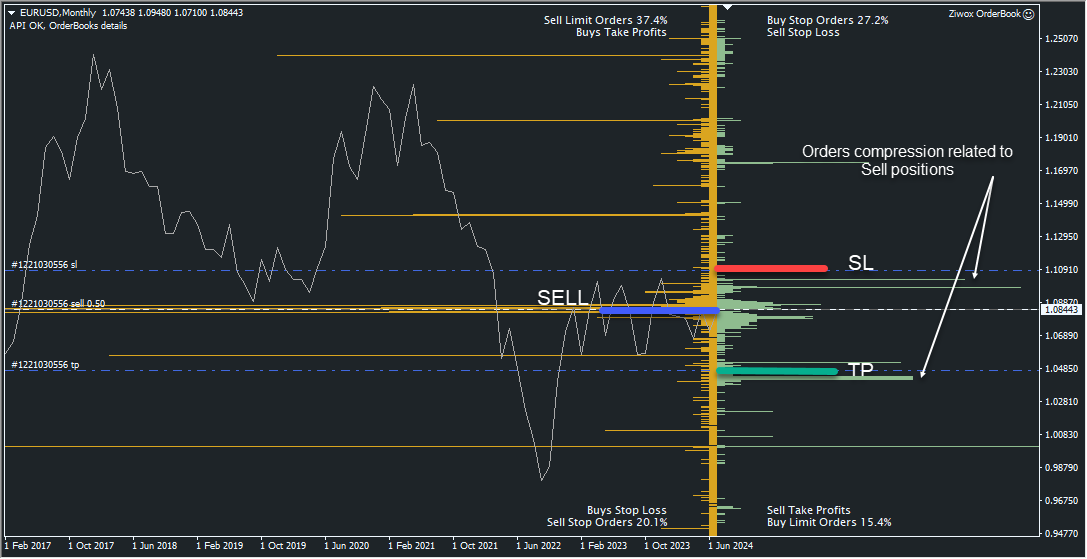

Finding Optimal Levels for Stop Loss and Take Profit

When it comes to setting stop loss and take profit levels, traders should utilize insights from the Order Book. It is advisable to place stop losses beyond significant support or resistance levels to avoid being prematurely triggered during potential stop hunting. Moreover, analyzing the order flow can reveal areas where numerous stop losses are clustered, and setting levels a reasonable distance beyond these targets can protect traders from being hunted. By employing sound strategies based on historical Order Book data, traders can improve the effectiveness of their stop loss and take profit levels, thus managing their risks better.

To underestandd it well, imagin you open a buy position, place your stoploss and take profits. there are hundred and thousant of traders like you. The position, Stoploss and the Takeprofit shows on the OrderBook like what you have on image bellow.

There are significent buy limit there that is the main market supports. it is the price magnet, cause of it it the liquidity. Always be sure thay your SL is under these levels.

Take Signals with Losing and Winning Trades Accumulate

Losing Trades: Analyzing clusters of losing trades in the right position book can suggest areas where price may bounce back upward once those positions are closed.

In the Positions book you can see overview of open trades. Positions is loss and positions in profit. Usually traders try to wait out unprofitable positions and close their profit trades faster than losses. Winning Trades are Closed About 2 Times Faster than Losing Ones and stop losses are usualy placed with double far as the takeprofits. Point is that:

- An accumulation of losing sellers will push up the price becasue Sell positions closed by buys

- accumulation losing buyers will pull the price down. becasue Buy positions closed by Sells

In OrderBook

- When stop-losses in the Sell histogram (left order book) are triggered, it indicate that buyers have been pushed out of the market.

- TakeProfit hit in Left top side of OrderBook, also indicate that buyers have been pushed out of the market due to the TakeProfits.

- Conversely, if stop-losses in the Buy histogram area are triggered, it indicates that sellers have exited the market.

The presence of Limit orders and Stop orders in the order book does not guarantee their execution when the price reaches their levels, as these orders can be moved or canceled.

Winning Trades: Conversely, a substantial presence of winning trades may indicate a potential market reversal, as rapid closures could push prices in the opposite direction.

We mentioned earlier, the trades in profit are closed much earlier than losses. so profitable Buy positions, are temporary and ther closing soon and sometimes the price whipsaws back to turning those profitable trades into losers.

If you are smart you will always get this reverse trend.

- Closing the winning Buy positions, pull the market down

- Closing the winning Sell possitions, push the market high

DO YOU LIKE TO USE THIS TOOL?