Trading using Break of Structure (BOS) Forex strategy: A Smart Money Concept (SMC) approach

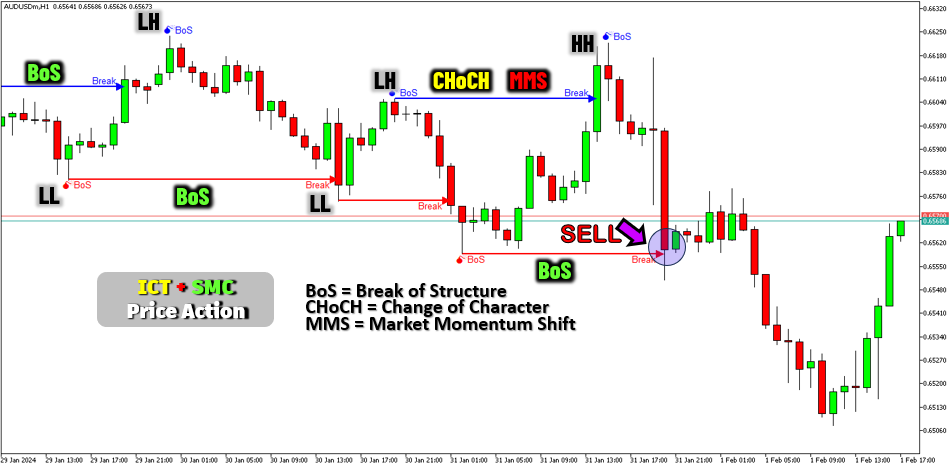

In the ever-evolving world of forex trading, identifying and capitalizing on market trends is essential for success. In our recent article, we explored how traders could utilize the Break of Structure (BOS) expert advisor in MQL5. This powerful tool was designed to help traders identify key market movements, offering opportunities to enter and exit trades with precision. In this post, we will revisit the intricacies of the BOS expert advisor, how it worked, and how traders could implement it within the MQL5 trading platform. Have a glance at what we mean.

The Break of Structure expert advisor focused on identifying shifts in market dynamics by detecting changes in market structure. A break of structure occurred when the price moved beyond a previous high or low, signaling a potential trend reversal or continuation. This expert advisor was instrumental in identifying significant market turning points, allowing traders to make informed decisions about their trades. By pinpointing these critical moments, traders could optimize their entry and exit points, maximizing profits while minimizing risks.

Before we can even go too deep, below is a link to the article with step-by-step explanations.

Implementing the BOS expert advisor in MQL5 was straightforward, thanks to the platform’s robust programming capabilities. We demonstrated how traders could create a custom BOS expert advisor by coding it to detect specific price patterns and movements. Once set up, the expert advisor automatically analyzed price data in real-time, providing visual signals when a break of structure occurred. These signals were in the form of arrows, lines, and other graphical elements that highlighted the critical points on the chart. By integrating this expert advisor into their trading strategies, traders could enhance their ability to identify and act on profitable trading opportunities.

Swing points were identified as below:

if (isSwingHigh){ swing_H = high(curr_bar); if (prt){Print("UP @ BAR INDEX ",curr_bar," of High: ",high(curr_bar));} drawSwingPoint(TimeToString(time(curr_bar)),time(curr_bar),high(curr_bar),object_code,def_clr_up,-1); } if (isSwingLow){ swing_L = low(curr_bar); if (prt){Print("DOWN @ BAR INDEX ",curr_bar," of Low: ",low(curr_bar));} drawSwingPoint(TimeToString(time(curr_bar)),time(curr_bar),low(curr_bar),object_code,def_clr_down,1); }

One of the key advantages we highlighted about using the BOS expert advisor in MQL5 was its ability to adapt to different trading styles and timeframes. Whether a day trader, swing trader, or long-term investor, the BOS expert advisor could be customized to suit specific needs. Traders could adjust the sensitivity of the expert advisor, set alerts for particular conditions, and combine it with other technical analysis tools to create a comprehensive trading system. This flexibility made the BOS expert advisor a valuable addition to any trader’s toolkit, providing a competitive edge in the fast-paced world of forex trading.

In conclusion, the Break of Structure expert advisor was a powerful tool traders could use to enhance their trading strategies in MQL5. By identifying key market movements and providing real-time signals, the BOS expert advisor helped traders make informed decisions, improving their chances of success. With its adaptability and ease of implementation, the BOS expert advisor was an invaluable resource for traders looking to gain an edge in the forex market. Embracing the power of the Break of Structure expert advisor enabled traders to take their trading to new heights in MQL5.

Cheers to many more coming our way!