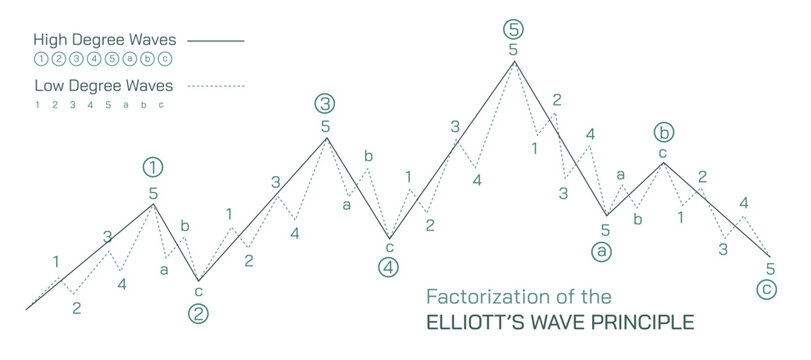

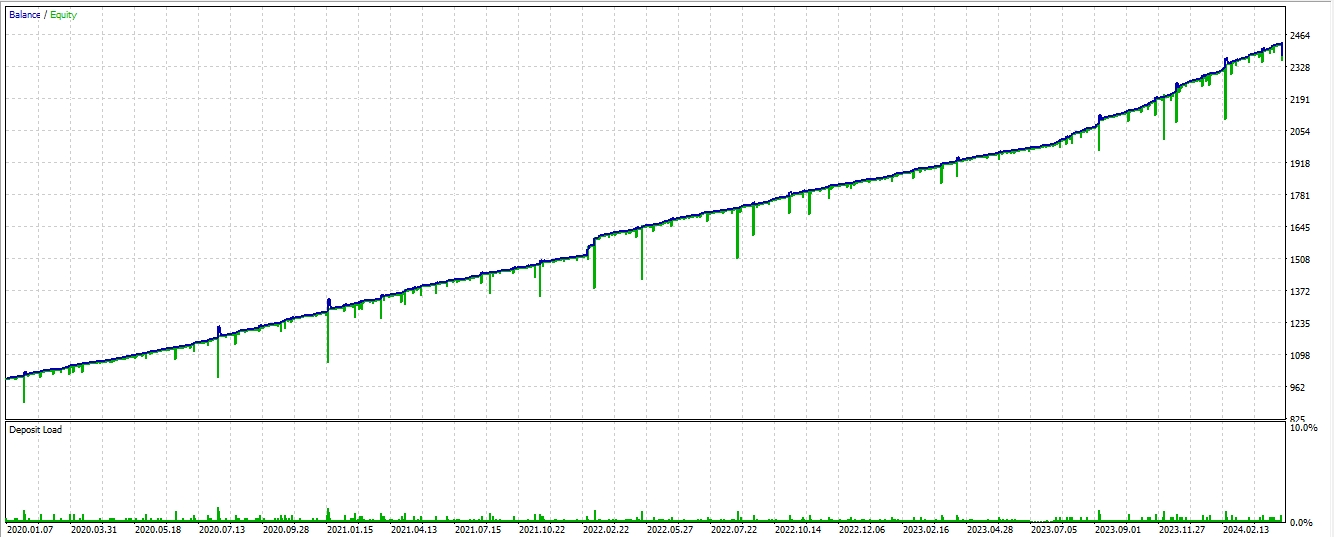

7thlab - WAVE THEORY is an automated system that helps traders analyze the market and make trading decisions without personal intervention. To do this, the advisor uses Elliott Wave Theory to determine entry and exit points for trades, which allows you to maximize the efficiency of market movements.

EA Goofy - https://www.mql5.com/en/market/product/81183?source=Site+Profile+Seller

Goofy strategy advisor - 7thlab - WAVE THEORY - This is not just a trading advisor. This is a whole ecosystem associated with the $QLTC coin built on the TON blockchain.

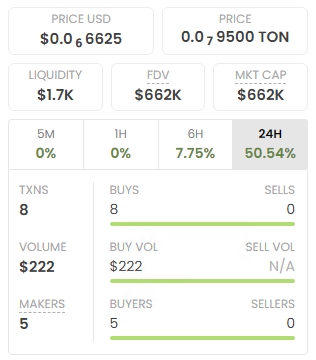

$QLTC - A coin that will allow you to accumulate passive income in the future. For all advisor owners. For each purchase of a trading advisor, from 10% to 50% of the profit received from the sale of the advisor will be transferred into the liquidity of the coin. To increase liquidity. Increasing liquidity will allow all coin owners to buy and sell the coin as a full-fledged asset. Each Trader who buys the Goofy advisor will receive a free asset in his wallet in the amount of $1000 GFC.

Coin monitoring is available - Link 1 - Link 2

Purchasing a token ➡️ Link (https://app.ston.fi/swap?chartVisible=false&chartInterval=1w&ft=TON&fa=16.02908108&tt=EQAgk5a3EsahQm5B4N0t0f5pP8KOH9nSZtTVIImyDaBr6UyX)

https://youtu.be/zEjqySD9pWE?si=2t4hhE5lYxvM4c2U 😈

Key Feature

- Analysis of Elliott Wave Theory:

The advisor analyzes market data using Elliott Wave theory to determine the current phase of the market and predict future price movements. This allows you to more accurately determine entry points into the market. - Orders pending:

After determining the entry point, the advisor automatically creates a pending order for price correction. This allows the trader to get maximum profit from the signal, since the order will be executed at a more favorable price. - High volatility news filter:

The EA includes a news filter that tracks micro- and macroeconomic events that can cause high market volatility. This helps avoid trading during periods of high uncertainty and reduces risks. - Automatic lot system:

The advisor automatically calculates the lot size based on the size of the deposit and the risk level set by the trader. This optimizes capital management and minimizes risks. - Order grid:

The advisor uses a grid of orders to maximize profits from price pullbacks. This means that if the price moves in the opposite direction, the advisor will open additional orders to take full advantage of market fluctuations. - Exact market entry:

Using the Elliott wave theory allows you to determine more accurate entry points into the market, increasing the likelihood of successful transactions. - Profit maximization:

Creating pending orders and using an order grid helps you maximize profits from market movements, even if the price is temporarily moving in the opposite direction. - Protection against news risks:

The High Volatility News Filter helps avoid trading during periods of high volatility, reducing risk and protecting the trader's capital. - Automation and convenience:

The automatic lot system and automatic order management allow the trader to minimize manual intervention and errors, making trading more convenient and efficient.

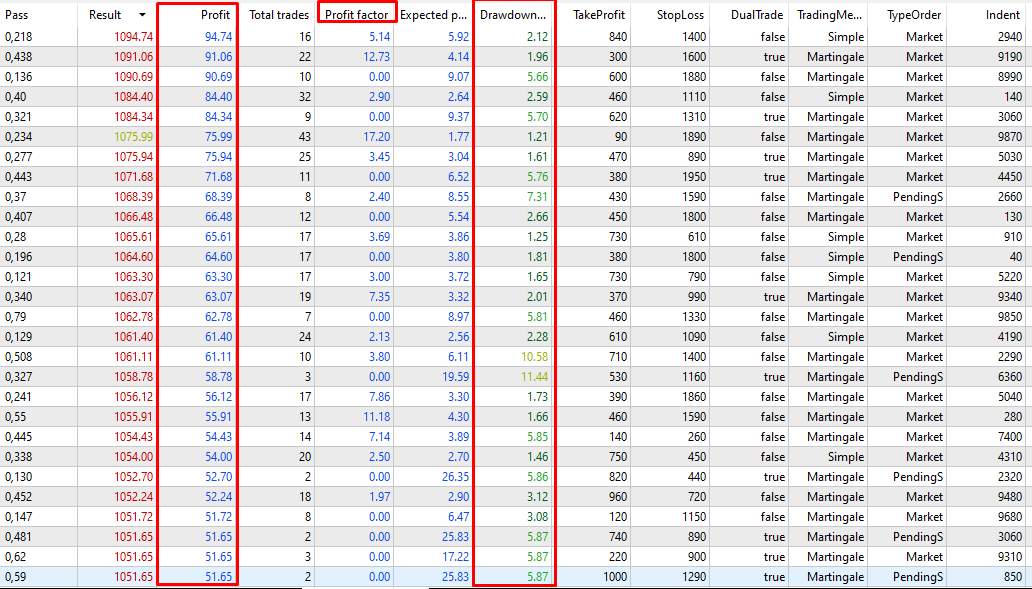

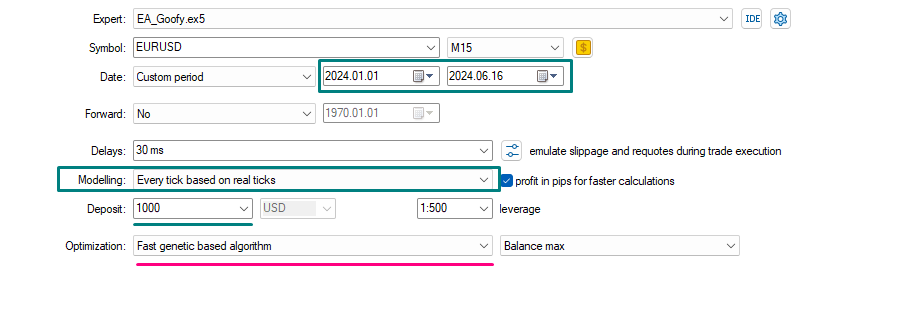

Before you start using the advisor, it must be optimized for the market conditions of your broker with your account type.

Use the standard MT5 optimization system for the last year or year and a half.

Main optimization timeframe from m1 - m5 - m15 - m30 - H1 - H4

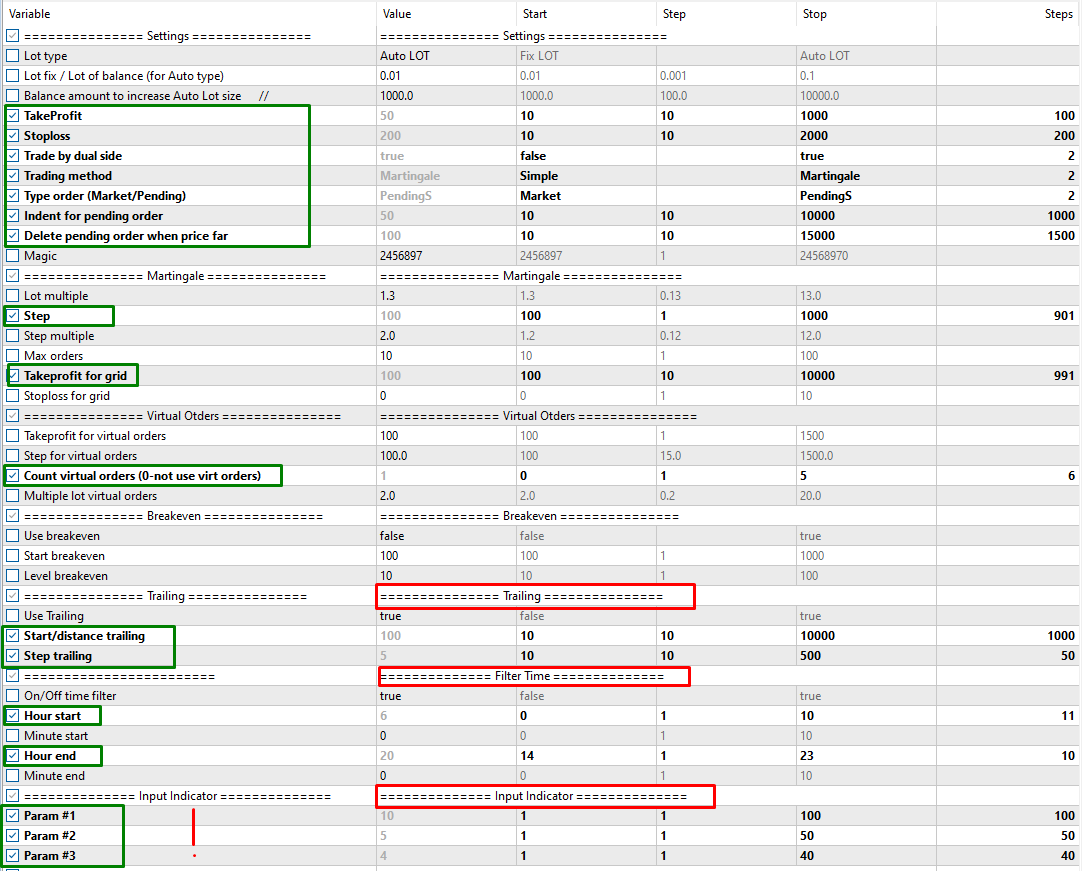

Main parameters for optimization:

Key optimization indicators