Putting VSA to Work:

Combining Volume and Price Action in Forex Trading

In our previous article, we explored the concepts behind Volume Spread Analysis (VSA) and its potential benefits for Forex traders. Now, let’s delve deeper and see how VSA can be applied in practical trading scenarios.

Combining VSA with Price Action:

- Pin Bars: A pin bar with a very small body and a long tail wick protruding upwards indicates rejection at the top. If accompanied by low volume, it suggests a potential trend reversal, especially if it occurs at a resistance level. Conversely, a pin bar with a long wick pointing downwards and high volume at a support level might signal buying pressure and a potential trend continuation.

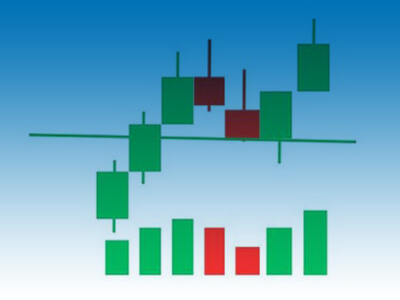

- Engulfing Bars: A bullish engulfing bar with high volume on the engulfing candle suggests strong buying pressure, potentially pushing prices higher. A bearish engulfing bar with high volume on the engulfing down candle indicates strong selling dominance, potentially leading to a price decline.

- Inside Bars: An inside bar with low volume suggests market indecision or consolidation within the previous day’s range. A breakout from this inside bar with high volume on the breakout candle signifies a potential trend continuation in the direction of the breakout.

VSA Example: Identifying a Potential Trend Reversal

Imagine you’re analyzing EUR/USD. You notice a bullish engulfing candlestick (a large green candle engulfing a smaller red candle) with high volume. This VSA setup suggests strong buying pressure, potentially indicating a bullish breakout. To confirm this, you look for a break above a key resistance level. If the breakout coincides with high volume, it strengthens the bullish case.

VSA Analysis:

- The large engulfing bar with high volume suggests strong buying pressure, potentially pushing prices higher (initially following the trend).

- However, the following smaller bodied candle closing near the low with lower volume indicates a possible shift in sentiment.

- The decrease in volume despite a price move lower suggests a lack of conviction from the bulls and potential selling pressure emerging.

Trading Decision:

Based on this VSA analysis, a cautious trader might consider taking profits on existing long positions or even placing a stop-loss order to mitigate potential losses if the price breaks below the low of the smaller bodied candle. This scenario highlights how VSA can act as a confirmation tool, suggesting a potential trend reversal despite the preceding bullish engulfing bar.

Remember:

VSA is not about predicting the future; it’s about understanding the battle between buyers and sellers. Here are some additional tips for applying VSA in your Forex trading:

- Focus on High-Volume Candles: Look for candles with significantly higher or lower volume compared to recent bars. These candles often hold more significance.

- Beware of Fakeouts: High volume on price movements that quickly reverse can indicate attempts to manipulate the market. Be cautious of entering trades based solely on such signals.

- Always Practice Risk Management: VSA is a valuable tool, but it should never replace sound risk management practices. Always use stop-loss orders to limit potential losses.

By mastering VSA and combining it with other technical analysis methods, you can gain a deeper understanding of market sentiment in the Forex market. Remember, practice and experience are crucial for refining your VSA interpretation skills.

To achieve the mentioned points, we want to introduce an indicator that is very helpful to the trader:

the "TW trend sniper" Indicator, a powerful indicator that is used to identify the main trends by using the "Trade Wizards" exclusive indicator formula along with the use of price action, the detection of currency trading sessions, Fibonacci and detection functions and artificial intelligence noise removal methods, volume analisys And detect fakeouts with high accuracy.

this strategy designed by the "Trade Wizards group" consisting of Experienced traders and expert programmers are now available to traders to advance your trading journey.

Happy trading

may the pips be ever in your favor!