0

163

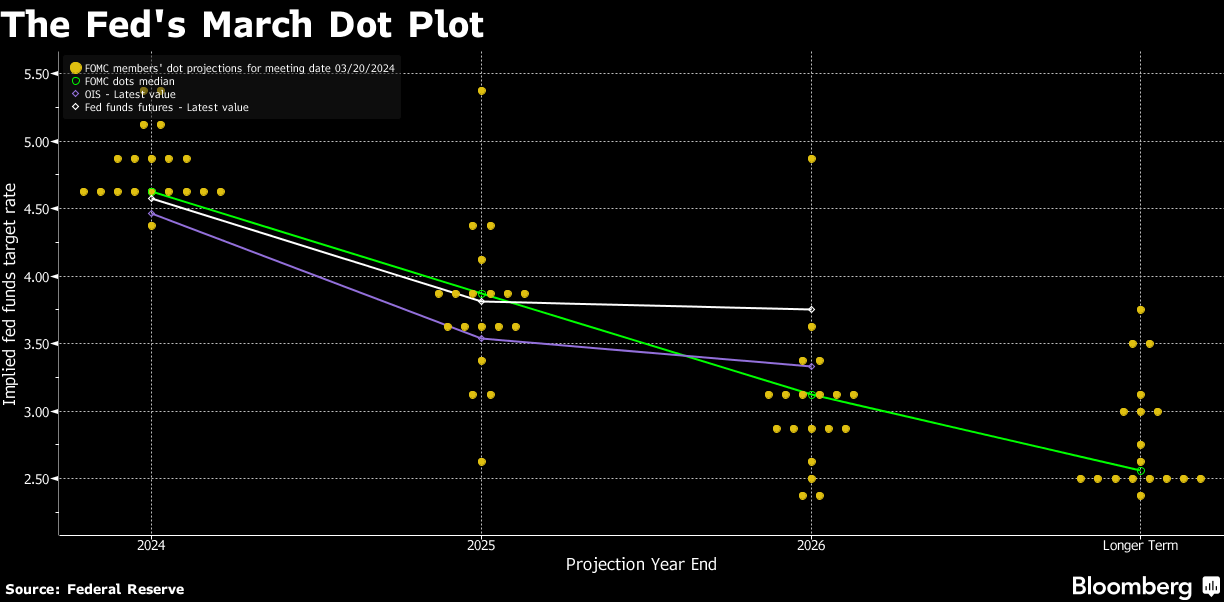

FED March Meeting already projected a 1% cut rate from 5.5% into 4.6% at the end of 2024 that divided into three rate cuts.

Stock market push even higher and gold creating another new all time high above $2200. I already anticipate this move before and the market range is between 1830-2300$ per oz.

There's a multiple scenario for Gold in 2024:

- Market already price in before the rate cuts (when the FED announces their first rate cut in 2024, there’s a possibility that the rally is over)

- US election will heavily drive the market sentiment (If Trump gets voted for 2nd time, trade war will rise and global tension could ease. If Biden get chosen again, World War III is a big possibility)

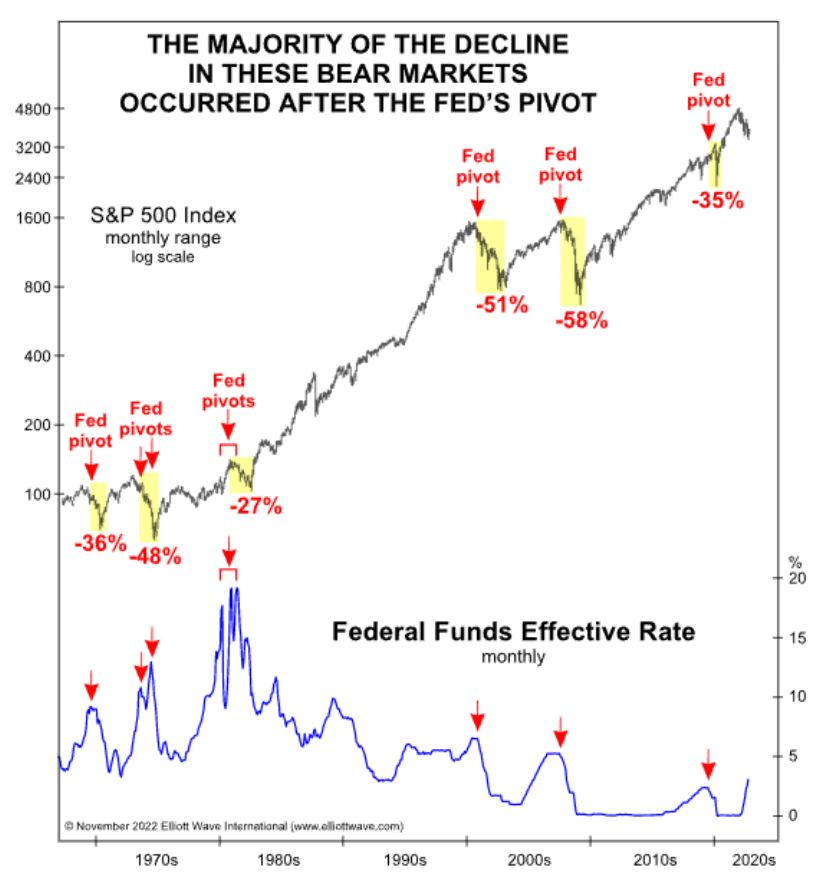

- FED Pivot historically have a bad record, with market decline of minimum 30% after FED policy change.

What's your thought on this one?