Reviewing Candlestick Patterns:

A Trader’s Guide

Candlestick charts are a cornerstone of technical analysis, offering a wealth of information about price movements within a single visual representation. But embedded within these charts lie secrets – candlestick patterns. These recurring formations can offer valuable clues about potential future price direction, although it’s crucial to understand their limitations as well.

Understanding the Candlestick

Before diving into patterns, let’s revisit the basic building block: the candlestick itself.

Each candlestick depicts four key price points – open, high, low, and close – for a specific timeframe. The body reflects the difference between the opening and closing prices. A hollow body signifies a close higher than the open (bullish), while a filled body indicates the opposite (bearish). Shadows, or wicks, extend above and below the body, representing the high and low price points reached during that timeframe.

But what truly elevates candlestick analysis is the recognition of patterns. These patterns, formed by the arrangement of candlesticks, can signal potential trend reversals or continuations. However, it’s crucial to remember that candlestick patterns are not guarantees, but rather indications of underlying market psychology.

Here, we’ll delve into some popular candlestick patterns, exploring their formation and application:

Common Candlestick Patterns:

Reversal Patterns:

These signals suggest a potential shift in the prevailing trend.

- Hammer: A bullish reversal, characterized by a small body and a long lower wick, indicating buying pressure despite a price drop.

- Inverted Hammer: A bearish reversal, resembling a hammer flipped upside down, suggesting selling pressure after a price increase.

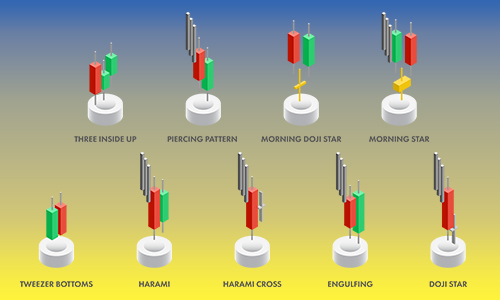

- Engulfing Patterns: A strong reversal signal where the second candle’s body completely engulfs the first candle’s body. Bullish engulfing occurs in a downtrend, bearish engulfing in an uptrend.

- Doji: A Doji is a small-bodied candlestick with the open and close prices being nearly identical. It suggests indecision in the market, potentially leading to a continuation of the prevailing trend.

Continuation Patterns:

These patterns suggest the current trend is likely to continue.

- Harami: A small-bodied candle entirely contained within the previous candle’s body, indicating a pause in the trend before its resumption.

- Three Soldiers/Crows: Three consecutive candles with progressively higher closes (soldiers) or lower closes (crows) in an uptrend or downtrend, respectively, indicating strong momentum.

Approving and Applying the Patterns:

While candlestick patterns offer valuable clues, it’s crucial to remember they are not guarantees.

When applying candlestick patterns, remember:

- Consider context: Analyze the pattern within the prevailing trend and surrounding price action.

- Confirmation: Look for the pattern to appear in the context of the overall trend. Does it align with existing support or resistance levels?

- Volume: Higher trading volume accompanying a pattern strengthens its validity.

- False Signals: Be aware that no pattern is foolproof. Price action after the pattern is crucial for confirmation.

- Manage risk: Candlestick patterns are probabilistic, not definitive. Always employ proper risk management techniques.

By understanding these approval criteria, traders can leverage candlestick patterns to make informed decisions.

Deepen Your Knowledge:

For a comprehensive exploration of candlestick patterns and their application, consider referencing the foundational text, “Japanese Candlestick Charting Techniques” by Steve Nison. This book provides in-depth explanations, illustrations, and trading strategies based on candlestick analysis.

Remember:

By understanding and effectively applying candlestick patterns, you can gain valuable insights into market psychology and enhance your technical analysis toolbox. Remember, however, that successful trading requires a combination of technical and Fundamental analysis, risk management, and a deep understanding of the markets you trade.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Happy trading

may the pips be ever in your favor!