News Overview: My trading day begins with a careful analysis of the overnight news. I focus on significant developments that could potentially impact the market. I pay particular attention to events that could have immediate effects on the opening price, such as changes in the Chinese currency value or Japanese monetary policy.

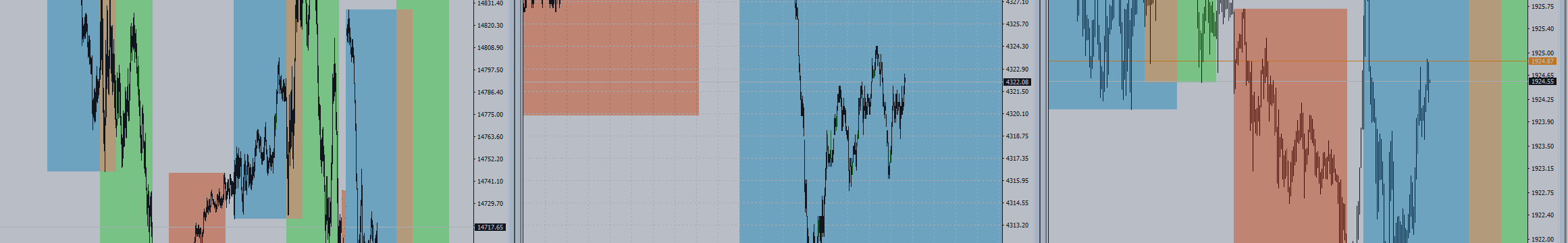

Chart Analysis: Subsequently, I take the time to thoroughly review my charts. This involves gaining an understanding of past trends and identifying potential trading opportunities for the current day.

Market Analysis: The markets I focus on are at the center of my attention. I analyze how the market closed on the previous day and evaluate this closing price in the context of the day's performance and in comparison to previous closing prices. It's important for me to understand how the value has evolved over time to make an informed assessment of the strength of the current market direction.

Market Opening: The market's opening is a critical moment. Especially in the stock markets, it often heavily depends on the performance of the S&P. For example, if the S&P closed at 4376 the previous day and is trading at 4315 this morning, it provides important clues about the expected opening of the DAX. I also take into account the analyses and assessments of brokers to get an idea of the market's opening.

Initial Trading Opportunities: I consider what initial trading decisions I could make at the market's opening. I plan in advance how I will react if the market opens as expected, above, or below it.

Daily Expectations: I set clear expectations for the trading day. I attempt to predict the likely course of the market, potential price ranges, and possible trends throughout the day.

"Line in the Sand": I define threshold levels below which I would revise my initial expectations. These thresholds mark the point at which my view of the market outlook changes.

Key Levels & Volume Areas: I mark significant price levels relevant to my trading strategy and identify significant volume areas that are relevant to my trading strategy, such as zones with noticeable trading volume or areas where trading volume has significantly increased. This can provide important information about potential market turning points.

Planned Trades: I note planned trading decisions that I intend to implement independently of the general market developments.

Updated Information: I keep an eye on current news and events throughout the day, especially planned speeches or press conferences. I note the times to ensure I am informed in a timely manner about significant developments.

Daily Review: At the end of the trading day, I take the time for an in-depth analysis of the day's performance. I summarize what has occurred on that day and draw lessons from it.

This method is designed to effectively prepare for the trading day and adapt flexibly to changes in the market. Continuous review and adjustment of my strategy are crucial for successful market participation.