Bank Levels

In the forex market, all financial institutions and market makers trade and place their orders strategically. These entities place the highest volume or lot size, thus greatly influencing the movement of the price in the forex market.

The idea behind the Bank levels zone feature in our Support and Resistance indicator is to offer to our customers the levels where we have identified big sell volumes or big trade volumes and those levels that have reversed the trend.

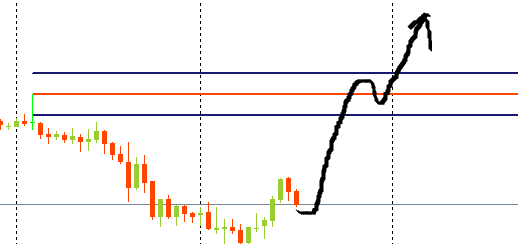

Scenario 1 : When the price touches the Buyers level , The buyers can take control again.

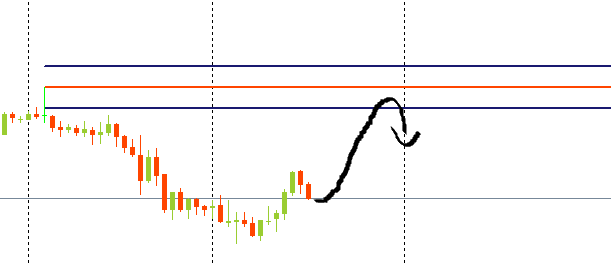

Scenario 2 : When the price breaks the high level of the Buyers zone , The seller can take control and we see a Downtrend continuation.

Scenario 3 : When the price touches the Sellers level , The sellers can take control again.

Scenario 4 : When the price breaks the low level of the Sellers, Then buyers can take control and we see an Up Trend continuation.

Scenario 4 : When the price breaks the low level of the Sellers, Then buyers can take control and we see an Up Trend continuation.

The bank levels drawn by the Bank Levels Indicator can serve as key support and resistance zones, pivot point, and even dynamic support and resistance lines.

Thus, these levels are good for trend following and reversal trading strategy. This features is particularly useful for short-term trading. Intraday traders and scalpers will find this indicator valuable while trading.

Please if you have any questions, feel free to post a comment or sending me a PM.

Author

SAYADI ACHREF , fintech software engineer and founder of Finansya.