Of the news for today, which may increase volatility in the market, market participants will pay attention to the publication (at 12:30 GMT) of statistics on the dynamics of home construction in the US in March. A slight relative decline in the US Department of Commerce report is expected, which may negatively affect US stock indices, in particular the S&P 500.

S&P 500 futures have been declining since today's open, as have blue-chip Dow Jones Industrial Average futures and tech Nasdaq100 index futures.

The longer prices remain elevated, and the longer the fighting in Ukraine continues, the more likely there will be a tipping point where stocks could move into a long-term bear market, economists say. It is worth noting that investors continue to actively sell government bonds, expecting higher inflation and higher Fed rates.

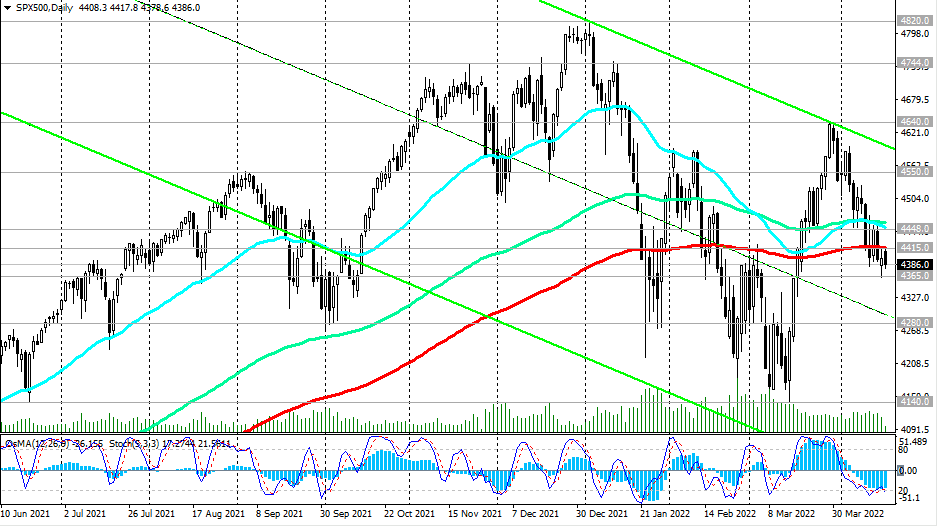

Having broken through the important support level 4455.0, S&P 500 futures are trying to break through the key support level 4408.00.

A break of the important support level 4365.00 may signal an increase in the downward dynamics of the S&P 500, increasing the risks of a transition to a long-term bear market. However, the US stock market maintains a long-term bullish trend. Above the resistance level 4455.00, long positions will become preferable again.

Support levels: 4365.00, 4278.00, 4160.00, 3900.00, 3845.00, 3610.00

Resistance levels: 4408.00, 4455.00, 4540.00, 4630.00, 4810.00

*) see also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex