Dear traders, this article is all about the SIEA PRO parameters.

If you have questions, please look at our SIEA FAQ first, where your questions might have been already answered.

If there are questions left, don't hesitate to contact us via private message here on mql5.com

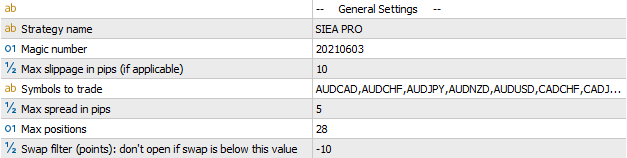

General settings

Strategy name: will be displayed as trade comment and in the SIEA Panel

MagicNumber: a unique number to identify SIEA trades. It's crucial to set different values if you are using several instances of the EA. By default, all SIEA strategies come with their own MagicNumber.

Max slippage in pips: Maximum accepted slippage for new trades (if applicable)

Symbols to trade: Contains all 28 pairs SIEA trades out of one chart

Max spread in pips: Maximum accepted spread for news trades

Max positions: SIEA is allowed to run up to 28 trades at the same time

Swap filter: Maximum accepted swap for new trades

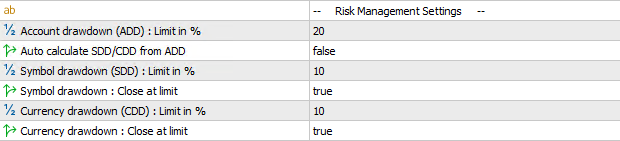

Risk Management Settings

Account drawdown (ADD): This is the maximum accepted drawdown for your account. If it's reached, SIEA will close the oldest trade and continue its work. The money management type can also be set to use ADD Limit, in which case this central parameter is used to calculate the lot sizes accordingly. If you accept more risk, SIEA trades larger lot sizes and vice versa.

Auto calculate SDD/CDD from ADD: If set to true, the SDD and CDD limit values are identical to what you set as ADD limit (SDD and CDD input are then ignored). You can define your own SDD and CDD limits in the fields below when set to false.

Symbol drawdown (SDD): This is the maximum accepted drawdown for a single trading symbol.

Symbol drawdown: Close at limit: Here, you decide whether SIEA closes the oldest trade or just prevents opening new ones when set to "false".

Currency drawdown (CDD): This is the maximum accepted drawdown for all trades of a single currency.

Currency drawdown: Close at limit: Here, you decide whether SIEA closes the oldest trade or just prevents opening new ones when set to "false".

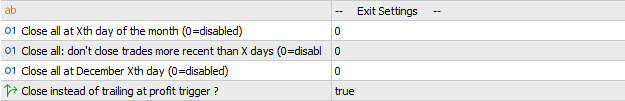

Exit Settings

Close all at Xth day of the month: This parameter is only used for SIEA ZEN and disabled at MAX and PRO.

As we don't want to keep trades open for too long in the ZEN version, we have a feature to close all trades at the end of each month (around the 27th by default). However, our SIEA strategy is not an intraday one, and most of the time, our trades need some space and time to move in the right direction. So a trade opened on the 25th, for example, will probably have too little time to go well. So beginning with version 2.0 we provide a new parameter called:

Close all: freeze X days (0=disabled), which will avoid closing trades opened with X days BEFORE the monthly close.

Example: "Close all at Xth day of the month" set on 27. AND "Close all: freeze X days" set on 4 (ZEN default) will have the following result:

On 27th January, all trades open BEFORE the 23rd January will be closed; trades opened from 23rd January (till 23th February) will be ignored and closed on the 27th February at the latest."

(December has a specific "Close all at "parameter, and this new parameter is not used for December.)

This new feature provides an overall performance boost of 10% plus compared to the previous SIEA ZEN setup. So we're sure you'll like it.

Close all at December Xth day: This parameter is only used for SIEA ZEN and disabled at MAX and PRO.

Close instead of trailing at profit trigger: The trailing starts when your trade reaches some specific profit. Now you can decide whether you want to trail the stop and let the trade run until it reaches its TP and take the risk to get stopped out at the trailing SL, or if you close it immediately.

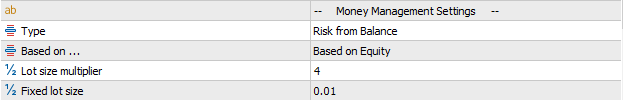

Money Management Settings

SIEA PRO offers four different types for the Money Management setup:

Fixed lot size: the "Fixed Lot size" parameter will allow you to set the desired value to use for every trade across every symbol.

Risk from Balance: lot size is strictly proportional to balance/equity. The type labels said "Balance", but the real value used depends on the "Based on..." parameter, which can be "Balance" or "Equity". The type selected will be used to calculate a factor.

Risk from Balance and ADD limit: the parameter "Account drawdown (ADD): Limit in %" is used to calculate a factor. The lot size will increase linearly to ADD. For example, if ADD=20, instead of 10 by default, the lot size will be multiplied by 2.

Risk smoothed from Balance, ADD limit: This is similar to the previous option, except the increase using ADD is not linear but progressive; it's "smoothed". For example, if ADD=20, the lot size will be multiplied by 1.4 only (and not 2)

The "Lot size multiplier" is the customisable part of this factor where you can raise or lower your risk. Some other values are used internally, but they are the same across all types (except fixed lot size).

The lot size is then calculated as : Lots = [Propotion of balance/equity] * [type factor] * [Lot size multiplier"]

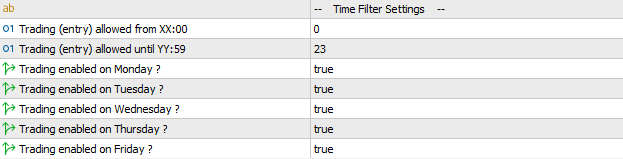

Time Filter Settings

The time filter settings are self-explaining. We recommend leaving them untouched.

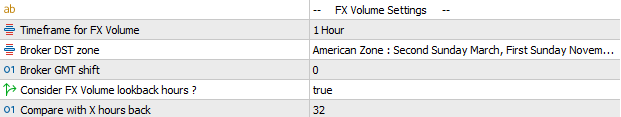

FX Volume Settings

The FX Volume settings are used for the internal volume analysis the trade trigger signals are based on.

Timeframe for FX Volume: We use the H1 time frame, the biggest identical period across all brokers worldwide. H4 and upwards differ due to the different time zone settings of the broker's servers.

Broker DST: This is set to American Zone by default, used by most brokers worldwide. Set it according to your broker server.

Broker GMT shift: This is determined automatically on a regular trading chart, so this parameter is only relevant for backtesting purposes. Please follow this link to see how to configure this correctly before running a backtest

News Settings

These settings are almost self-explaining too. By default, our internal News filter is enabled and scans for central bank news events. 2 hours before and 2 hours after such an event, no new trades are allowed. We recommend keeping these settings unchanged. On backtests, even if set to true, this is ignored as we don't have historical news data.

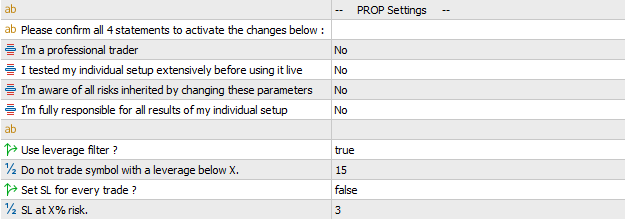

PROP Settings

These settings have been requested by professional PROP traders that need specific functions to fulfil the needs and requirements of PROP trading firms.

They are NOT for retail traders because using them can have a severe negative impact on the overall performance of SIEA. To enable these parameters, you have to confirm the following liability disclaimer. If one of the four following questions is answered with No, the parameters below will be ignored, and SIEA runs with its default settings.

Use leverage filter: Set to "true" by default to filter out all trades with extreme margin requirements.

Do not trade symbol with a leverage below X: Defines the limit value for the leverage filter.

Leverage filter background information

Independent of your account leverage brokers define individual margin requirements for specific currencies and currency pairs/trading symbols you only see in the symbol specifications. They can do that anytime, and SIEA checks the margin requirements before trading. This prevents us from taking trades that have extreme margin requirements and quickly eat up your complete free margin. When your broker sets these margin requirements back to normal, SIEA will trade these pairs as all others.

Set SL for every trade: Set to "true" SIEA will set an individual SL for every single trading position.

SL at X% risk: This defines the maximum risk for each Stop Loss.

Stop Loss background information

Using a stop loss on every single trade is a real performance killer in a multi-symbol setup with several running trades. Let's say one trade is down 2% - sounds much, but what if three other trades are running, each with a profit of 0,7%? Then the drawdown is covered, and the P/L floats around zero. A Stop Loss set at 2% creates facts, closes this trade and books a loss of 2%, which is completely unnecessary if you have proper risk management in place as SIEA does. Our experience, confirmed by years of testing and live trading, is that all trends in Forex come to an end sooner or later. So if a trade turns against you, it's just a question of time when it changes its direction in your favour. Proper risk management handles that easily and brings former negative trades back into the profit zone. A stop-loss can't. It just creates a realised loss.

So if you are forced to use individual stops, we highly recommend adjusting your entire risk management in a way that SIEA can do its job and provide the performance it's designed for.

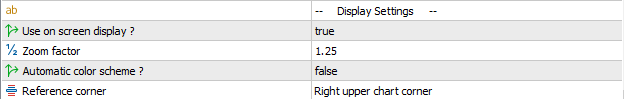

Display Settings

Use on screen display: If set to "false," it will hide the SIEA panel on your trading chart.

Zoom factor: With this factor, you can raise or shrink the SIEA panel

Automatic color scheme: If set to "true", SIEA analyses your background color and adapts the panel coloration accordingly.

Reference corner: Here, you decide which corner of your chart the panel will be displayed.

Miscellaneous Settings

![]()

Logging informations: This is set to "true" to provide our users with detailed insight into what's happening and why.