These are a selection of set files for the Market Reversal Alerts EA version 4.

You can purchase the EA on the MQL5 marketplace here: https://www.mql5.com/en/market/product/65383

The full manual and video on how to use it are available in this blog post.

Set files are attached as a zip at the bottom of this post.

Zip file includes MT4 & MT5 versions of the set files.

Here is a video of the set files in action:

The set files have all been backtested on 1 years data at tick level and will form a good starting point to optimise from and give you an idea of the sort of thinging I put into creating a strategy. All are position trading strategies so do not use fixed stops and use the natural ebb and flow of the market to extract money. They also use a gradual lot size increment to slowly add risk to the positions taken making exits faster when positions go into drawdown. They can all be enhanced and optimized with additional settings but all have shown a profit. Some are fairly conservative while others more aggressive with higher drawdowns but all can be adjusted to suit your needs with different ADR targets, take profits, lot sizing etc...

Initial Testing Criteria:

Pair used - GBPUSD

Time frame - M5 or M15 as stated in set file name

Starting balance - £3000

I would advise you also test these strategies on other FX pairs and indicies as they will likely work very well due to the fact the all use ADR for targeting, lot sizing and distancing between entries. The is a dynamic measurement so the EA will dynamically adjust for each pair you test on.

Some of the strategies will also work on other timeframes and should also be tested and adjusted as you need to fit your risk criteria.

e.g. The mean reversion strategy uses M15 for entries and H4 for RSI exhaustion. You could also use M5 and H1, H1 and D1, H4 and W1 etc... These will give more or less entries as they are faster or slower timeframes.

Strategies:

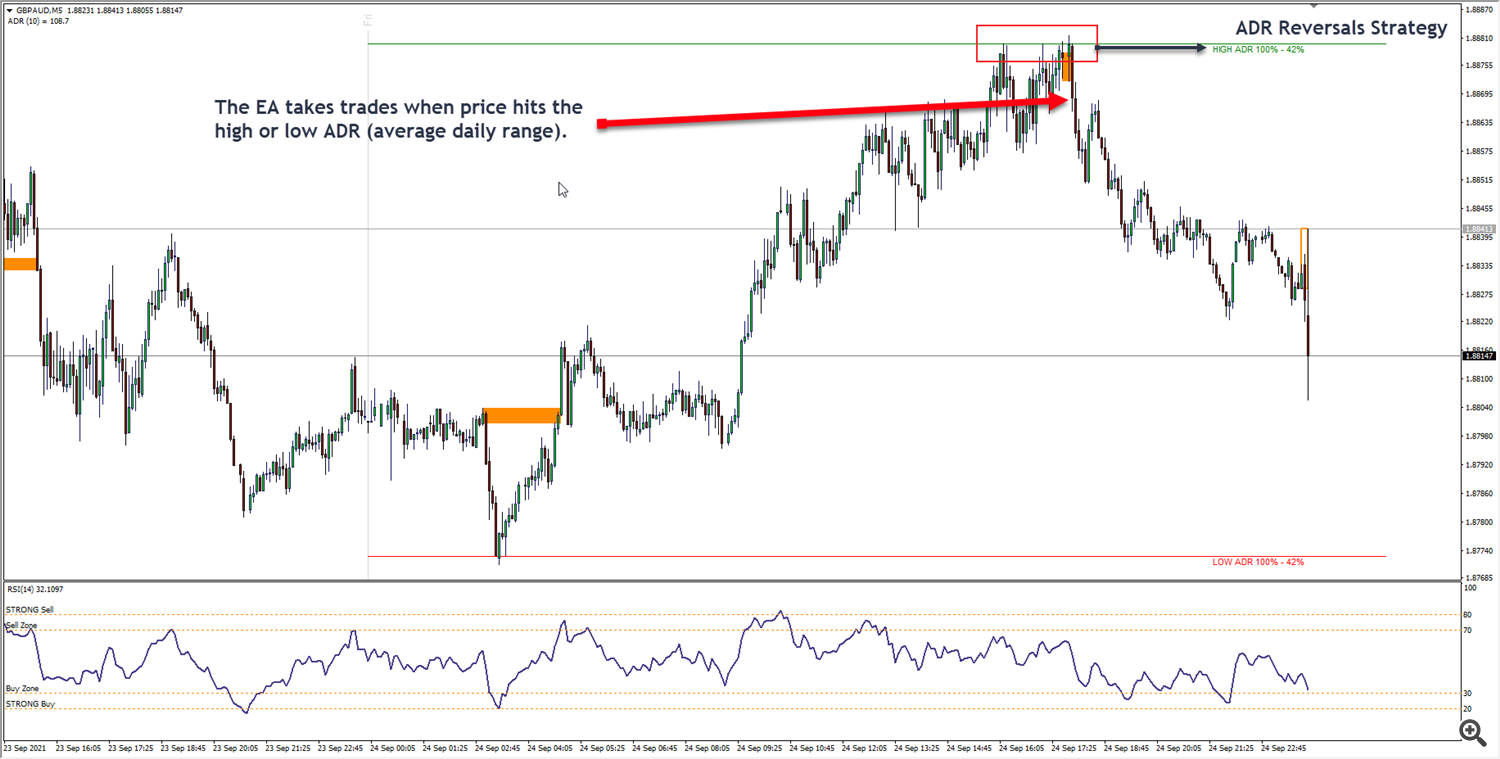

ADR Reversals - GU_M5_ADR_Hit.set

The ADR reversal strategy takes advantage of the average movement forex pairs and all tradeable instruments have on a daily basis. Research shows that any instrument you trade has an average daily range (ADR) and typically it will trade within that range around 58% of the time. When price extends beyond this range it indicates either a breakout of a range may be in process or alternatively a liquidity run to gather stop and pending orders before reversing the opposite direction. In either case there will at some point be either a pullback or reversal in price as the buying or selling pressure used to make these moves beyond normal trading ranges will need to be compensated.

When price exceeds the normal ADR (the set file uses 100% but you can adjust for higher levels) the EA will take a reversal trade in the opposite direction. e.g. if the ADR high is hit the trade will be a short and if the low is hit the trade will be a long. In many cases this initial trade will be successful but if a true breakout occurs the EA will scale into the position waiting fo rthe opposite pressure to be applied and the market correction to take place.

These are typically scalp type trades and usually traded using either the M5 or M15 time frames as the moves in the opposite direction can happen very quickly. Typical targets should be somewhere between 1/2 ADR to 1 ADR but the highest strike rate and lowest drawdown will be achieved if just targeting a small 1/4 ADR pullback move and you will often be in and out of the trade the same day.

To trade this strategy manually you can use the Market Reversal Alerts Indicator and the ADR reversal indicator.

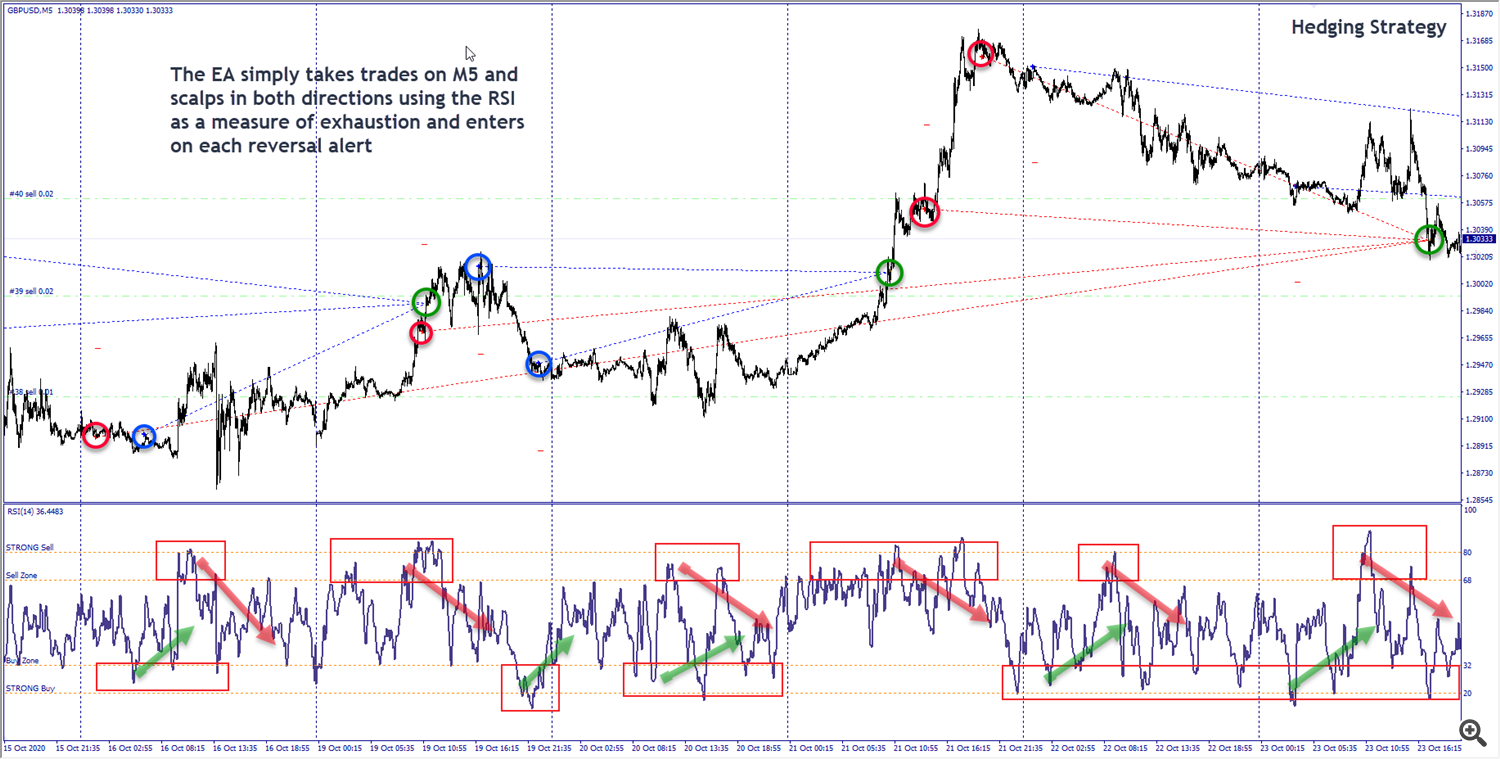

M5 Hedging - GU_M5_Hedging.set

OPTION: This strategy has also been back tested on the M15 time frame too with the following results:

The hedging strategy extracts money from the market using the natural choppy nature of lower timeframes like M5. It takes trades when the RSI shows price has had a strong push in one direction expecting at some point in the near future a profit taking move or reversal will occur. This wave like structure is evident in both rangebound and trending markets on lower time frames so is fairly resistant to most market conditions.

Trades will tyically be over within a day or two but on occasion if fundamental news or a large push happens to a particular currency it can require a few days to complete the trade. The advantage however with this strategy is the fact you are hedging (taking trades in both directions on reversal alerts) so you are always banking profit in one direction even if another trade in the opposite direction is going into drawdown. This makes the strategy a great balance builder and in quiet market conditions it can run for days with very little drawdown constantly banking profits.

The targets for this strategy will typically be in the range of 1/2 to 1 ADR as price will move up and down constantly within it's average daily range so keeping targets within this level and dynamically adjusting them to current market conditions means you will easily be able to exit positions when a strong profit take move starts to happen.

To trade this strategy manually you can use the Market Reversal Alerts Indicator.

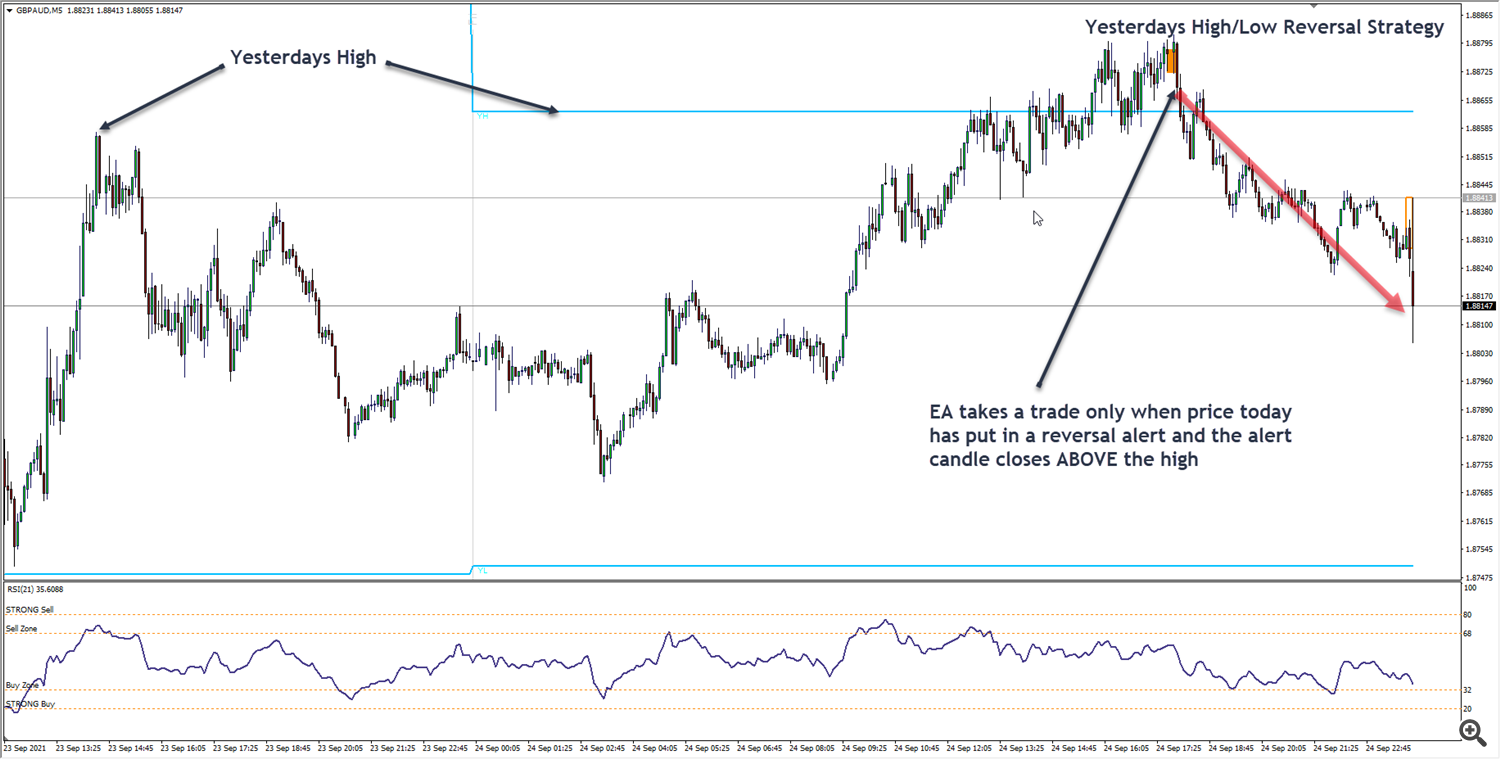

Yesterdays High/Low Reversal - GU_M5_Yesterdays_H-L.set

The yesterdays high/low strategy is designed to enter trades when the market has pushed outside the ranges traded on the previous day. This is particularly effective when the previous day pushed in the same direction as the current day the EA is trading, meaning we are having at least 2 days of push in one direction. If you study daily charts you will often find that price likes to put in pullback and reversal moves often on the third or fourth day of a push.

This strategy also works well as the market often will seek liquidity to make it's moves and this is in the form of stop orders and pending orders placed by traders which are often at daily high and low points in the market. When price pushes outside the previous days high or low to gather liquidity if then tends to move back the opposite way, this is what we are taking advantage of.

If the EA enters on the first day of what will become a multi day push and goes into drawdown it will average into the position waiting for the down day (profit take move) to come and take advantage of that move to exit the positions it has taken and profit.

To trade this strategy manually you can use the Market Reversal Alerts Indicator and any indicator that displays yesterdays highs and lows on your chart of which there are many free ones available.

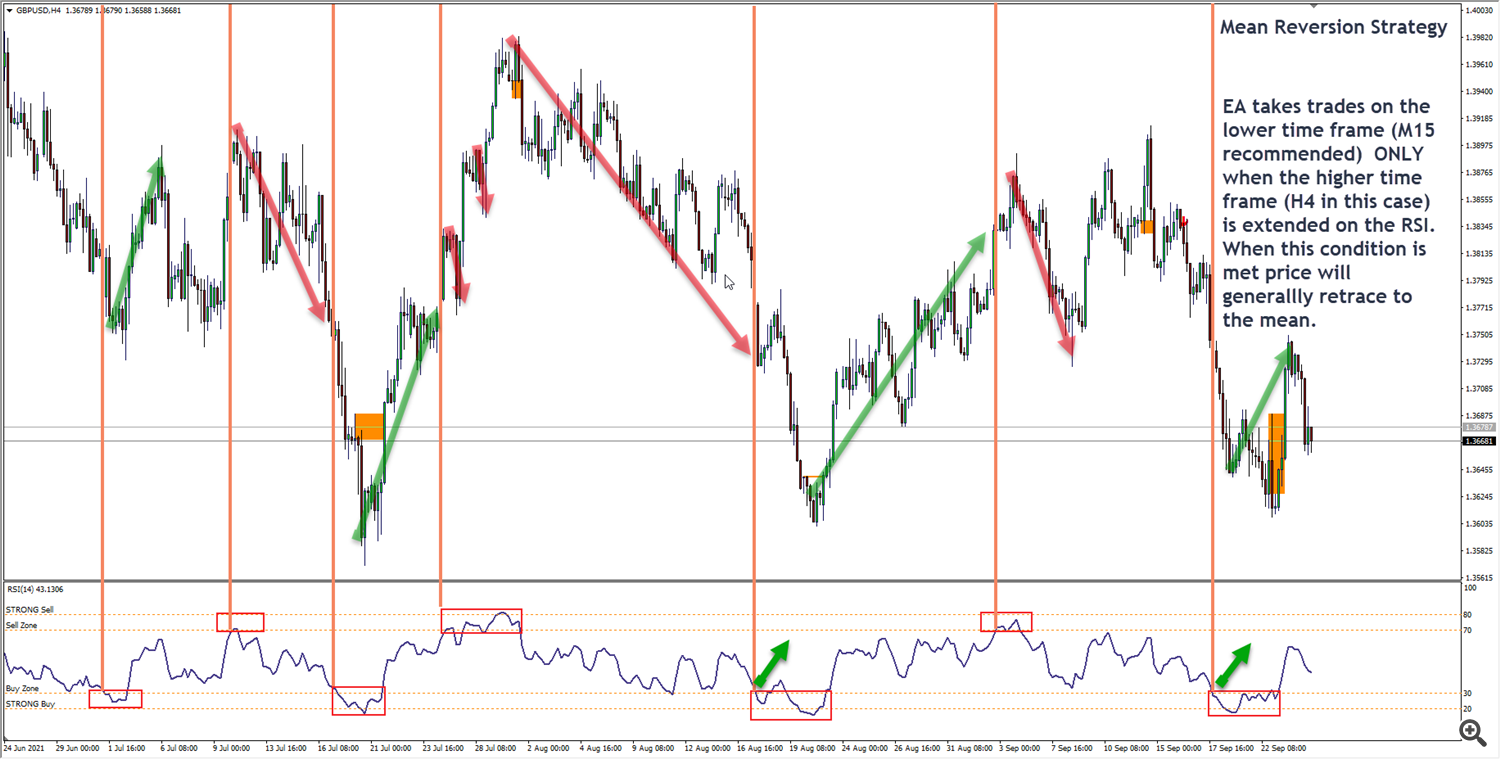

Mean Reversion - GU_M15_Mean_Reversion.set

The mean reversion trading strategy uses multi-timeframe analysis to enter positions at exhaustion points. The market moves naturally up and down many times while major market participants enter positions and then take profit on them. This causes the waves we see playing out over and over again. Every time a major buyer enters the market they become a future seller as to exit their position (with a profit or a loss) they have to sell their position they bought. We can measure the strength of buying and selling cycles or moves with a number of indicators. The RSI (relative strength index) however is one of the most efficient at showing how strong a move has been.

This strategy utilises the power of RSI to show us when the market has performed a long sustained move in one direction and is best used on a higher time frame like the 4 hour or daily chart but also works well on the hourly chart too. The EA will wait for the higher timeframe (H4 in this case) to get extended on the RSI into a buy or sell zone. You can use any level you choose but the higher the level the less signals you will get but the more accurate they will be. 70/30 is a commonly used level but 80/20 give incredibly accurate turning points but they are not hit as often. Once the level is achieved on the HTF (higher time frame) the EA starts monitoring the lower entry time frame for reversal alerts and starts to build a positon.

Often these initial entries will be correct as the market reversal alert is showing the first potential signs of weakness on the lower timeframe when the higher time frame is ready to pull back or reverse. If price continues to push the EA simply scales into the position gradually and waits for the exhaustion to end and the profit take moves to commence, exiting all positions in profit.

To trade this strategy manually you can use the Market Reversal Alerts Indicator and the standard RSI indicator.

Trend Pullback - GU_M15_Trend_Pullback.set

The trend pullback strategy is another multi-timeframe strategy that uses a higher timeframe in two ways. Firstly for trend direction analysis and secondly for exhaustion in the opposite direction of the main trend.

The EA uses the daily time frame to find trend direction. This is done by using the 72 EMA on the daily which is a reliable trend indicator of intermediate trend as it represents around 3 months of market movement. When price is above or below this EMA the EA looks for positions only that fall in line with that trend.

Next it looks at the H4 chart to find points of exhaustion using the RSI in the same way as the mean reversion strategy but will only be interested in exhaustion levels in line with the trend. i.e. if the market is trending down as in the images above we are only interested in taking trades when the H4 RSI is extended at high levels (above 70 or 80) as this indicates a pullback in the current trend may be happening.

When the H4 RSI is extended the EA then looks to take entries on the lower timeframe on M15 when a reversal alert happens. This means we are entering trades in line with the overall market trend when a pullback is due according to the intermediate timeframe RSI and getting in at what is potentially the start of the continuation move of the trend on M15.

To trade this strategy manually you can use the Market Reversal Alerts Indicator and a standard RSI and moving average.

There is also an S&P500 Strategy with set files available for those interested here: https://www.mql5.com/en/blogs/post/747102