Today I am publishing about the positive results obtained by combining the indicators:

- WPR

- STANDARD DEVIATION

- CCI

- ENVELOPES

Starting Balance: 300.00 USD

Leverage: 1/500

Lot: 0.01

Spread 2

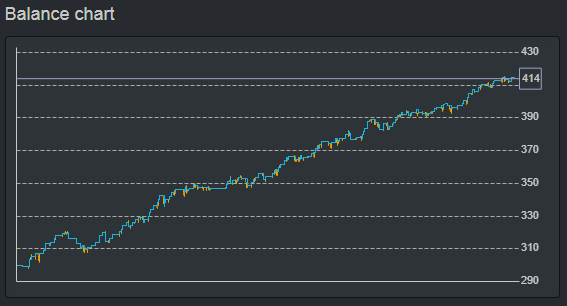

Backtest output

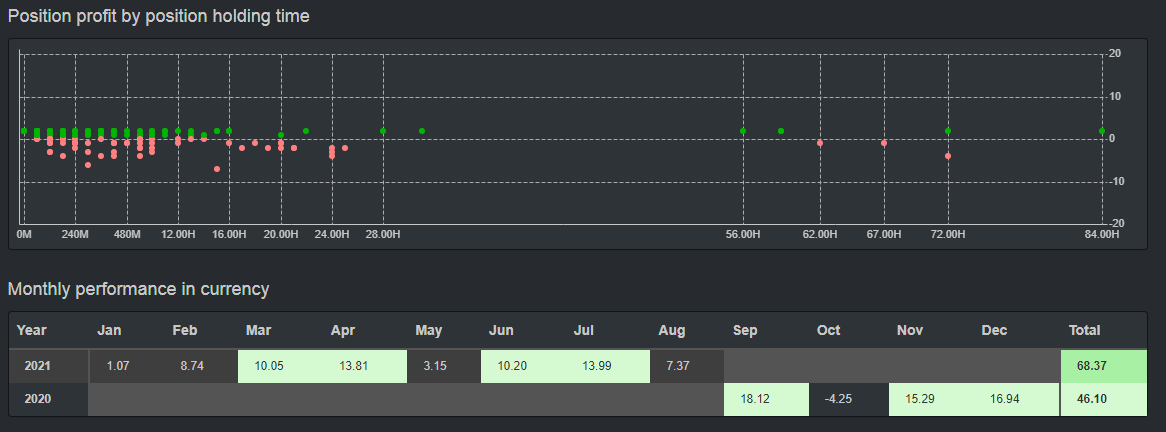

| Average HPR | 0.18 % |

| Average position length | 7 bars |

| Backtest quality | 100.00 % |

| Balance line stability | 85.49 |

| Bars in trade | 1308 |

| Bars in trade | 21.23 % |

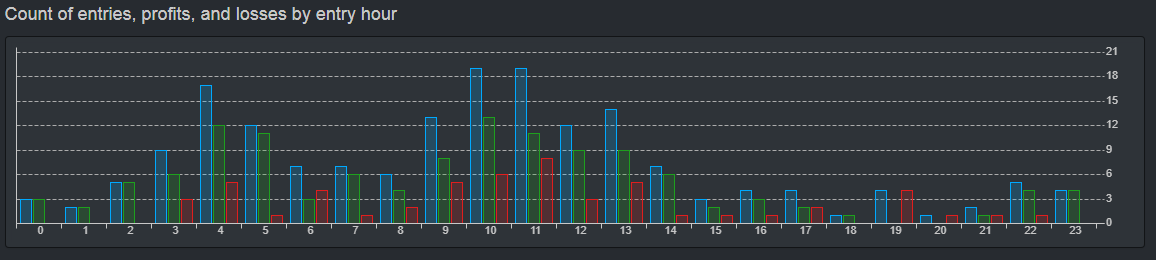

| Count of trades | 180 |

| Max consecutive losses | 3 |

| Max drawdown | 4.07 % |

| Max drawdown | 13.04 USD |

| Months on profit | 91.00 % |

| Net balance | 414.47 USD |

| Net profit | 114.47 USD |

| Profit factor | 2.17 |

| Profit per day | 0.32 USD |

| R - squared | 97.03 |

| Return / drawdown | 8.78 |

| Sharpe ratio | 0.34 |

| Max stagnation | 7.27 % |

| Max stagnation | 19 days |

| System Quality number | 4.61 |

| Win / loss | 0.69 |

Although the results show good results, it is necessary to note that not every month was profitable, and past results do not guarantee positive future results.

The main idea is to publish a technical analysis study with enough parameters for you to perform a back test, and thus draw your own conclusions.

I do not recommend using the EA in real account.

Download EA Click Here