0

94

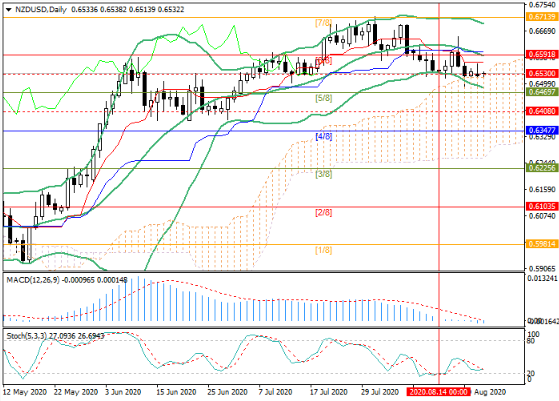

After the downward correction of the last week, the pair has stabilized at the level of 0.6530 (Murray [6/8], H4). It is likely that the downward movement will resume in the near future, as the New Zealand dollar remains under the pressure of negative statistics.

Retail sales in the second quarter fell by 14.6% at once amid the coronavirus epidemic. Catering and tourism were hit hardest, as did fuel. Foreign trade data for July will be released on Wednesday, which is also expected to be weak. Exports could fall from 5.07 billion to 4.90 billion, while imports could rise from NZ $ 4.64 billion to 4.80 billion, leading to a reduction in the trade surplus. The US dollar gains support after today's consultations on the implementation of the first phase of the US-China trade deal. The US Trade Mission said both sides see progress and are committed to taking further steps necessary to ensure the agreement is a success. In addition, investors hope that the approval for the use of blood plasma and a promising British vaccine for treating patients will help turn the tide of the US pandemic and provide a boost to the economy.

Support and resistance levels

Medium-term downtrend persists, and the price may soon drop to 0.6469 (Murray [5/8]), 0.6408 (Murray [2/8], Н4) and 0.6347 (Murray [4/8]). The key level for the “bulls” is the level 0.6590 (Murray [6/8], the middle line of Bollinger bands). Its breakdown will give the prospect of growth to the level of 0.6713 (Murray [7/8]).

Technical indicators generally confirm the decline. Bollinger Bands are directed downward. The MACD histogram has moved into the negative zone. Stochastic is trying to turn upwards, which does not exclude an upward correction within the downtrend.

Resistance levels: 0.6590, 0.6713.

Support levels: 0.6469, 0.6408, 0.6347.

Trading plan

Short positions can be opened below the level of 0.6530 with targets at 0.6469, 0.6408, 0.6347 and stop-loss at 0.6575.

Long positions should be opened above the level of 0.6590 with the target at 0.6713 and stop-loss at 0.6540.

Implementation period: 4-5 days.

Scenario

Timeframe Weekly

SELL STOP recommendations

Entry point 0.6525

Take Profit 0.6469, 0.6408, 0.6347

Stop Loss 0.6575

Key levels 0.6347, 0.6408, 0.6469, 0.6590, 0.6713

Alternative scenario

BUY STOP recommendations

Entry point 0.6595

Take Profit 0.6713

Stop Loss 0.6540

Key levels 0.6347, 0.6408, 0.6469, 0.6590, 0.6713