This page dedicated to EA Jarvis setting, this is to help you out on how to drive and manage this EA.

As a resume :

- EA : https://www.mql5.com/en/market/product/45578

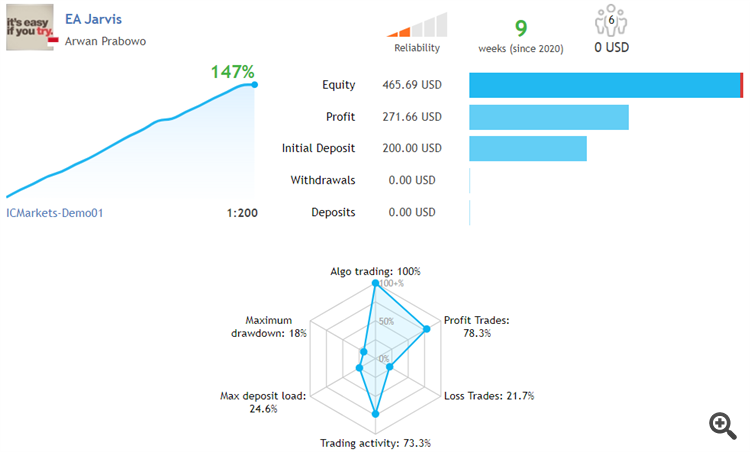

- Trading history : https://www.mql5.com/en/signals/731166

- Set file used for above account (start from balance 200): https://c.mql5.com/31/431/jarvis_set_live_mql5_v2.6.set

- Set file being used start from balance 800 : https://c.mql5.com/31/532/jarvis_set_live_mql5_balance_800.set

Trading Condition :

- Broker : ICMarket

- Leverage : 1:200

- VPS latency : 7 - 80 ms. VPS Spec : 768 MB, win 7. VPS Location : europe

How to attach this EA :

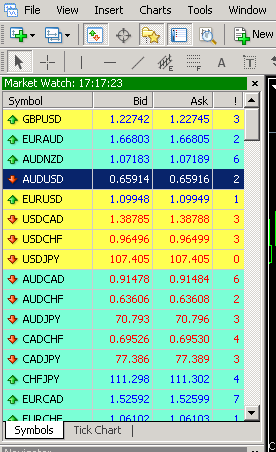

1. Make sure all pair in the market watch always shown.

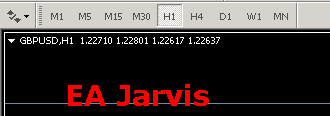

2. Install only in one pair. Time frame = 1 H

3. Find out your broker time, and I recommend to set the start trading hour ( time filter ) is 1 hour after london market open.

Set and adapt with your broker time. In my broker ( ICMarket = GMT+2 ) the london market open at 10.

Hence I set the EA to start at 11.

TIPS :

- You may want to use TP & SL by pips, you can use it, but please explore it in the DEMO, you can play with mode : Normal/Reversal

- Honestly I'm a fan of martingale strategy, hence I am not fully test the TP & SL value.

- I my earlier forward test, Martingale = false/off and set the TP & SL both = 35 pips, resulting about 69% winning ratio in 3 weeks.

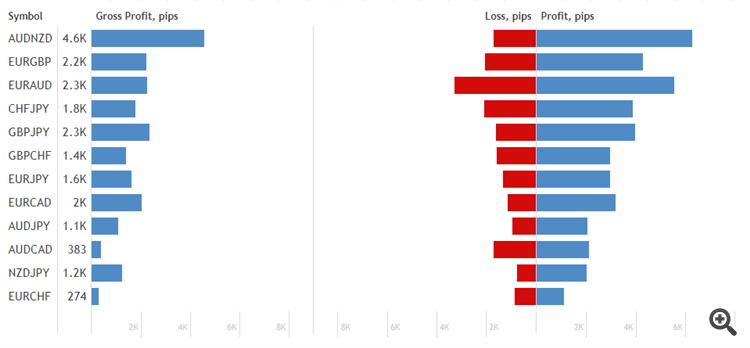

- Learn from my trading result, you can focus on the profitable pair only or lowest spreads

- Analyze my Trading history : https://www.mql5.com/en/signals/731166

- I make the trading history available for you to learn and review

Trading ideas to set up the EA :

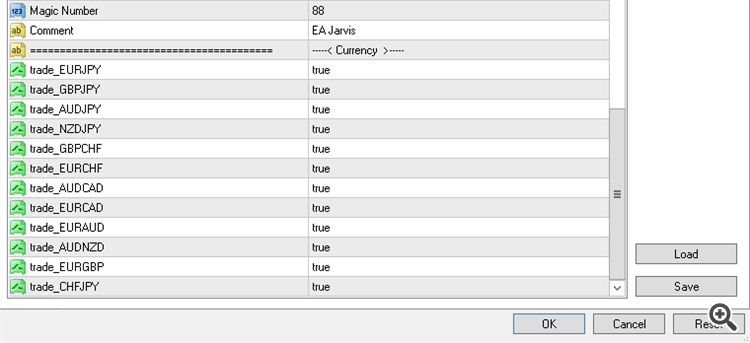

As per 25th May 2020 on my signal : We can see EURGBP, AUDNZD, GBPJPY, EURCAD are the best ratio of winning/profitable pips vs loss pips.

And AUDCAD is the very few traded and the loss is quite high.

By this might give use ideas : To set up trade = true for EURGBP, AUDNZD, GBPJPY, EURCAD

and trade = false for AUDCAD

This is the benefit to share transparently the live running test of EA performance, hope this helps every user of EA Jarvis

Update version 2.6 : Draw down protection - the feature most requested !!

Some notes I would like you to understand :

1. This ea based on correlation and actual trends. And i believe this is the real-time market condition, please read the EA description.

2. Each broker has different spreads, server time, tick data feeds, liquidity provider, contract size, stops level, execution policy etc. This might lead to different result for the same strategy.

3. Solution : Try to mitigate the risk, by understand your broker profile and specification

4. Profit & Risk in the past can not guarantee the future result. T & C apply

5. Master this EA by run live demo and understand how to drive it. Ask me here, I will do my best to explain.