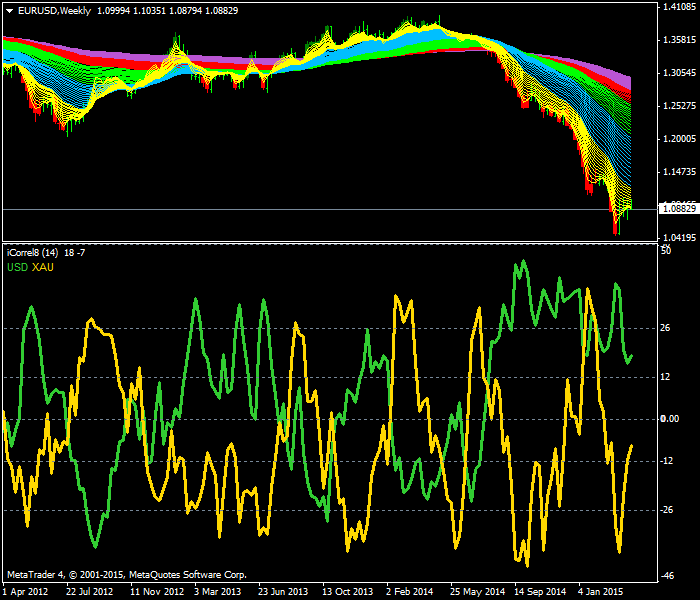

Gold-Usd correlation is yet another significant forex market indicator. Gold, denominated in terms of the U.S. dollars, directly impact price movement of EURUSD.

Due to its relative rarity and historical significances, it is considered as one of the most treasured metal in the world. Gold serves as proxy for value and is widely traded in every nook and corner of the world from peasants in the hinterland of Himalayas to small potato vendors to corporations, large multi-national banks and central banks of every nations. The peasants in the Himalayas who buy gold might merely have purpose of gifts or ornamental purpose. Small potato vendors who purchases gold might serve them as a vehicle for monetary exchange in his/her potato business. Large corporations and multi-national banks on the other hand trade gold for hedging purposes.

The central banks, on the other hand, trade gold with purpose to manipulate the monetary value of their respective nations. Major central banks like the Fed in the U.S., and the E.C.B in the Euro zone both hold vast gold reserves. The ECB in particularly is notoriously recognized for dumping many tonnes of their gold reserve on the market in order to stabilize the value of the Euro against the U.S. dollar.

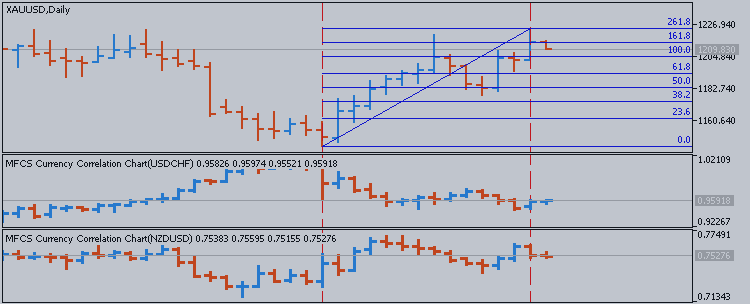

This strong negative correlation between dollar and gold makes gold as an ultimate forex hedging

tool. Traders and investors can buy gold in order to hedge against the U.S. dollar weakness.

When gold is purchased, the U.S. dollar is sold. Selling dollar will naturally devalue the currency as we have more supply of dollar. When gold is purchased, it's price rises because of demand for gold. So if you notice gold making lower lows then anticipate dollar gains and vice versa.

Historically speaking, strong negative gold-Usd correlation has existed in near perfect as investors often hedge against the U.S. dollar weakness by buying gold. However, don't take my analysis on this correlation at face value. Even this strong correlation breaks down during massive economic crisis.