Forex Forecast and Cryptocurrencies Forecast for May 04 - 08, 2020

First, a review of last week’s events:

- EUR/USD. Macro indicators paint a completely non-rosy picture of the state of the global economy. However, things in Europe look much worse than in the United States. The European economy has sagged at a record 3.8% in history over the previous quarter and 14.4% over the previous year, while in the United States these figures are just 1.2% and 4.8%, respectively.

Last week, both the ECB and the Fed held meetings. Following the statements made on their results, it can be concluded that both regulators are concerned about the prospects of the crisis deepening, but the Fed can and is taking faster and more effective steps to support its economy than its European counterpart.

In terms of allocations, the ECB's balance sheet has risen by €645 bn since the beginning of March, while the Fed's balance sheet has risen by $2.3 tn. The European Central Bank has lowered the rate for the target long-term lending program LTRO from -0.5% to -1% and announced the launch of the non-target financing program PELTRO at -0.25% but left the key interest rate unchanged at 0%. In addition, investors had expected the ECB to decide on the purchase of bonds of “fallen angels” - securities whose investment rating threatens to fall to “junk” due to the pandemic. But it didn't happen either.

However, the US Federal Reserve also left the interest rate unchanged, which allowed the dollar to stay within the four-week lateral corridor 1.0750-1.1000. After reaching the height of 1.1018, the pair underwent a slight correction and completed the five-day period at 1.0980;

- GBP/USD. In general, the week dynamics of this pair's quotes echoed that of the EUR/USD, however, its correction after the sharp takeoff on Thursday April 30 was significantly stronger.

The pound's weekend sell-off was primarily due to a deteriorating fundamental backdrop in the UK economy. Due to the shutdown of a large number of enterprises, the manufacturing sector PMI fell to a record low of 32.6, which was significantly lower than the critical value of 50.0.

As a result, having started on Monday from the level of 1.2365, the pound finished on Friday in the area of a strong support/resistance zone of 1.2500, losing 135 points to the dollar over the week;

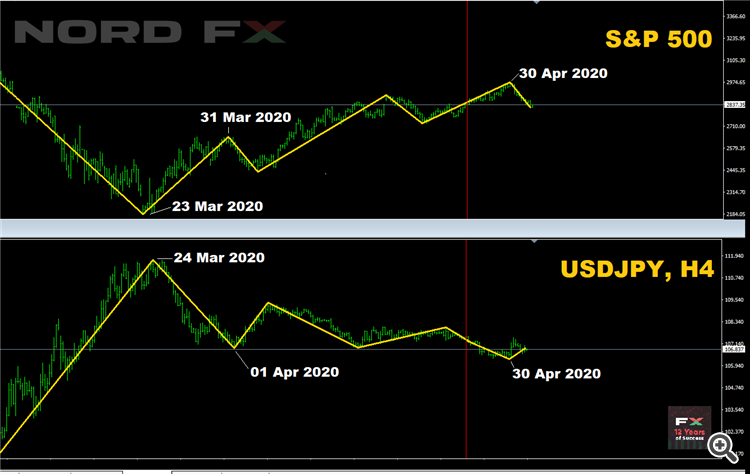

- USD/JPY. With ultra-high volatility caused by the COVID-19 pandemic, the inverse correlation of this pair with the S&P500 and Nikkei225 is particularly noticeable in recent weeks.

As expected by the majority of experts (55%), supported by the vast majority of indicators on H4 and D1 (75-100%), the past week began with another bear attack on the support of 107.00, which is a significant level for the yen for many months and even years. It would seem the breakdown took place and the pair even reached the 106.35 horizon. But the bears failed to consolidate their success. U.S. exchanges closed the last trading day of April with a vast decline. Futures for the S&P500 lost about 3.0%, while Japan's Nikkei225 rolled back from an 8-week high. Following the inverse correlation rule, the USD/JPY pair turned north and returned to where it started on Monday - to the zone 107.40-107.50. The bears made another attempt to break the level of 107.00 on Friday May 1, resulting in the pair finishing the trading session slightly below it — at 106.85;

– cryptocurrencies. Halving in the Bitcoin network is getting closer and closer. This event overshadows even what happens in connection with the coronavirus pandemic for crypto-analysts and crypto-traders. The wait is not long, everything should happen on May 12. And, as most experts predicted (65%), the main currency went up in the run-up to the halving, pulling along the entire cryptocurrency market. If the BTC/USD pair was at the level of $7,400 on April 24, it was already close to the height of $9,400 on April 30, showing a gain of 27% over 5 days. The number of bitcoin holders with 0.1 coins in their account reached a record level, exceeding 3 million.

However, apart from the bulls-optimists, of course, there are also bears on the market, pessimists, who believe that the halving is already embedded in the Bitcoin current market price, and therefore there are no reasons for its explosive growth at all. This point of view prevailed by the end of last week, when many traders and miners began to take profits, lowering BTC quotes on April 30 to $8,400.

Then bitcoin rose again and by the evening of Friday May 1 it moved to the $8,700-9,000 zone. The total cryptocurrency market capitalization at the end of the week was $ 247 billion (15% per week), and the Crypto Fear & Greed Index doubled from 20 to 40, finally leaving the red zone of fear and reaching neutral values.

As for such top altcoins as Ethereum (ETH/USD), Ripple (XRP/USD and Litecoin (LTC/USD), they obediently repeated the dynamics of the reference cryptocurrency without ever making any independent movements.

***

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. Despite the economic crisis, falling GDP and rising unemployment, April as a whole was very successful for the main stock indices - investors massively bought back assets that sharply fell in price during the March collapse. As for EUR/USD, the European currency, albeit with difficulty, managed to prevent the onset of the dollar. And although the bears constantly pressed the euro to the lower boundary of the side channel 1.0750-1.1000, the pair ended the month where it was on April 01 — near its upper limit of 1.1000. Now, in order for the European currency to be able to withstand pressure, the ECB needs to seriously intensify its actions. However, EU leaders still cannot agree on the form of grants or loans to implement the upcoming aid program. Such slowness reinforces market expectations regarding a possible drop in European GDP this year by 12%.

Now about the week ahead. At the time of writing this forecast, the vast majority of indicators are colored green. However, about 15% of the oscillators on H4 and D1 already give signals about the pair being overbought, which indicates that it may rebound to the center of the channel 1.0750-1.1000, which is agreed by 65% of analysts. The targets are 1.0900 and 1.0750. If the uptrend continues, the pair will try to break through the resistance of 1.1100 and reach a height of 1.1240.

Among the significant events of the upcoming week that may affect the formation of local trends, you should pay attention to the publication of data on business activity and the labor market in the United States on May 05, 06, and especially on Friday, May 08. The unemployment rate in April is forecast to be 10% lower than in March (14% vs. 4%), and the NFP (the number of new jobs outside the agricultural sector) fall from -701 to -20,000. All this will play against the dollar, although, as often happens, the market can take these negative forecasts into account in advance;

- GBP/USD. There are no specific signals from the indicators regarding the future of this pair, although the greens have a slight advantage over the reds. The greens are supported by graphical analysis on D1, according to which the pair will rise to the height of 1.2865 in the next 1-2 weeks, and then another 100 points higher. The nearest targets are 1.2650 and 1.2725. Supports are at 1.2245, 1.2165 and 1.1965 levels.

The experts' forecast for this pair is also neutral: a third of them vote for its growth, a third – for a fall, and a third – for a sideways trend. But when switching from a weekly to a monthly forecast, most of them (60%) expect the British currency to weaken and the pair to fall.

In addition to the deteriorating state of the UK economy, the pressure on the pound is being put on by uncertainty over Brexit, analysts said. Negotiations on leaving the EU have again reached an impasse, and the main Euro negotiator, Michel Barnier, said that Great Britain was refusing any compromises on very many fundamental issues. Moreover, the British have refused any postponements related to the completion of the process of parting with the European Union, as a result of which the possibility of a tough Brexit has once again loomed on the horizon.

The coming week should pay attention to Thursday 07 May, when the meeting of the Bank of England will take place. The interest rate is likely to remain unchanged at 0.1%. Therefore, the Bank's monetary policy report is of particular interest to investors. And here something unexpected is possible. Given that the recession of the British economy in the II quarter is likely to exceed 8%, the regulator can go on expanding the program of quantitative easing, the volume of which currently stands at £ 645 billion;

– cryptocurrencies. First, traditionally medium and long-term forecasts of gurus and cryptosphere enthusiasts. So, the head of the CoinCorner exchange, Danny Scott, said that the financial crisis against the background of the coronavirus pandemic is forcing more and more investors to turn to bitcoin. "If the situation with the fiat, stock markets and oil does not stabilize, you can expect the coin for $20,000 or even more after the halving. Fiat money that even ordinary citizens receive as part of support can be converted to cryptocurrency. People are beginning to fear that the dollar will lose stability and cease to be an asset with minimal volatility".

Warren Buffett's adviser Preston Pish is also optimistic about bitcoin, who believes that the price of BTC can reach $200-300 thousand. His position is based on fundamental principles, which once again include the halving and the subsequent shortage of the coin supply in the market. At the same time, Pish’s position radically diverges from the position of the famous investor and billionaire Warren Buffet, who is an ardent opponent of cryptocurrencies and especially Bitcoin.

Venture capitalist Tim Draper agrees with Pish as well, he has repeatedly said that the BTC will reach $250,000 by the end of 2022 or early 2023. He has once again confirmed this forecast at Virtual Blockchain Week, saying that one of the catalysts for the growth of the first cryptocurrency will be its use in trading transactions. In his opinion, representatives of this sector of the economy can not but appreciate the advantages of bitcoin and the cheapness of transactions. It is hard to argue with the latter, especially after it became known that the commission for the transfer of BTC on April 22 worth $367 million amounted to only 63 cents.

In general, while maintaining optimism, some experts fear that after the halving, due to a decrease in the reward for a mined block from 12.5 BTC to 6.25 BTC, only the most efficient miners with new equipment and access to cheap electricity can remain in the industry. Such consolidation may disrupt the cryptocurrency ecosystem, which will run counter to promises to increase the decentralization of mining. However, a possible increase in the cost of bitcoin and a drop in energy prices caused by the current crisis gives hope that small crypto farms can stay afloat, while maintaining profitability.

And now about forecasts for the coming week, which may surprise, as more than half of analysts (55%) predict not growth, but the fall of the BTC/USD pair to the zone of 7,700-8,000. Another 20% predict its movement along the $9,000 horizon, and only 25% expect that bitcoin quotes will break through the resistance at the $10,000 level.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.