|

Hey! This is Philip

with this week's

trade idea of the

Free Profitable

Forex

Newsletter!

Markets are trading on edge despite the

recovery in risky assets last

week as the coronavirus

pandemic is now spreading in

full force across the United

States. It is already well

clear that this crisis, which

at its core also has a medical

crisis, will be bigger than the

2008-09 financial crisis.

Corona Crisis Keeps

Markets Nervous

Markets are not expected to

calm down before the

medical situation is

under control. As a

result, more wild

market action is

likely, and traders

are having their

guards up

high.

With that said,

it is not very

useful to look for

trades based on

fundamentals in a

time when

fundamentals matter

little, and instead,

liquidity and rapid

newsflow are the main

driving force of

prices.

In all this, technicals

and price patterns

can be very valuable

because they provide

clear levels for our

trades.

Such is the

example of the

potential EURJPY Buy

trade that we are

discussing below.

Buying Opportunity:

Double Harmonic Support

On EURJPY 1H Chart

The Harmonic patterns are

great in times of high

uncertainty like now

because they still give

very reliable signals

and, at the same time, that

comes with relatively

tight stops. This enables

excellent risk-reward

ratios more often than

not. And nothing is more

important for trading in

volatile times than

keeping your risk at a

minimum.

As I am going to show in two

separate charts below,

the confluence of

harmonic zones of these

two patterns means that

this 117.20 - 117.40 area

is robust support for

EURJPY now, making the

case for a bounce highly

probable.

The

pair is just entering this

area as of the moment of

writing.

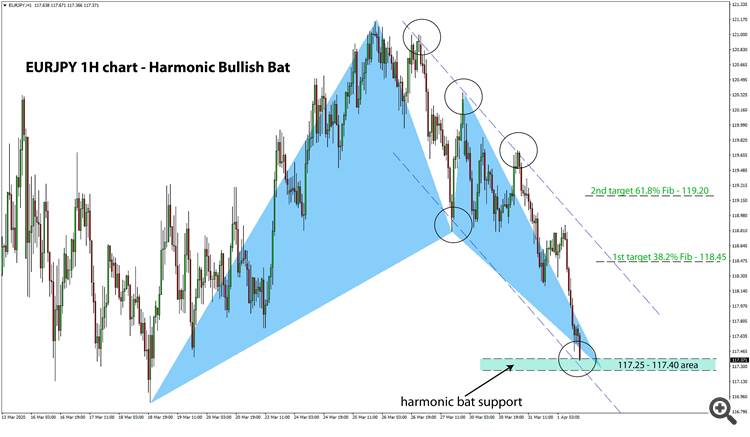

The Harmonic Bat:

- As

can be seen from the

bullish bat pattern,

shown on the chart above,

its harmonic support

zone is in the 117.25 -

117.40 area.

-

The two targets of

this pattern (those are

the 38.2% and 61.8% Fib

retracements) are at

118.45 and 119.20.

-

That gives a potential

profit of 100 - 200 pips.

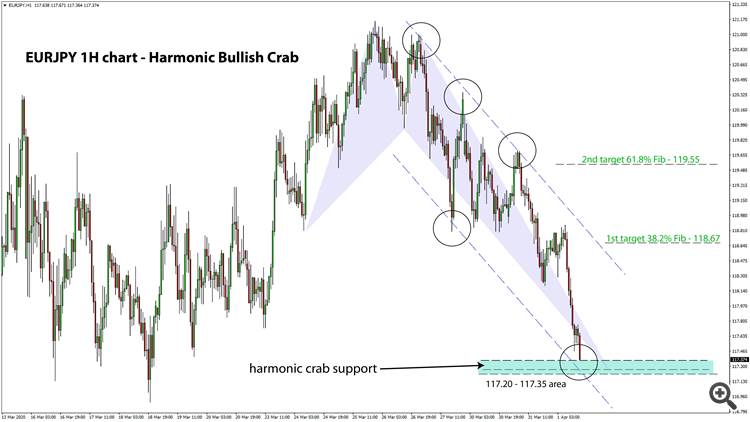

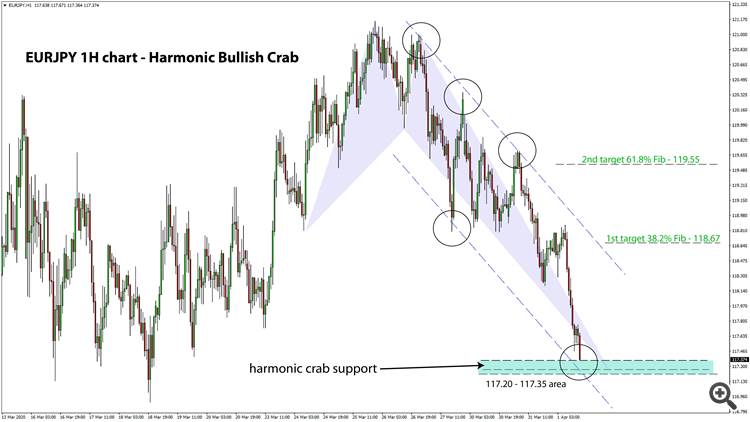

The Harmonic Crab:

- The

situation is similar with

the crab pattern as well,

shown on the chart below.

-

Its harmonic support

zone stands at 117.20 -

117.35 - closely

overlapping the support

of the bat pattern.

-

The specific 38.2%

and 61.8% Fib targets of

the crab are at 118.67 and

119.55, close but

slightly higher than the

bat.

In

addition to the two patterns, there is

the downward channel that has its

support trendline coming into the same

area as the double harmonic support

area.

All of this makes a case for

a EURJPY rebound in this area

that much more likely.

Note: the

two charts above are exactly

the same, they are just showing

the two different patterns.

-

Look to buy in the

above-described

confluence support

area of the Bat and

Crab

patterns.

-

The two zones

overlap to form a

confluence zone of

117.20 - 117.40.

-

Keep in mind, as

the price tests this

area, it may dip

slightly lower than

the low, but that is

fine as long as it

bounces back

quickly.

Stop loss:

-

Look to place

a tight stop just

below

this 117.20

- 117.40

confluence

support

zone.

-

Some 10 - 20

pips lower is

fine to allow

some greater

breathing room

for the trade.

Targets:

-

Aim for the Fib

targets

described/shown

above.

-

Since the bat

pattern has the

targets slightly

lower, you can aim for

them as a safety

measure and take

profits at those

target levels. The

price, though, may

achieve the targets

of both patterns.

|

|

|

|