The New Zealand dollar vs. the Canadian dollar is in a place where it can receive a boost from one of the two different and important lines, each giving an opposite direction in the long run.

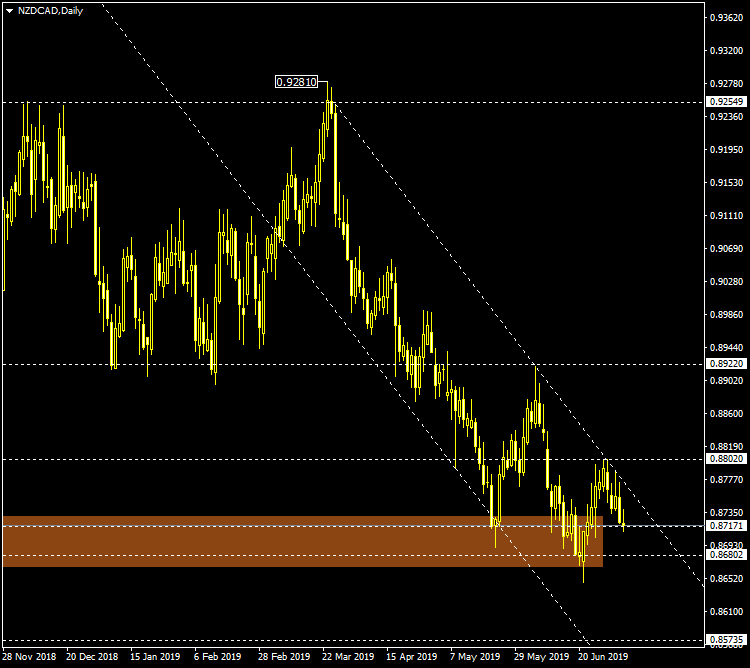

From 0.9281, the price is in a descending trend, the resistance line of which results by joining two points - the first being the high of March 27, 2019, and the second the high of June 5, 2019, respectively - that also intersect with two important levels, namely 0.9254 and 0.8902. Notable is the third confirmation that also took place at a confluence zone, the high on July 1, 2019, being rejected by both the earlier mentioned resistance line of the descending trend and the 0.8802 level. In such a context, the sellers would be entitled to believe that they should expect further decline.

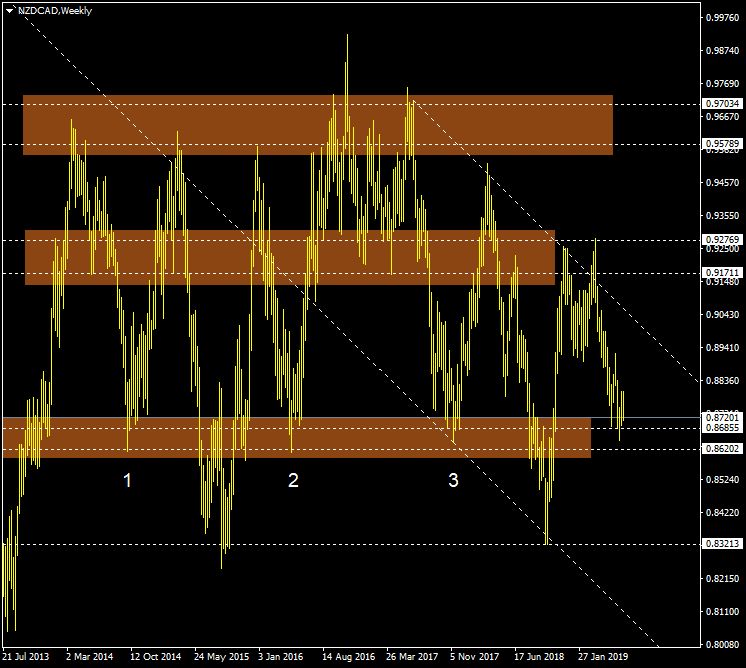

On the other hand, the 0.8717 - 0.8680 zone is a weekly supportive area, also enclosing a psychological level - 0.8700 - that has turned the price around for three times. And since I mentioned the weekly chart, there is a descending trend that can be observed, with a current impulsive wave in development. So, in the end, the question is: will the weekly impulse continue or cease?

- - If the 0.8717 - 0.8680 area repels any bearish continuation attempt, then a bottoming structure could emerge. Signs of such an outcome would be a higher low with respect to the candle on 21 June, 2019, followed by the piercing of the descending trends' resistance line.

- - If the bears manage to cross the 0.8717 - 0.8680 area and cause a departure from it, then a throw-back that will confirm 0.8680 as resistance is to be expected.