Oil prices continue to recover. The rise of the last days has become the longest since April. The price of Brent crude is growing for the seventh consecutive session.

Prices received additional support from data on the reduction of oil production in the US last week by 100,000 barrels per day.

By the beginning of today's European session, August futures for WTI crude oil on the NYMEX were trading at $ 45.21 per barrel, with an increase of $ 0.28, while Brent crude futures gained 0.63% to $ 47.72 per barrel. Prices for these types of oil this week rose by more than 5%.

The spot price for Brent crude is approaching $ 48.00 per barrel at the beginning of the European session. Also, the growth of oil prices contributes to the weakening of the dollar in the foreign exchange market. The probability that in December the Fed can raise the rate by another 0.25% goes into the background. Investors' attention this week was focused on the statements of the leaders of several of the world's largest central banks (Europe, Great Britain, Canada) about the possibility of an early tightening of monetary policy in these countries, which led to the growth of currencies of these countries against the US dollar.

Nevertheless, the fundamental factors for oil prices remain rather negative. Excessive supply in the market can grow on the background of increased oil production in Libya and Nigeria.

The number of oil drilling rigs in the US increased again last week, this time by 11 units to 758 units, which was the 23rd consecutive week of the increase. Excess supply in the oil market remains, and the world's oil reserves remain high.

Investors are still not sure about the stabilization of oil prices. If the US again grows oil production, then pessimism can again return to the oil market. Despite the current price increase, a negative impulse prevails in the oil market.

Today (17:00 GMT) publishes a weekly report of the Baker Hughes oilfield services company on the number of active drilling platforms in the US, which is an important indicator of the activity of the oil sector of the US economy and significantly affects the quotes of oil prices. At the moment, the number of active drilling platforms in the US is 758.

Support and resistance levels

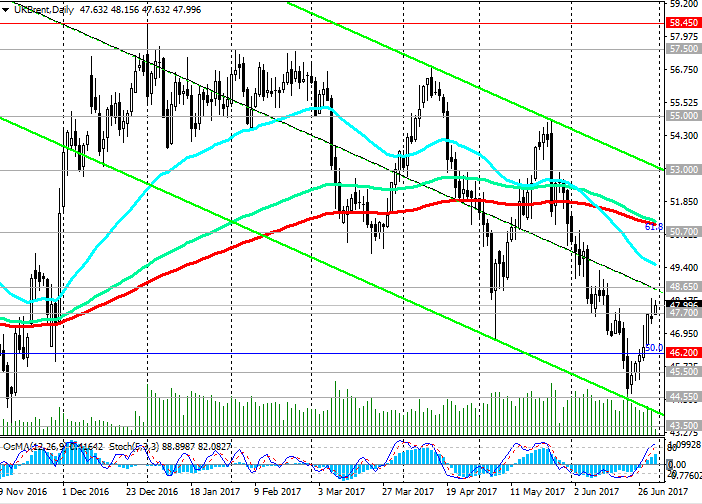

Last week, the price of Brent oil broke the lower border of the rising channel weekly chart near the level of 47.70 and develops a downward trend within the falling channel on the daily chart.

The lower boundary of this channel passes near the level of 43.50 (November minima).

The price is below the key resistance level of 50.70 (EMA200, EMA144 on the daily chart, the Fibonacci level of 61.8% correction to the decline from the level of 65.30 from June 2015 to the absolute minimums of 2016 near the 27.00 mark), 46.20 (Fibonacci level 50.0%) .

Corrective growth may continue to the resistance level of 48.65 (EMA200 on the 4-hour chart), from which the price may again return to a downtrend.

On the monthly and weekly charts, the OsMA and Stochastic indicators remain on the sellers’ side.

In the event of breakdown of support levels of 43.50 (November lows), 41.70 (Fibonacci level of 38.2%), the price of Brent crude will finally return to a downtrend.

Return to consideration of long positions is possible only if the price returns to the zone above the short-term local resistance level of 48.65 (EMA200 on the 4-hour chart).

The oil market is dominated by negative sentiment, and against this background, oil prices remain under pressure with a tendency to further decline.

Support levels: 47.70, 46.20, 45.50, 44.55, 43.50, 41.70

Levels of resistance: 48.65, 50.00, 50.70

Trading Scenarios

Sell Stop 47.30. Stop-Loss 48.30. Take-Profit 47.00, 46.20, 45.50, 44.55, 43.50, 41.70

Buy Stop 46.10. Stop-Loss 44.90. Take-Profit 47.25, 47.50, 48.35, 50.00, 50.70, 51.35

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com