This week a number of important events will take place: meetings of central banks of Switzerland, Great Britain, Japan. However, the focus of traders will be a two-day meeting of the Fed (June 13-14) and the Fed's decision on the interest rate, which will be published June 14 at 18:00 (GMT). Forecast: the rate will be increased by 0.25% to 1.25%. After the decision on the interest rate, a comment on the monetary policy (FOMC Statement) is published and the press conference of the Federal Reserve begins. In the period of publication, a surge in volatility is expected across the financial market, and market participants will study the statement of the Fed on the presence of signals for further plans for monetary policy.

Higher interest rates tend to support the dollar, making US assets more attractive to investors, and putting pressure on commodity prices and commodity currencies. If the Fed signals about the possibility of one or two more rate increases this year, the US dollar will receive significant support.

Also on Wednesday (at 22:45 GMT) a report on New Zealand's GDP for the first quarter is published. Forecast: + 0.7% (previous value + 0.4%). The publication of data will cause increased volatility in NZD. Against the background of rising prices for agricultural products in recent years (especially for dairy products, which is an important part of New Zealand's exports), it is likely that the report on New Zealand's GDP for the first quarter will come with positive indicators, and this will positively affect the positions of the New Zealand currency.

If the GDP report turns out to be worse than expected, and the Fed signals about the possibility of further interest rate hikes, then the NZD / USD pair may drop sharply and finally begin a corrective downward movement to the pair's active growth from the middle of last month.

Otherwise, the pair NZD / USD will continue its upward movement against the backdrop of positive macro data coming in from New Zealand recently.

We also await data from New Zealand on the balance of payments for the first quarter (it is expected that the negative balance was 1 billion New Zealand dollars against the surplus of 1.18 billion NZ dollars in the 1st quarter of last year), which are published today at 10:45 (GMT) And data from China (retail sales, industrial production in May) on Wednesday morning, which will increase the volatility of trades on the New Zealand dollar.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and Resistance levels

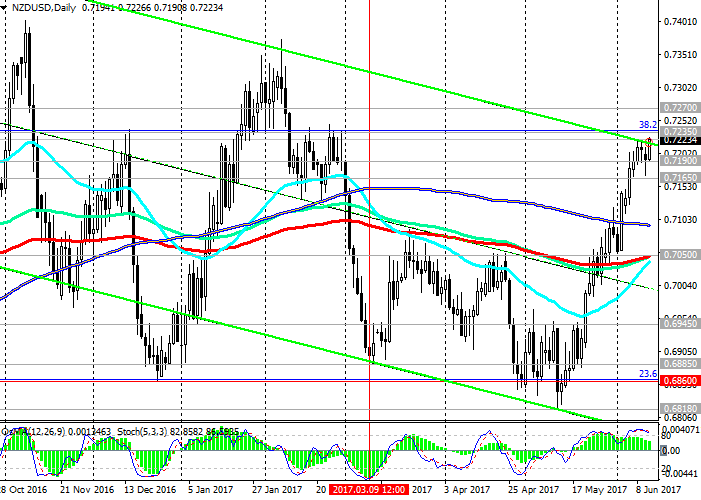

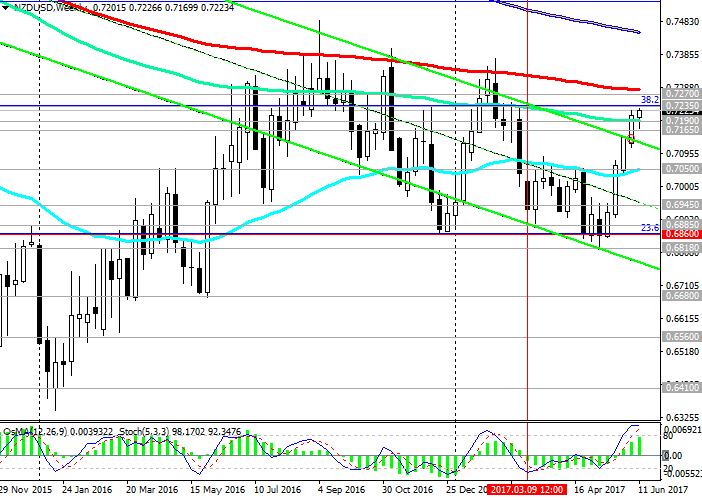

As a result of active growth, which began in the middle of last month, the pair NZD / USD broke through a strong resistance level of 0.7190 (EMA144 on the weekly chart) and came close to the resistance level of 0.7235 (the Fibonacci level of 38.2% of the upward correction to the global fall wave from the level of 0.8800 , Which began in July 2014, the minimums of December 2016).

A little higher, through to the resistance level of 0.7270 is the 200-period moving average on the weekly chart. Thus, the NZD / USD pair is in the zone of strong resistance levels. For further growth and breakdown of these levels, the pair NZD / USD needs strong positive fundamental drivers, for example, signals from the RBNZ about the possibility of an early interest rate increase in New Zealand. The next meeting of the RBNZ on this issue will be held on June 21, ie. Already next week.

As you know, RBNZ last month kept interest rate at 1.75% and stated that interest rates will remain unchanged for quite a long time, at least until the third quarter of 2019. If, however, in the rhetoric of the bank will be marked a more rigid position, the New Zealand dollar will receive a strong support, and then the resistance level of 0.7270 can be passed.

Otherwise, the New Zealand dollar and the pair NZD / USD are waiting for a decline.

While the RBNZ seeks to keep the current monetary policy unchanged, the Fed says it plans to gradually tighten monetary policy in the US. The difference between the monetary policies of the RBNZ and the Fed will remain the main fundamental factor in favor of the US dollar in the next couple of years, despite the possible growth periods for the NZD / USD pair over several weeks.

The return of the pair NZD / USD to the short-term support level 0.7165 (EMA200 on the 1-hour chart) may trigger a further decline in the NZD / USD pair and in the medium term with a target near the key support level of 0.7050 (EMA200, EMA144, EMA50 on the daily chart).

By the way, indicators OsMA and Stochastics on the daily period begin to unfold on short positions.

Support levels: 0.7190, 0.7165, 0.7100, 0.7050, 0.6945, 0.6900, 0.6885, 0.6860, 0.6818

Resistance levels: 0.7235, 0.7270, 0.7300, 0.7380

Trading Scenarios

Sell Stop 0.7190. Stop-Loss 0.7240. Take-Profit 0.7165, 0.7100, 0.7050, 0.6945, 0.6900, 0.6885, 0.6820

Buy Stop 0.7240. Stop-Loss 0.7190. Take-Profit 0.7270, 0.7300, 0.7380

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com