Is currency trading worth the risk?

A Comprehensive Guide to Currency Trading: Tips and Strategies for Success Currency trading is an exciting and growing field in the financial world. This comprehensive guide will delve into various aspects of currency trading, providing insights and strategies to help you become a successful trader in the currency trading market.

Section1: Introduction to Currency Trading

1.1 What is Currency Trading?

Currency trading refers to the buying and selling of currencies with the aim of making a profit in the currency trading market. Financial assets in the currency trading arena are traded at varying prices.

1.2The History of Currency Trading

Currency trading has a rich history that dates back several decades. It has gradually evolved from local markets to a global marketplace for currency trading.

1.3The Importance of the Currency Market

The currency market is the largest financial market in the world, accounting for a significant daily trading volume. Understanding currency trading is essential for anyone looking to enter the financial landscape.

Section2: Fundamental Concepts in Currency Trading

2.1 Understanding Currency Pairs

In the currency trading market, buying and selling usually occurs in pairs, such as EUR/USD, which indicates the value of the Euro against the US Dollar in currency trading.

2.2 What are Pips and Spreads in Currency Trading?

A pip is the smallest price change in a currency pair, while the spread refers to the difference between the buying and selling price in currency trading.

2.3 Analyzing the Currency Market

Market analysis in the realm of currency trading can be divided into three categories:

fundamental analysis, technical analysis, and market sentiment, all of which are essential for predicting price trends in currency trading.

Section3: Currency Trading Strategies

3.1 Short-term Currency Trading Strategies

Short-term traders in currency trading often focus on quick price changes and utilize tools such as scalping and day trading to capitalize on fleeting opportunities.

3.2 Long-term Currency Trading Strategies

These strategies involve longer-term investments in currency trading, where traders make decisions based on fundamental analyses.

3.3 Risk Management in Currency Trading

Risk management is paramount in currency trading, including setting trade sizes,

using stop-loss orders, and diversifying portfolios to protect your capital in currency trading.

Section4: Tools and Resources for Currency Trading

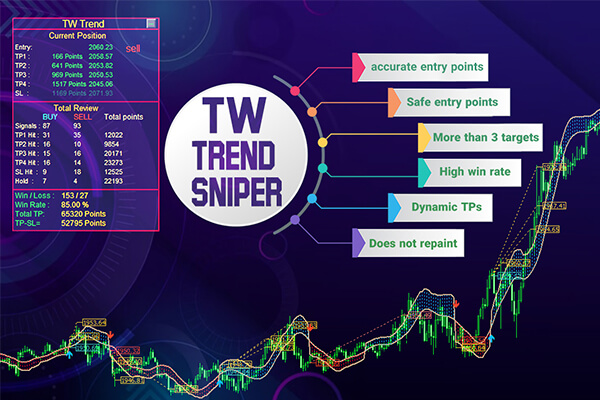

4.1 Best Trading Software for Currency Trading

Using modern trading software can assist traders in making more accurate decisions and improving their timing for buying and selling in currency trading.

4.2 Educational Resources for Currency Trading

Books, websites, and online courses can provide valuable information to novice traders looking to enhance their currency trading skills.

4.3 Staying Updated with Economic News for Currency Trading

Keeping up with economic news and market analyses is crucial for traders who want to understand market fluctuations in currency trading.

Section5: The Psychology of Currency Trading

5.1 Controlling Emotions in Currency Trading

One of the biggest challenges for traders in currency trading is controlling emotions such as fear and greed.

5.2 Acceptance of Imperfection in Currency Trading.

Traders must accept that no strategy in currency trading is 100% fool proof and remember to learn from their mistakes.

5.3 Focus and Discipline in Currency Trading

Paying attention to detail and maintaining discipline in following trading strategies is crucial to success in currency trading.

Section6: The Future of Currency Trading

6.1 Technological Developments Impacting Trading

The rise of blockchain technology and cryptocurrencies is expected to significantly impact the future of currency trading.

6.2 Economic Changes Affecting Currency Trading

Global economic and political developments can have a considerable effect on the currency market, making it vital for traders to stay informed about currency trading trends.

6.3 Opportunities and Challenges in Trading

Traders should recognize that with opportunities in currency trading, new challenges also emerge, requiring new strategies.

currency trading presents both challenges and rewards, making it a compelling venture for those willing to invest time and effort into understanding the market. Throughout this guide,

we’ve explored the foundational concepts, various trading strategies, and essential tools that can aid in your currency trading journey.With a solid grasp of the key elements of currency trading—

including analyzing currency pairs, managing risks, and remaining disciplined—

you can navigate the markets with greater confidence. Moreover, staying informed about technological developments and economic changes will empower you to adapt and seize opportunities as they arise in currency trading.