After in April British Prime Minister Theresa May unexpectedly announced early parliamentary elections the British stock market collapsed. The index of the London stock exchange FTSE100 has lost almost 2.9%. It was followed by all European major stock indexes. Early general elections in the UK would allow Prime Minister Theresa May to consolidate the dominant position of the Conservative Party in parliament on the eve of the June elections in order to negotiate with the EU on more favorable conditions for Brexit.

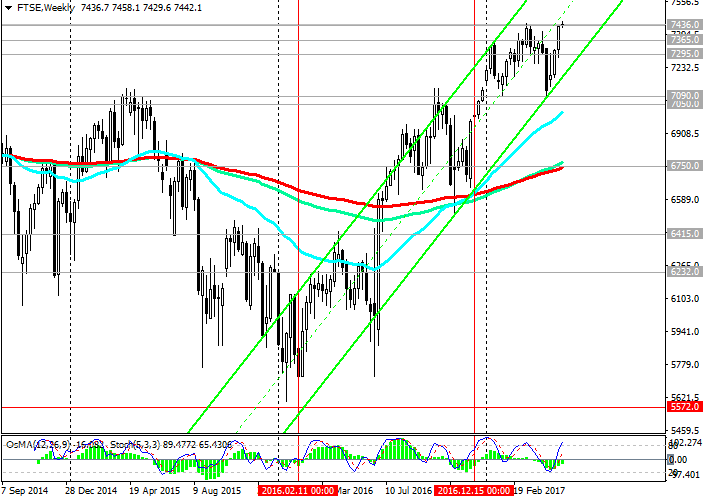

Despite the collapse in April, the FTSE100 index was able not only to recover completely, but to exceed the annual absolute maximum recorded in March near the 7447.0 mark.

At the beginning of today's European session, the FTSE100 index is declining; however, it is still in positive territory, trading near the 7444.0 mark with a rise after more than 1200 points (+ 19%) in the referendum on Brexit at the end of June.

The focus of traders will be today the speech of British Prime Minister Theresa May, which will begin at 19:00 (GMT). It is necessary to take into account the possibility of a sharp increase in volatility during the speech of Theresa May.

It is also worthwhile to be careful when opening trading positions tomorrow, when at 08:30 (GMT) inflation data are published in the UK for April. As expected, annual inflation accelerated to 2.6% from 2.3% in the previous month. The sharp increase in inflation in the country, gives grounds to assume that the Bank of England can again return to consideration of the question of raising the interest rate in the UK. And this is a negative factor for the British stock market.

Nevertheless, weak wage growth rates in the UK, which are lagging behind the rate of inflation in the country, can cause the British to cut their spending, which in turn can cause a slowdown in the national economy.

For this reason, the Bank of England will refrain from tightening monetary policy in the country, which is a positive factor for the British stock market. If the inflation data published in the UK tomorrow is below the forecast (+ 0.4% in April and + 2.6% in annual terms), the FTSE100 index will respond with growth.

Support and resistance levels

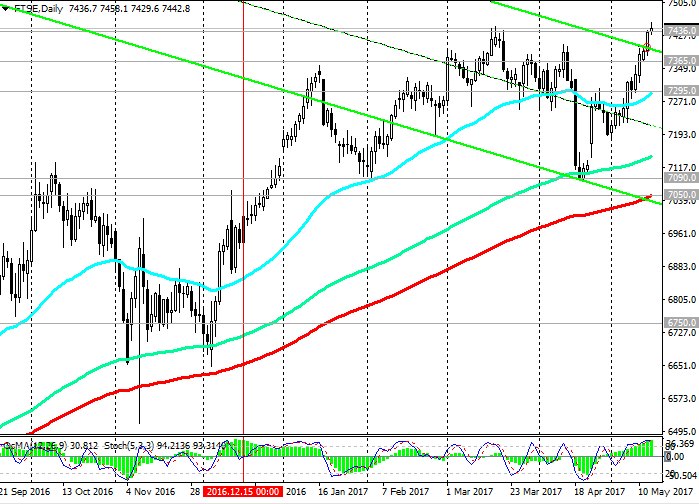

By mid-March, the FTSE100 index rose to its maximum near the 7447.0 level. Over the past two months, the FTSE100 index has fallen, adjusting to the support level of 7090.0. Nevertheless, recovering from a sharp fall after the statement of Theresa May about early parliamentary elections, the FTSE100 index is again rising in the uplink on the weekly chart.

Indicators OsMA and Stochastics on the 4-hour, daily and weekly charts recommend long positions.

While the FTSE100 index is above the short-term support level of 7295.0 (EMA200 on the 4-hour chart), positive dynamics remain.

In the event of a breakdown of this level, there may be risks of reducing the FTSE100 index to support levels of 7090.0 (February lows, October highs), 7050.0 (EMA200 and the lower border of the descending channel on the daily chart).

Breakdown of the level of 7050.0 and further decline will mean a reversal and the end of the upward trend of the FTSE100 index.

Nevertheless, the fundamental background creates the prerequisites for further growth of the index.

While the FTSE100 index is above 7295.0, long positions are more preferable.

The Bank of England maintains an extra soft monetary policy, which is a strong positive factor for the British stock market.

Support levels: 7386.0, 7295.0, 7200.0, 7090.0, 7050.0

Resistance levels: 7450.0, 7500.0

Trading Scenarios

Sell Stop 7365.0. Stop-Loss 7460.0. Take-Profit 7350.0, 7295.0, 7200.0, 7100.0, 7050.0

Buy Stop 7460.0. Stop-Loss 7365.0. Take-Profit 7500.0, 7520.0, 7550.0

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics