Current dynamics

As expected, today the RBA did not change the interest rate in Australia, leaving it at 1.5%. The RBA's accompanying statement noted that the labor market has lost momentum, and inflation may grow slower than expected. As the RBA Governor Philip Lowe noted, "some indicators of the labor market have recently weakened." Weakening consumer spending and lowering inflation, as well as the continuing sharp rise in house prices, amid weakening labor market indicators, are the main risk factors for the RBA and the Australian economy. In this regard, economists believe, the RBA will refrain from changing interest rates in the country for the time being.

At this decision of the RBA, the Australian dollar reacted sharply lower, including in the pair AUD / USD. At the beginning of today's European session, the decline in the AUD / USD pair continued.

The different focus of monetary policies in the US and Australia will facilitate the flow of investment funds from the Australian dollar to the US dollar and further weakening of the AUD / USD.

Support and resistance levels

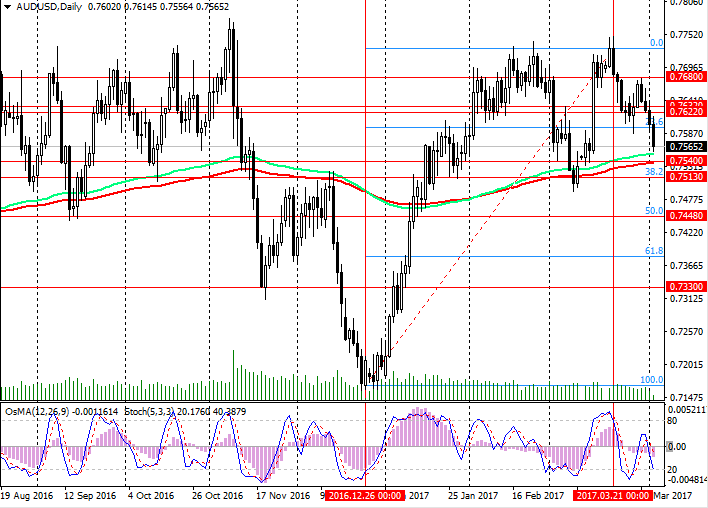

For the first two days of the new trading month, the AUD / USD pair has already lost 0.85%. If the decline continues at the same active pace, by the end of April, the AUD / USD pair will be seen near the 0.7300 mark. However, much in the dynamics of the AUD / USD pair will also depend on the dynamics of the US dollar. Tomorrow (18:00 GMT) the protocol will be published from the last March FOMC meeting, at which the rate was raised by 0.25% to a level of 1.0%. If the FOMC protocols contain signals for the possibility of three or four rate increases, the US dollar can receive significant support in the foreign exchange market.

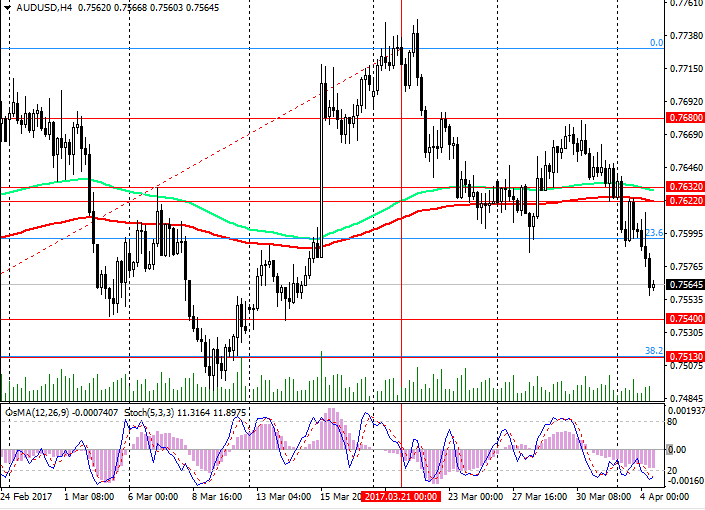

The pair AUD / USD broke through important short-term support levels of 0.7632 (EMA200 on the 1-hour chart), 0.7622 (EMA200 on the 4-hour chart) and continues to decline to support level 0.7540 (EMA200 on the daily chart).

Indicators OsMA and Stochastic on the 1-hour, 4-hour, daily, weekly charts went to the side of sellers.

In case of deeper decline and breakdown of the support level of 0.7513 (38.2% Fibonacci level), the risks of further reduction of the AUD / USD pair will increase with a long-term target near the support level of 0.7155 (May lows, December 2016).

An alternative scenario for growth will become relevant in case of consolidation of the AUD / USD pair above the resistance levels 0.7622, 0.7632.

Support levels: 0.7540, 0.7513, 0.7448

Resistance levels: 0.7622, 0.7632, 0.7680, 0.7740, 0.7760, 0.7800, 0.7840

Trading Scenarios

Sell in the market. Stop-Loss 0.7585. Take-Profit 0.7540, 0.7515, 0.7460

Buy Stop 0.7585. Stop-Loss 0.7555. Take-Profit 0.7622, 0.7632, 0.7680, 0.7740