Trading

recommendations

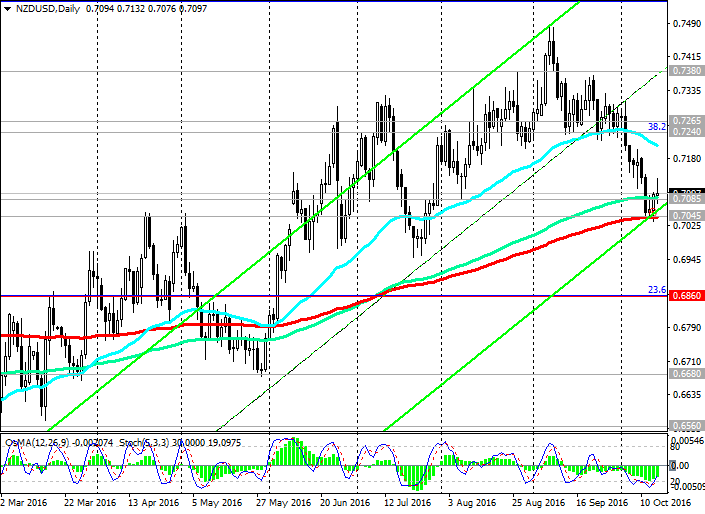

Sell Stop 0.7095. Stop-Loss 0.7110. Take-Profit

0.7045, 0.7000, 0.6975, 0.6930, 0.6900, 0.6860

Buy Stop 0.7140. Stop-Loss 0.7085. Take-Profit 0.7150, 0.7240, 0.7265, 0.7380, 0.7485

Technical

analysis

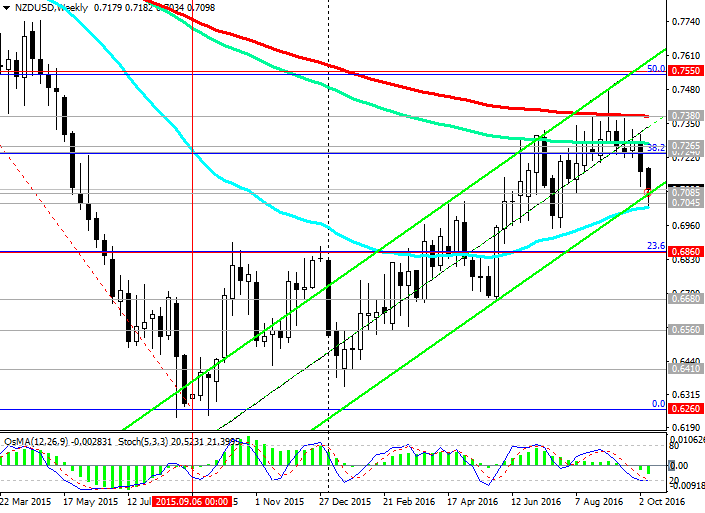

Since the beginning of the month amid a general

strengthening of US dollar pair NZD / USD is actively reduced. Having broken

support levels 0.7265 (EMA144 on the weekly chart), 0.7240 (EMA50 daily chart

and Fibonacci level of 38.2% upward correction to the global wave of decrease

in pair with the level of 0.8800, which began in July 2014), the NZD / USD

downward movement develops. However, NZD / USD pair found support at the 0.7045

support level (EMA200 EMA50 daily and weekly chart). Near this level as the lower

boundary of the rising channel on the daily and weekly charts are. The

breakdown of this important support level may lead to further bearish movement

to the support level 0.6860 (23.6% Fibonacci level). The breakdown of the level

0.6860 may reverse the upward trend.

Indicators OsMA and Stochastic on the daily,

weekly charts are on seller’s side, on the monthly chart - also deployed on

short positions. On the 4-hour chart indicators are also unfolding in short

positions, signaling the end of a short-term upward correction.

The breakdown of current support level 0.7085

(EMA144 on the daily chart) will cause a further decline in the pair NZD / USD

0.7045 with the immediate goal.

Consideration of the long positions after the pair

may return the pair to the zone above the level of 0.7240. Break of 0.7380

resistance level will increase the risk of further growth of pair within the

rising channel on the weekly chart. However, against the background of a

different orientation of monetary policy the Fed and RBNZ such a scenario is

unlikely. The preference - short positions.

Support

levels: 0.7045, 0.6975, 0.6930, 0.6900, 0.6860

Resistance levels: 0.7140, 0.7240, 0.7265, 0.7380, 0.7485

Overview and Dynamics

Strong data from China boosted the inflation rates

and the Pacific, including New Zealand dollar. The price index of China's

manufacturers increased on 0.1% in September, marking the first increase in

more than four years. The consumer price index rose 0.7%. It is favorable for

the New Zealand dollar, as China is the largest trading partner of New Zealand

and the New Zealand buyer of agricultural products, especially dairy products.

The New Zealand economy is largely

export-oriented. About 18% of the total export volume of exports of dairy

products. The recent fall in world prices for dairy products (price index for

dairy products fell last week by 3.0%) contributed to an additional pressure on

the New Zealand currency.

Published earlier in the week macroeconomic data

point to the stability of the New Zealand economy. The surplus of the state

budget of New Zealand was 1.8 billion New Zealand dollars against 414 million

New Zealand dollars in the previous fiscal year. Data on consumer confidence

have also been positive. The consumer confidence index in October rose by 1.1%

and reached the highest level since mid-2015. Nevertheless, the growing level

of confidence and economic growth, as well as the budget surplus will not be

canceled, apparently RBNZ Decisions about the next interest rate cut in New

Zealand already RBNZ meeting on 9 November. Markets assess the likelihood of a

rate cut to 85% from 60% a week earlier. Earlier this week, the country's

central bank confirmed its intention to lower the rate again as early as next

month, making it clear that his priority is inflation and inflation

expectations. This puts pressure on the New Zealand dollar.

Next week will be another auction of dairy

products, but no more important data received within the next two weeks. The

pair NZD / USD will generally be influenced by news from the US. And they

recently received very positive that he supports the US dollar on the currency

market, including in the pair NZD / USD.

From the news today forward data from the US. At

12:30 (GMT) will be published by the US unit of inflation indicators for

September (retail sales, producer price indices). Also at this time it begins

the speech of the Federal Reserve Bank of Boston Eric Rosengren. At 14:00 it

will be published index of consumer confidence from the Reuters / Michigan in October

(pre-release). However, all the attention of traders will focus on the speech

of Fed Chairman Janet Yellen, scheduled for 17.30. If Yellen affect the subject

of monetary policy in the United States, the volatility of the US dollar in

trade rises sharply in the foreign exchange market. If the speech Janet Yellen

will contain signals about interest rate rises in the US before the end of the

year, the US dollar strengthened sharply on the currency market.

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.