TRADING RECOMMENDATIONS AND TECHNICAL ANALYSIS

"The Fed expects moderate GDP growth in real terms, the further recovery of the labor market and the acceleration of inflation to 2% in the next few years. Based on these prospects the Federal Reserve's economy continues to consider appropriate to a gradual increase in rates over time ", - said Janet Yellen during his speech at the recent economic symposium in Jackson Hole on Friday. "The arguments in favor of raising key interest rates have increased in recent months," - added Yellen.

More specifically expressed Fed vice Chair Stanley Fischer, who believes that the US central bank may raise interest rates next month.

However, Fischer added that "we can not say that, until we see the data."

In response to these statements the dollar strengthened sharply on the currency market.

The KOF leading index, which is considered an indicator of economic stability in Switzerland in August fell below 100.0 (99.8 vs. 102.3 and 102.7 in July), which is the lowest level since December 2015.

Published together with the index KOF employment indicator in Switzerland in Q2 grew by 25 000 employees (4.903 million against 4.878 million in the 1st quarter). Low unemployment, which remains in the range of 3.5% -4.0% is already a long time, it remains one of the lowest in the world, that is the strength of the Swiss economy.

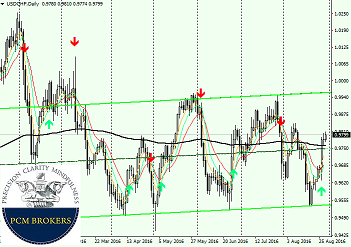

The Swiss franc rather sluggishly responded to the reported data. Pair USD/CHF on the Fed's representatives in the US statements regarding monetary policy prospects rose sharply on Friday. Today, with the opening of the trading day, the pair continues to grow.

At 13:00 (GMT) today published the index of housing prices in the United States from the agency Standard and Poor's in June, which is an important indicator of the American real estate market, and at 14:00 - the level of consumer confidence in the US in August, reflecting consumer confidence in economic development countries.

On Friday (12:30 GMT) will be published a report on the number of new jobs outside agriculture US (NFP) for August. The growth rate is expected to 180 000 new jobs. Strong data on the number of jobs will increase the likelihood of an early rate hike, which will strengthen the US dollar, and vice versa.