Q3 targets are 1.29 on GBP/USD and 0.8760 on EUR/GBP, with high odds that sterling will undershoot this new baseline.

EUR/USD contagion was expected to be significant in the hours after the vote, but since the macro and political read across should be limited, analysts put EUR/USD at 1.09.

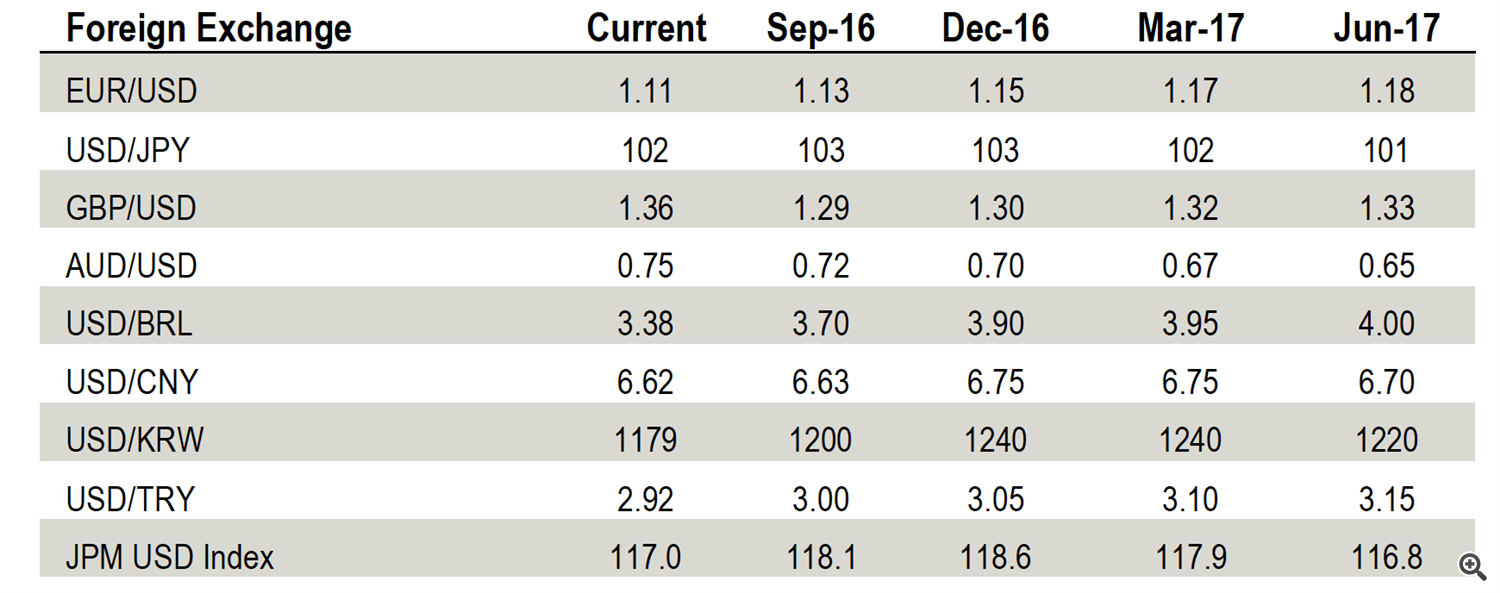

JPMorgan are forecasting a gradual retracement to 1.12 in Q3 given a dovish Fed and US Presidential election risks that would favour reserve assets like the euro, yen and gold.

USD/JPY was expected to decline to 101 intra-day, with limited retracement afterwards in view of Fed policy, and relatedly, the ineffectiveness of BoJ easing. Even if the MoF/BoJ were to intervene, a

USD/JPY spike would probably reverse within a week.

“We thought highly-cyclical currencies like commodity FX and emerging markets might fall 2% to 3% on the day but should stabilise the following week since the hits to UK and Euro area growth would be too small collectively to affect global demand or commodity balances,” says the note.

Today almost all currencies have met these initial projections, and since there is no change to the macro and policy context analysts expect to prevail over the next several months, forecast changes are minor.

UK Economic Growth Lowered, Inflation Forecasts Raised

With regards to the economy, JP Morgan's baseline view is that heightened uncertainty will produce drags amounting to about 1.25% of GDP for the UK and 0.5% of GDP for the Euro area over the coming year.

Lower currency values and policy easing across the continent should cushion the blow.

However, for the UK a weaker exchange rate also means higher inflation as an importing nation such as the UK relies on a strong exchange rate to keep prices down on the shop floor.

Fourth quarter inflation is forecast higher to 1.1%, and a sharp move to 2.2% is expected by the second quarter of 2017.

Despite the higher inflation, "we anticipate the Bank of England will ease quickly, lowering rates to zero over the next two months," say JP Morgan.

Analysts meanwhile expect the ECB to respond more gradually, pushing policy rates further into negative territory and expanding its QE program in September.