Aussie, Kiwi & Nikkei Fight Back

Introduction

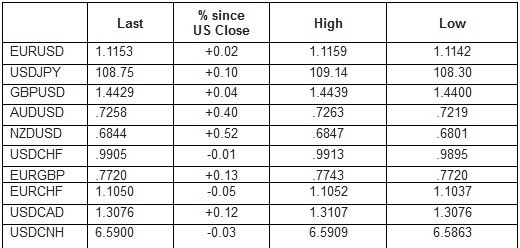

After poorer retail sales than expected weighed on AUD this week, the currency has risen versus the greenback over the NY and APAC trading sessions. Kiwi Dollar has followed suit, Asian stocks are largely higher whilst Brent and WTI Crude Oil Futures trade close to and above US$50 per barrel respectively. The OPEC meeting in Vienna yesterday resulted in a decision not to adopt a ceiling in terms of production cuts. The market looks ahead to the US NFP figure release today, with Bloomberg estimating that 160k new jobs will have been created within these employment sectors of the US.

Asian Session

Caixin Servies PMI data has been release out of China overnight and proved positive. This may have helped to buoy AUD somewhat, with a commodity price index published by ANZ Bank also aiding this move higher. .7215 has been the APAC session high for AUD/USD, with Citigroup Inc. analysts estimating that a further RBA benchmark interest-rate will be less likely should the US Federal Reserve raise their respective rate in the summer.

Goldman Sachs Group Inc. suggested that the weakening CNY, which has undergone a fifth straight week of decline, could be set to cause real problems for the global economy. The intensity of capital outflows from China would be at real risk if the yuan declines further, analyst at the bank in New York said.

The day ahead in Europe and NY

USD/TRY trades currently at 2.9501 after CPI and PPI figures there proved largely better than expected. The Turkish lira is a touch lower however, perhaps after ties were severed with Germany regarding the ‘genocide' in Armenia. The Bundestag voted to class this event as a genocide which resulted in a recall of the Turkish envoy to Germany and a harsh reaction from the Turkish elite and people.

Norwegian unemployment data has already been released, showing a drop in the rate from 3.1% to 2.9%. Swedish industrial production figures will be released at 08:30 BST with info. regarding new orders in the Manufacturing sector also published. EUR/SEK and EUR/NOK currently trade at 9.2819 and 9.2897 with the NOK/SEK cross trading right now at .9991.

Flash PMI figures will be released in Germany at 08:55 BST and for the Eurozone at 10:00 BST. Throughout the morning, PMI figures will print within other individual European nations too, including the UK. Retail sales data for Europe will be released along with the continent-wide PMI figures at 10:00 BST.

This morning's European data will precede the main event of the day which comes in the form of US unemployment data and non-farm payroll figures. This is accompanied by ISM manufacturing figures in the states and other significant employment data. Trade info. prints out of both NY and Toronto, with the final PMI publication of the day coming from the US too.

Spot

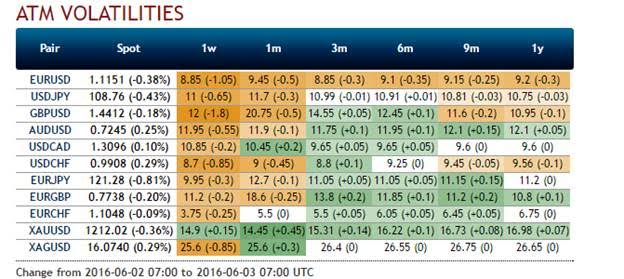

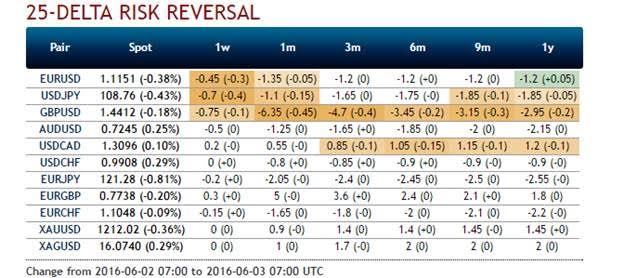

FXO The one month cable straddle remains supported at a volatility of 20.75%. This may well be likely to remain the case should the polls show continued indecision and potentially increasing support for the campaign to leave the European union.

Flows have been concentrated on the shorter dated options within the space of major currency pairs. Yhis comes as no surprise ahead of the US figures today, with Monday EUR/USD straddles trading at around the 9.0% volatility mark and the same instrument in cable at similar levels.