EUR/GBP Triggered & German ZEW Declines

German ZEW sentiment survey fell to a 6.4 reading from 11.2 in the

previous month. The median had been for a rise to 11.7. The rekindling

of Fed rate hike expectations as soon as next month, along with Brexit

concerns, with the UK’s vote on EU membership now only a month away,

have weighed on the index.

The current situations component painted a starkly different picture, leaping to a 53.1 reading from 47.7 in the previous month. ZEW noted that despite the strong growth of the Germany economy, “uncertainties regarding developments such as a possible Brexit currently inhibit a more optimistic outlook.” German Q1 GDP, was confirmed at +0.7% q/q,. A Brexit poll by ORB showed a jump in those favouring “Remain” to 55% versus 42% for “Leave,” which has propelled sterling back above 1.4500 against the dollar. UK bookmaker Ladbrokes is now giving 81% odds for the Brits to vote for remaining in the EU at the Jun-23 referendum, up from 79% yesterday and 71% that were being given at the beginning of last week.

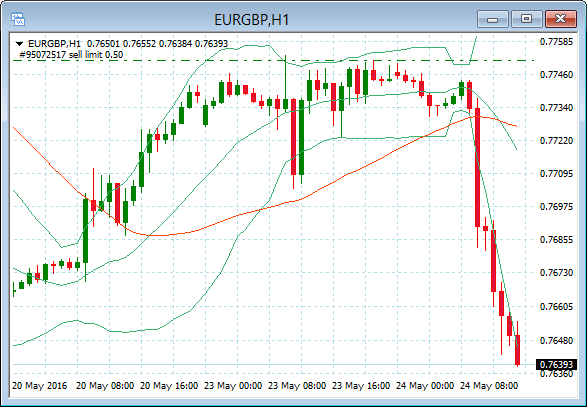

I wrote last week (May 19) “The EURGBP looks to have a downside Target 1 0.7530 – 0.7500 and the 200 DMA, further down 0.7420 is a Weekly support and 61.8 FIB, and finally 0.7330

is the 2016 low. The big move in the pair yesterday was three times

the normal daily range. It broke through the March and February lows

around 0.7720-0.7700 and closed exactly on the 38.2 Fibonacci level and

outside the lower Bollinger band. Following such a large move my entry would be triggered on a retracement to the 0.7720 – 0.7770 area”.

So we are now SHORT EURGBP.

EURGBP, H1