Morgan Stanley FX Chart Of The Week: Sensitivity Analysis

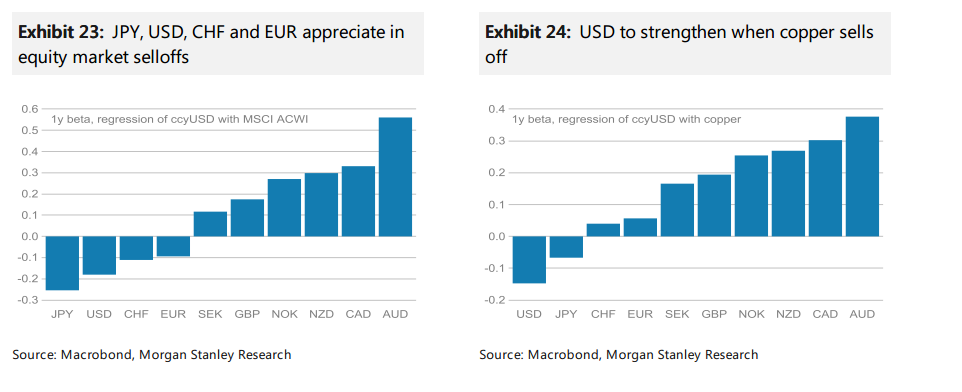

The US 2s10s curve has been flattening since the start of May. We have

run a regression analysis of each currency vs the USD against changes in

the US 2s10s curve.

In a flattening environment the SEK is expected to depreciate the most in G10 while the JPY appreciates the most. Within EM, BRL, COP and KRW are most sensitive to selling off.

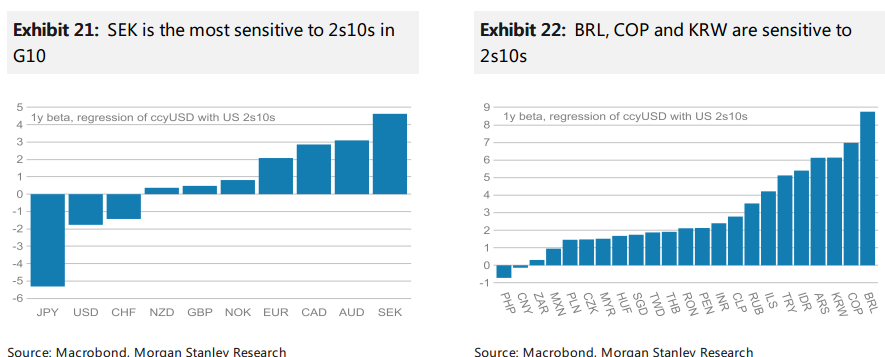

Since the middle of April, oil has continued to rally together with the

USD, potentially the start of a breakdown in the inverse correlation. At

the same time copper has started to fall, while oil rallies.

We

find that the AUD, CAD and NZD are most sensitive to depreciation if

copper falls. On the other side, the USD appreciates more than the JPY

in times of copper selling off. In contrast, the JPY appreciates more

than the USD in times of a global equities sell off, followed by the CHF

and the EUR.