The Week Ahead: Central banks to determine the next move

The past week was full of action for currency traders, the Yen dropped to lowest levels in three weeks against the dollar, the Canadian currency at highest levels since July led by oil rally, Pound being the best performing currency of the week, meanwhile the Euro still stuck in 1.1150 – 1.1450 range. Now with ECB’s meeting in the rear view mirror, traders will turn their attention into the FOMC and BoJ for new signals.

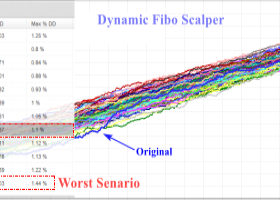

The dollar index, which has been in a downtrend since November found some relief to break higher in the last three trading days. The most recent rally is not associated to changes in U.S. economic fundamentals as no major data were released, but the price action was determined by moves in other major currencies. For the rally to resume we require a solid fundamental evidence that shifts investors forecasts towards more rate hikes in 2016. Tightening monetary policy on Wednesday’s meeting is of the table as recent economic conditions don’t allow taking this risk. However, focus will be on the small tweaks to the language, specifically towards the risks from global economic conditions which seems to have adapted somehow. According to Fed Fund futures, investors are pricing one rake hike in 2016 with June probability standing at 20.6%, meanwhile recent comments from Fed officials indicate that market’s outlook for interest rates is too dovish. If the Fed managed to convince markets about their potential to lift rates two times this year a rally in the dollar will resume. On the data front U.S. first quarter GDP reading due on Thursday will be another risk event to the U.S. currency. Although the growth is expected to cool down from 1.4% in Q4 last year to 0.7%, fears of an economic recession that weighed on markets earlier this year will be overblown.

A day after the FOMC meeting, attention will shift to the Bank of Japan. Last Friday a report said the central bank is considering expanding its negative rate policy to bank loans, in a similar attempt to ECB’s TLTRO to stimulate banks’ lending to the economy. Similar to other developed central banks, the loose monetary policy executed by BoJ had failed so far to boost inflation expectations and growth. Another factor weighing on the economy is the stubbornly strong Yen with speculators net long positions at record high according to latest CFTC data. There’s a high chance that BoJ will pull the trigger on further simulative packages, leading traders to cover their short USDJPY trades ahead of the meeting, however the impact on the announcement day will be a hard guess.

Sterling was the best major performing currency the past week, rising 1.4% against the U.S. dollar. The move was driven by recent polls supporting the campaign for Britain to remain in the European Union as U.S. President Barack Obama walked into the debate. Although opinion polls will continue to dominate the currency move, trader will assess how much the uncertainty of a Brexit impacted economic growth. UK Q1 GDP figures will be released Wednesday and economists expect growth to have slowed by 0.2% from Q4 last year to 0.4%. The release will drive some volatility, however if polls continued to drift in favor of Bremain, the rally will likely resume and GBPUSD has the potential to break above 1.45 psychological level.