Analytical Review of the Stocks of General Electric Company

Analytical Review of the Stocks of General Electric Company

General Electric Company, #GE [NYSE]

Industrial goods, Diversifies industry, USA

Financial performance of the company:

Index – DJIA, S&P 500;

Beta – 1.19;

Capitalization – 302.06 В;

Return on asset – 0.30%;

Income - 1.68 B;

Average volume – 50.82 М;

P/E - 213.43;

ATR – 0.64.

Analytical review:

- The company ranks the first on capitalization in the sector of “Industrial goods” among the issuers traded in the American stock market.

- Since the beginning of March, company’s shares have grown by over 5%. It is expected that the rise in quotes will continue.

- According to the last report for Q4 of the fiscal year 2015, net profit of the company increased by 2.5 times (from 2.51 billion USD to 6.30 billion USD). EPS amounted to 0.26 USD, which was above the forecast of 36.8%.

- The company plans to expand and diversify its business. Currently, General Electric evaluates possibility and prospects of doing business in Iran. In the near future Tehran plans to recover economy offering attractive contracts for oil production to the foreign investors.

- The company doubled the budget of restructuring in 2016. The company plans to sell asset management unit and expand business in the production of manufacturing goods.

- Large investment funds and banks (RBC Capital, Stifel, Barclays) predict the rise in the shares will rise up to 36 USD.

Summary:

- Last company’s report has increased investors’ confidence in the management of the company. The company has strong growth potential.

- Development of business in Iran, implementation of restructuring plan will boost the rise in the shares of the company.

- It is likely that in the near future company’s quotes will go up.

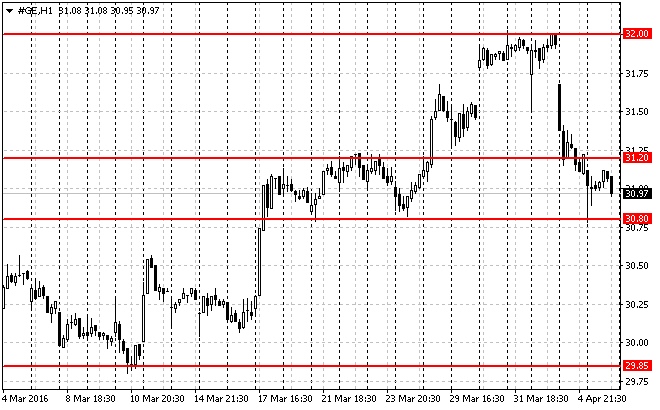

Trading tips for CFD of General Electric Company

Medium-term trading: the moment the issuer is traded in the range of 30.80-31.20 USD. If the price maintains this zone4.95-105.45 USD and in case of the respective confirmation (such as pattern Price Action), we will recommend to open long positions. Risk per trade is not more than 2% of the capital. Stop order can be placed slightly below the signal line. Take profit can be placed in parts at the levels of 31.85 USD, 33.00 USD and 34.50 USD with the use of trailing stop.

Short-term trading: on the chart with the timeframe 15M the issuer is traded near the local support and resistance levels of 30.90 - 31.35 USD. We recommend to enter the market after breakdown and testing of these levels. Positions can be opened near the signal line and the nearest support/resistance levels. Risk per trade is not more than 3% of the capital. Stop order can be placed slightly above/below the signal line. Take profit can be placed in parts of 50%, 30% and 20% with the use of trailing stop.

The material has been provided by LiteForex - Finance Services Company - www.liteforex.com