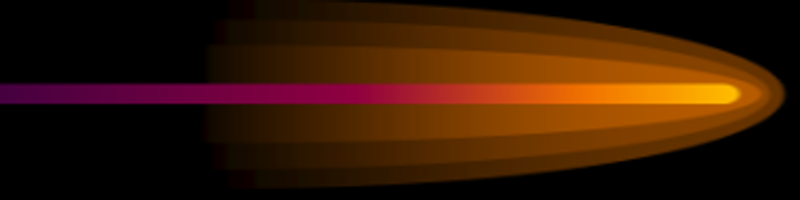

Estimated pivot point is at the level of 1.0970.

Our opinion: Buy the pair from correction above the level of 1.0970 with the target of 1.15 – 1.16.

Alternative scenario: Breakout and consolidation of the price below the level of 1.0970 will allow the pair to continue decline to 1.0806.

Analysis: Presumably, the development of the third wave of the senior level continues. Locally, it seems that the impetus in the third wave (iii) of iii of the junior level has completed. If this assumption is correct, after the completion f the correction the pair will continue to rise to 1.1500 – 1.16. Critical level for this scenario is 1.0970. Breakdown of this level will trigger decline in the pair to 1.08 or further down.

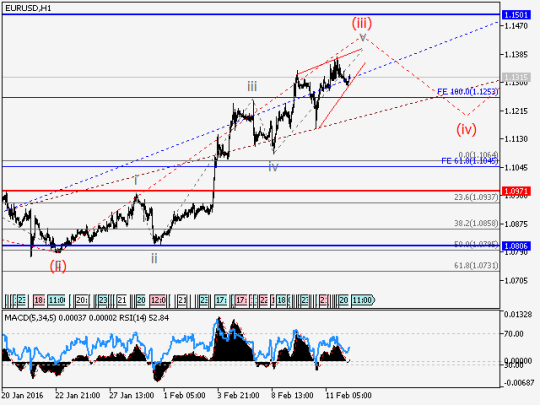

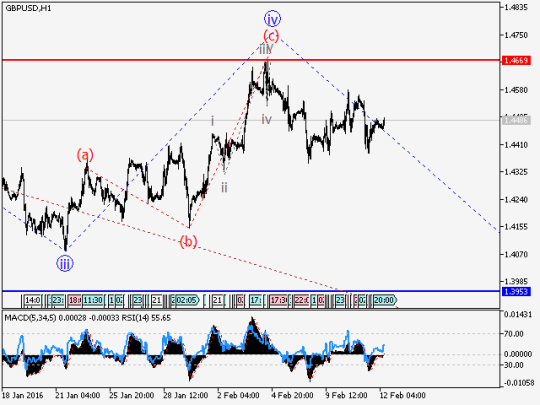

GBP/USD: Wave analysis and forecast for 12.02 – 19.02: Downtrend continues.

Estimated pivot point is at the level of 1.4670.

Our opinion: Sell the pair below the level of 1.4670 with the target of 1.3950.

Alternative scenario:

Breakout and consolidation of the price above the level of 1.4670 will

enable the pair to continue the rise to the level of 1.55.

Analysis:

Presumably, the formation of the local correction as the wave iv of 3

has completed as part of the “bearish” impetus. At the moment, it seems

that the fifth wave is being developed. If this assumption is correct,

the pair will continue to decline to 1.3950. Critical level for this

scenario is 1.4670.

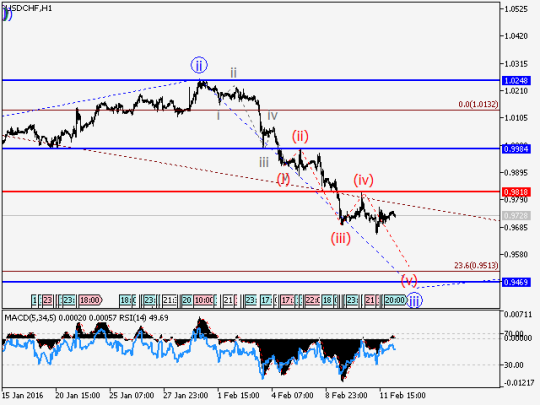

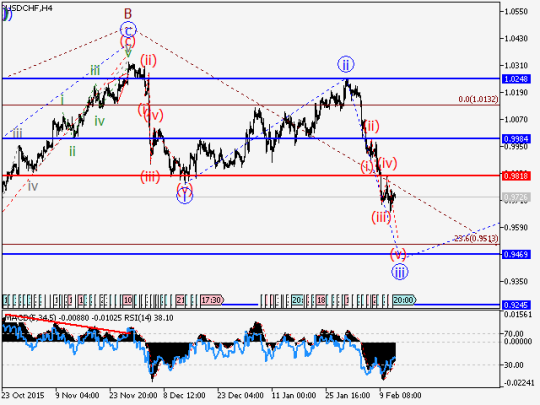

USD/CHF: Wave analysis and forecast for 12.02 – 19.02: Downtrend continues.

Estimated pivot point is at the level of 0.9818.

Our opinion: Sell the pair from correction below the level of 0.9818 with the target of 0.9470.

Alternative scenario:

Breakout and consolidation of the price above the level of 0.9818 will

allow the pair to continue the rise up to the levels of 0.9980 – 1.0250.

Analysis: The formation of the downward impetus continues in the third wave iii of C. Locally, it seems that slam correction in the fourth wave (iv) has completed and the fifth wave is developing. If this assumption is correct, the pair will continue to decline to 0.95 within the developing impetus. Critical level for this scenario is 0.9818.

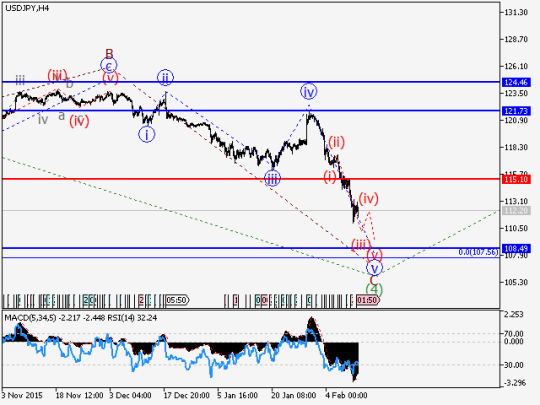

USD/JPY: Wave analysis and forecast for 12.02 – 19.02: Downtrend prevails.

Estimated pivot point is at the level of 115.10.

Our opinion:

Sell the pair from correction below the level of 115.10 with the target

of 108.50. In case of breakdown and consolidation of the price above

the level of 115.10, buy the pair with the target of 121.70.

Alternative scenario:

Breakout and consolidation of the price above the level of 115.10 allow

the pair to continue the rise to the levels of 121.70 – 124.50.

Analysis: The wave С of 4 is being formed within the large correction. At the moment, it is likely that the final fifth wave v of C is developing, within which “bearish” impetus is being formed. If this assumption is correct, the pair will continue to decline to 108.50. Critical level for this scenario is 115.10.

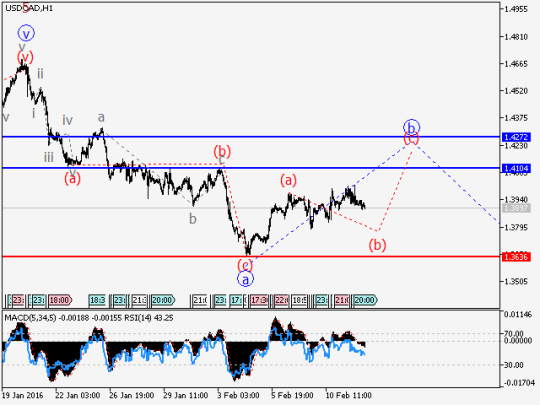

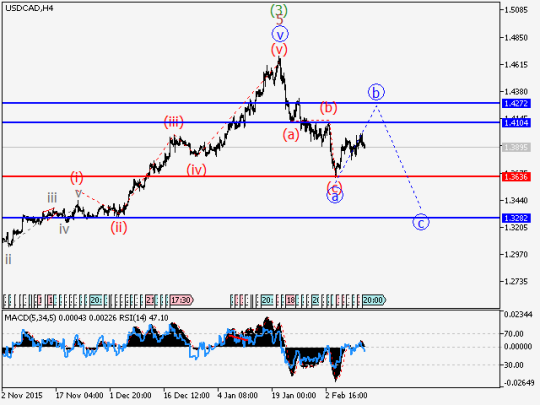

USD/СAD: Wave analysis and forecast for 12.02 – 19.02: The pair is undergoing correction.

Estimated pivot point is at the level of 1.3636.

Our opinion:

In the short-term: buy the pair above the level of 1.3636 with the

target of 1.41 – 1.4270. In the medium-term: wait for the completion of

the correction and sell with the target of 1.3280.

Alternative scenario: Breakdown and consolidation of the price below the level of 1.3636 will enable the pair to continue decline to 1.3280.

Analysis: Presumably, the formation of the downward zigzag has completed in the emerging large “bearish” correction. Locally, it seems that upward correction as the wave b is developing. If this assumption is correct, the pair can rise up to 1.41 – 1.43. Critical level for this scenario is 1.3636. Breakdown of this level will trigger the decline in the pair to 1.3280.

The analytical materials are provided by

Aleksander Geuta,

a trader and analyst of LiteForex