Forex Trading strategy with EMA for a Strong Trend

We will look at the following forex trading strategy which is based on use of three exponential moving averages. Used mainly for trading orders which are executed and closed within the same session, without excluding the use for orders which will remain open for more than one session. A very important issue is the recognition of the trend and the price action.

We can apply this forex trading strategy for all products (forex pairs).

Indicators are included in this forex trading system are as follows:

The traders prefer the hourly chart. But we can use this forex trading strategy at four hours and daily timeframes.

First you need to determine if the price is moving with a strong upward trend. This would be the case if:

EMA (60) and EMA (15) having an upward slope.

EMA (5) is above the EMA (15).

EMA (15) is above the EMA (60).

Upon compliance with the above three conditions must consider that the trend is upward.

We expect the price to make a retracement and come into contact with the EMA (60).

If this occurs we have a buy forex signal.

We place a protective stop loss at 40 pips.

If the price moved in accordance with our choice and achieved profits of 40 pips, we close 50% of our trading position and move the stop loss to breakeven point (entry point + spread) for the rest of our position.

For as long as the price moves to the direction we have chosen, move our stop loss leaving always a margin of 40 pips in order to have the necessary space for the accumulation or retracement.

We can apply this forex trading strategy for all products (forex pairs).

Indicators are included in this forex trading system are as follows:

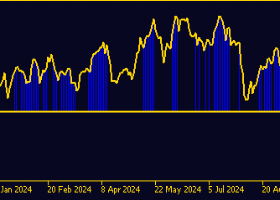

- EMA (5) - Exponential Moving Average. Apply to close.

- EMA (15) - Exponential Moving Average. Apply to close.

- EMA (60) - Exponential Moving Average. Apply to close.

Timeframe

Buy Rules

First you need to determine if the price is moving with a strong upward trend. This would be the case if:

EMA (60) and EMA (15) having an upward slope.

EMA (5) is above the EMA (15).

EMA (15) is above the EMA (60).

Upon compliance with the above three conditions must consider that the trend is upward.

We expect the price to make a retracement and come into contact with the EMA (60).

If this occurs we have a buy forex signal.

Stop Loss

We place a protective stop loss at 40 pips.

Profit Target

If the price moved in accordance with our choice and achieved profits of 40 pips, we close 50% of our trading position and move the stop loss to breakeven point (entry point + spread) for the rest of our position.

For as long as the price moves to the direction we have chosen, move our stop loss leaving always a margin of 40 pips in order to have the necessary space for the accumulation or retracement.

Sell Rules

First you need to determine if the price is moving with a strong downward trend. This would be the case if:

EMA (60) and EMA (15) having an a downward slope.

EMA (5) is below the EMA(15).

EMA (15) is below the EMA (60).

Upon compliance with the above three conditions must consider that the trend is downward.

We expect the price to make a retracement and come into contact with the EMA (60).

If this occurs we have a sell forex signal.

Stop Loss

We place a protective stop loss at 40 pips.

Profit Target

If the price moved in accordance with our choice and achieved profits of 40 pips, we close 50% of our trading position and move the stop loss to breakeven point (entry point + spread) for the rest of our position.

For as long as the price moves to the direction we have chosen, move our stop loss leaving always a margin of 40 pips in order to have the necessary space for the accumulation or retracement.

Notes

Important : All investors should know that any forex trading strategy before implementing in a real account needs to be tested in a demo account in order to be fully understood.

Also, all traders should be aware that extraordinary events occurring in the forex market very often, and is likely to alter the financial results of a forex trading strategy.