EUR/USD: Wave analysis and forecast for 15.01 – 22.01: The pair is likely to grow.

Estimated pivot point is at the level of 1.0707.

Our opinion: Buy the pair from correction above the level of 1.0707 with the target of 1.1250 – 1.16.

Alternative scenario: Breakout and consolidation of the price below the level of 1.0707 will allow the pair to continue to decline to 1.06 – 1.05.

Analysis:

Presumably, the formation of the local correction as the second wave ii

of 3 has completed. Locally, it seems that the one-two wave (i) of iii

is being formed, as well as the correction to it as the wave (ii) as a

irregular. If this assumption is correct, the pair can continue to rise

up to 1.1250 – 1.16. Critical level for this scenario is 1.0707.

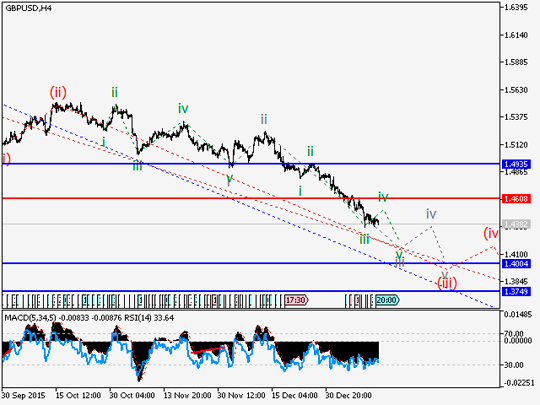

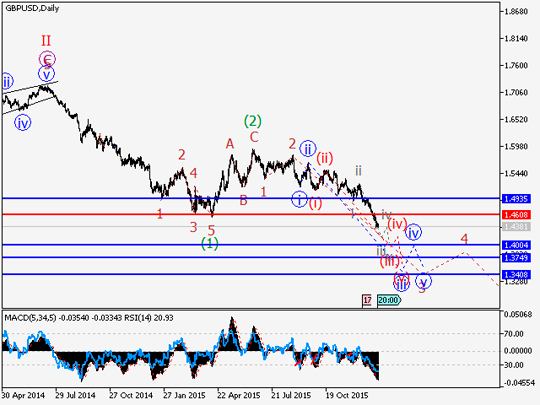

GBP/USD: Wave analysis and forecast for 15.01 – 22.01: The pair is likely to decline.

Estimated pivot point is at the level of 1.4608.

Our opinion: Sell the pair from correction below the level of 1.4520 with the target of 1.40.

Alternative scenario:

Breakout and consolidation of the price above the level of 1.4608 will

enable the pair to continue the rise to the level of 1.4935.

Analysis: In the result of the decline in the pair, all possible critical levels of the ascending scenario have been broken down. At the moment it is likely that the third wave (3) is being formed in the “bearish” trend. Locally it seems that the extension of the third wave of the junior level is being developed 3 of (3). If this assumption is correct, the pair will continue to decline to the levels of 1.40 – 1.3750. Critical level for this scenario is 1.4608. Breakdown of this level will trigger the rise in the pair to 1.4935.

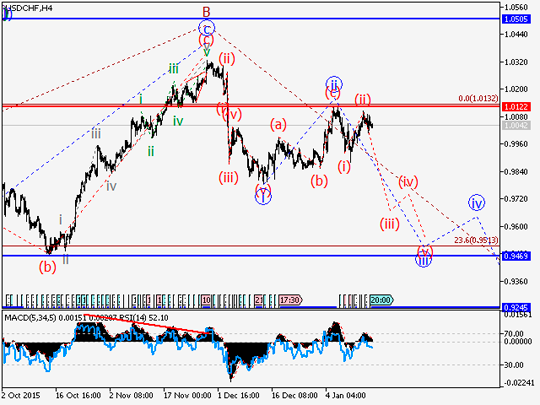

USD/CHF: Wave analysis and forecast for 15.01 – 22.01: Downtrend continues.

Estimated pivot point is at the level of 1.0122.

Our opinion: Sell the pair from correction below the level of 1.0122 with the target of 0.9470.

Alternative scenario:

Breakout and consolidation of the price above the level of 1.0122, will

allow the pair to continue to rise to the level of 1.0360 – 1.05.

Analysis: Presumably, the formation of the upward correction as the wave ii of С has completed. Locally, it is likely that the third wave iii is being developed, and within this wave one-two wave of the junior level (i) has been formed and correction (ii) is nearing completion. If this assumption is correct and the price does not break down the critical level of 1.0122, the pair is likely to decline to the level of 0.95 in the third wave.

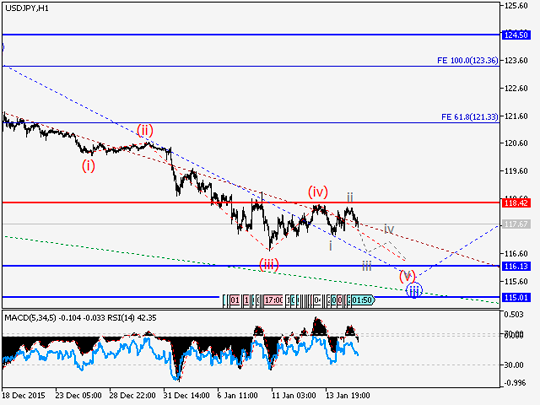

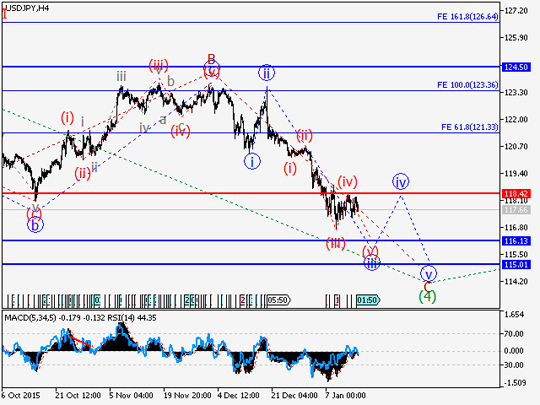

USD/JPY: Wave analysis and forecast for 15.01 – 22.01: Downtrend continues.

Estimated pivot point is at the level of 118.42.

Our opinion: Sell the pair from correction below the level of 118.42 with the target of 116.00 – 115.00.

Alternative scenario:

Breakout and consolidation of the price above the level of 118.42 will

enable the pair to continue the rise up to the levels of 121.00 –

122.00.

Analysis: The formation of the wave С

of 4 of the senior level continues. Within this wave the impetus is

likely to develop. At the moment, the formation of the third wave of the

impetus iii of C is likely to finish and within it the decline in the

fifth wave (v) is expected . If this assumption is correct, the pair

will continue to decline to 116.00 – 115.00. Critical level for this

scenario is 118.42.

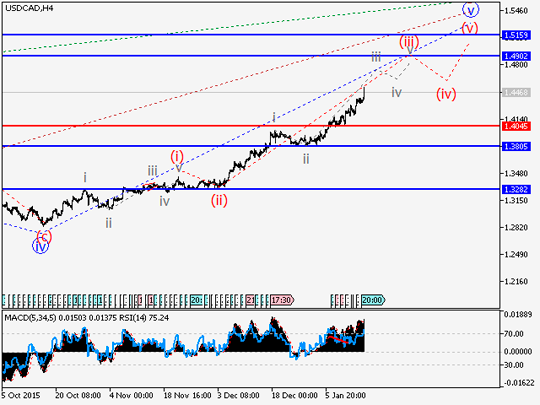

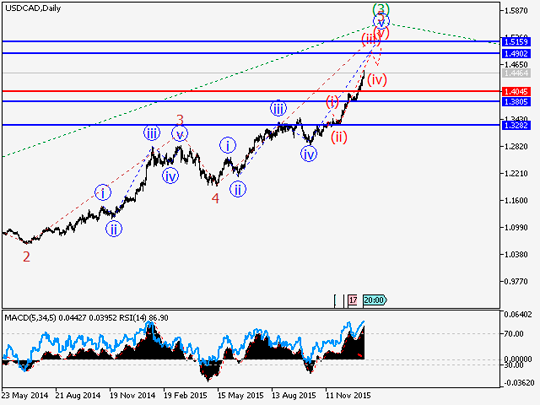

USD/СAD: Wave analysis and forecast for 15.01 – 22.01: Uptrend continues.

Estimated pivot point is at the level of 1.4045.

Our opinion:

Buy the pair from correction above the level of 1.4045 with the target

of 1.49 – 1.51. In case of breakdown of the level of 1.4045, sell with

the target of 1.38 – 1.33.

Alternative scenario:

Breakout and consolidation of the price below the level of 1.4045, will

enable the pair to continue to decline to the levels of 1.38 - 1.33.

Analysis: The formation of the upward momentum continues in the fifth wave of the senior level 5 of (3) on the daily timeframe. Locally, it is likely that the fifth wave of the junior level (v) is being formed, within which the extension of the third wave (iii) seems to develop. If this assumption is correct, the pair will continue to rise up to 1.49, or above. Critical level for this scenario is 1.4045. Breakdown of this level will trigger to decline in the pair to 1.38 – 1.33.

The analytical materials are provided by

Aleksander Geuta,

a trader and analyst of LiteForex