EUR/USD: waiting for the FES decision. Tradinf Recommendations

Trading recommendations and Technical Analysis – HERE!

Yesterday's positive data from the United States, published at 13:30 (GMT) strengthened the dollar against most currencies. The consumer price index for November came in better than forecast (0.5% in annual terms, versus 0.4% forecast and 0.2% in October).

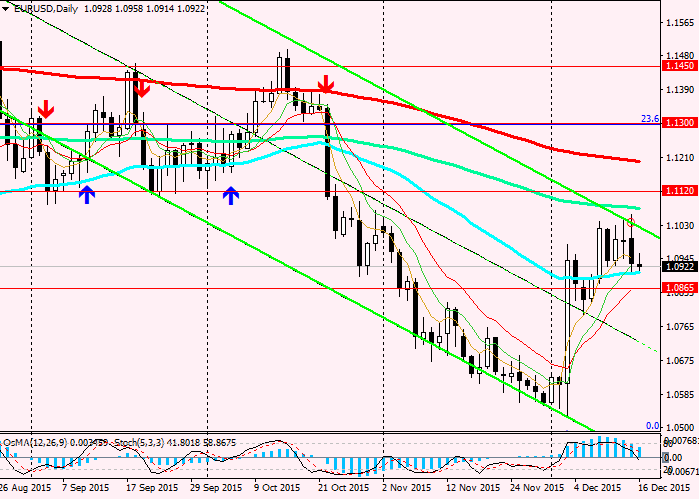

The Euro has lost more than 60 points for the opening day and dropped 50 pips to the opening of the week.

On the Eurozone today published a number of important news, including indexes of business activity in the manufacturing sector and the services sector for December and inflation consumer prices indices for November. Judging from the published data, the growth rate of the Eurozone economy in November has changed slightly.

The market may ignore all current data in anticipation of a truly historic fed decision on rates in the United States, which will be published at 19:30 (GMT).

If the rate increase has no doubt more than 80% of the market participants, comments from fed officials regarding the plans and pace of future rate hikes will depend on the further dynamics of dollar pairs, including EUR/USD.

The US economy shows indicators of steady recovery and apparently strong enough to withstand the increase in the key rates range from 0%-0,25% to 0,25%-0,50%.

But, if the fed not to raise rates, the dollar will come short-term shock down. The dollar's decline may be significant.

Press conference the fed will start at 19:30 (GMT). Doesn't make sense to recall that from 19:00 to 19:30 (GMT) we expect increased volatility in the financial market that must be considered when making trading decisions. It is better not to enter the market in this time period.

See also review and trading recommendations for the pair NZD/USD!