Trading recommendations and Technical Analysis – HERE!

Recently as last week's meeting, OPEC did not change production of oil, leaving it on the same level of 31.5 million barrels of oil per day.

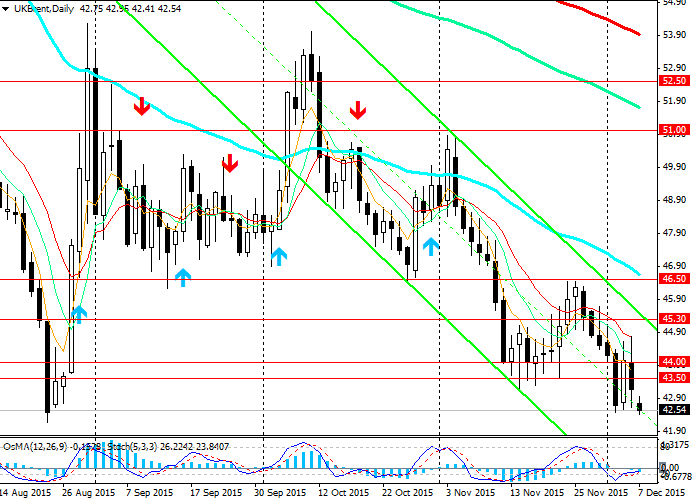

The price of Brent crude, beginning Friday, has declined by about $ 1.5 per barrel and is trading in the middle of the European session near the mark of 42.50. There were concerns about a global glut of oil. Other major oil producing countries also are not going to cut production. The struggle for its share of the global oil market is exacerbated. Once Iranian oil will return to global markets, prices could fall even more. According to the latest results of the January futures for oil of mark Brent on ICE Futures fell in price by $ 0.21 to 42,79 USD per barrel.

Last week Saudi state oil company Aramco has sharply cut the January official selling oil prices. So, for North-West Europe the prices for oil were reduced from 2,65 to 8.50 dollars per barrel, depending on grade.

Pessimism about oil prices may push them even lower than the reached lows for the year near the current level of 42.50.

On Wednesday the U.S. Department of energy will publish data on reserves and production of crude oil in the week of 28 November – 4 December.

However, even if the data show a decrease in the reserves, it will have only a short-term support prices.

Growing geopolitical tensions in the world, the slowing Chinese and global economy, the lingering oversupply of oil in the world and growing, the US dollar will continue to put pressure on oil prices in the medium term.

See also review and trading recommendations for NZD/USD!