Trading Experiment

This is a simple trading experiment combining the use of position management and planned trade method. The idea is to plan the trades over the weekend and set the orders on Monday. Only pending orders are allowed and the trades either hit take profit or get stopped out. Only trade set ups with a minimum of 1:3 RR are given focus.

Account Details

Starting with an account size of $3000, 1% or $30 risk is used. The goal of this trading experiment is to diligently follow the trading method involved with strict discipline with an aim to see if there is any real progress using this method.

Trading Strategy

Making use of only a 50 period EMA and Stochastics (14,3,3) and combining it with a simple High/Low in price, positions are taken.

Account Monitoring

The trades and the accounts can be monitored from here: https://www.mql5.com/en/signals/149811

Week 50 Trade Set Ups

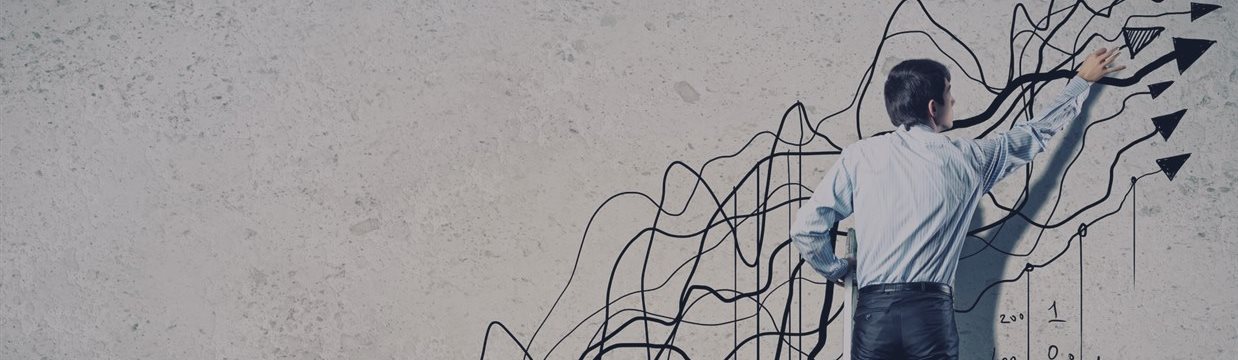

Trade #1: EURUSD Long at 1.0625, TP 1.11, SL 1.05224 (0.03 Lots, RR: 4.47)

- Price hit a low and then reversed strongly. The rally could be a fake unless there is a retest to 1.06250 to establish support, in which case, an eventual rally to 1.11 is very likely

- Because 1.0625 marked the previous lower low, there is a scope for price to dip to this level in order to prepare for an eventual move higher

- The target to 1.11 comes on a bullish divergence in the Stochastics oscillator

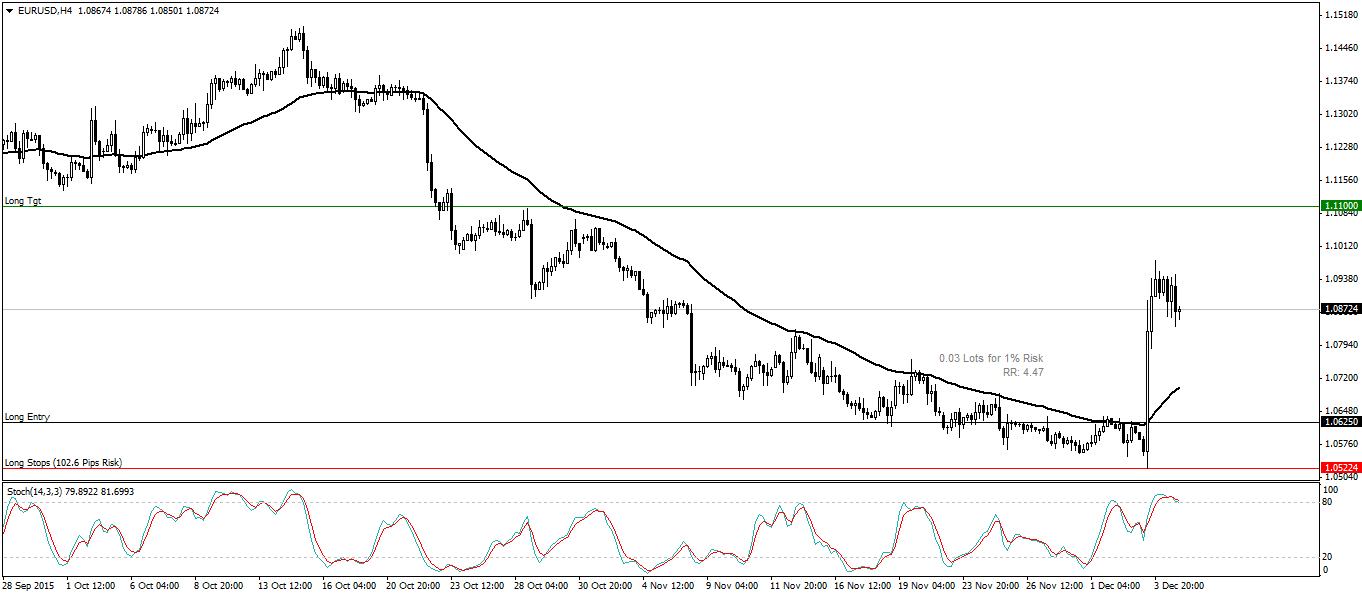

Trade #2: AUDNZD Short at 1.09724, TP 1.0718, SL 1.10486 (0.05 Lots, 3.34)

- Price formed a higher low near 1.09724 and could possibly retest this level for resistance before moving lower

- The bias remains to the downside with the weekly shooting star pattern indicating the downside bias

- There is also a strong bearish divergence with Stochs failing to confirm the highs, thus showing a correction to 1.0718

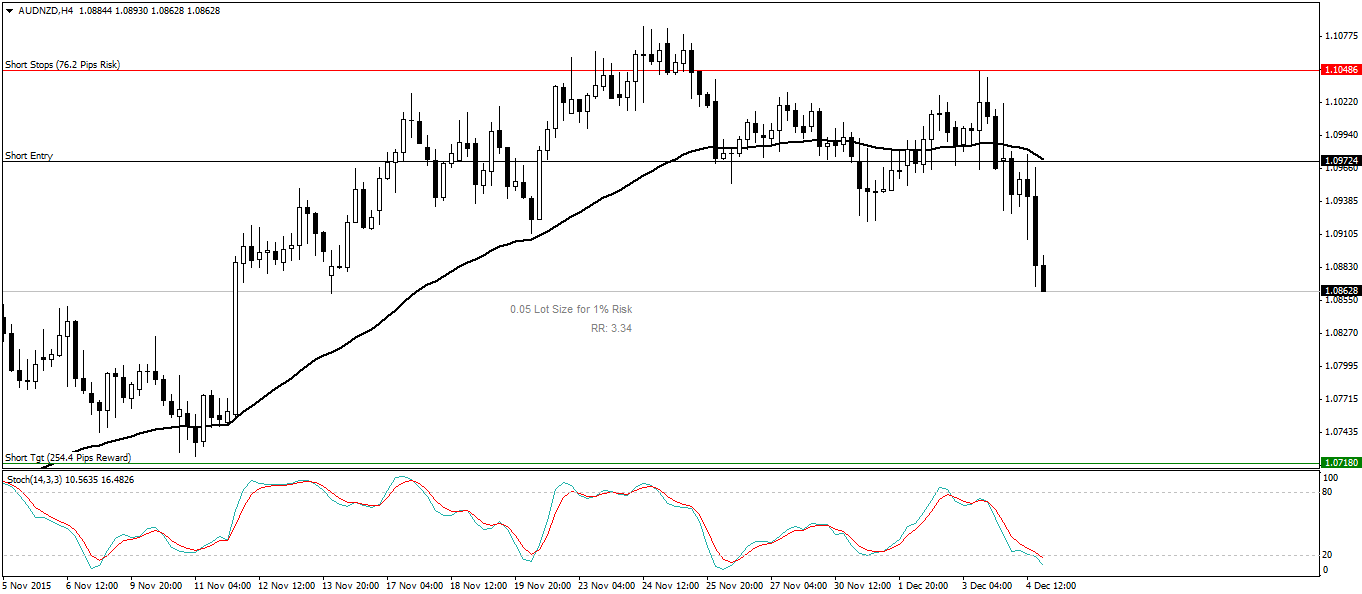

Trade #3: EURGBP Long at 0.70465, TP 0.7318, SL 0.6989 (0.03 Lots, RR: 4.72)

- Similar to EURUSD, EURGBP turned strongly higher last week and is due for a test to the previous lows near 0.70465

- Establishing support at 0.70465 will indicate a move to the longer term bullish divergence target near 0.7318

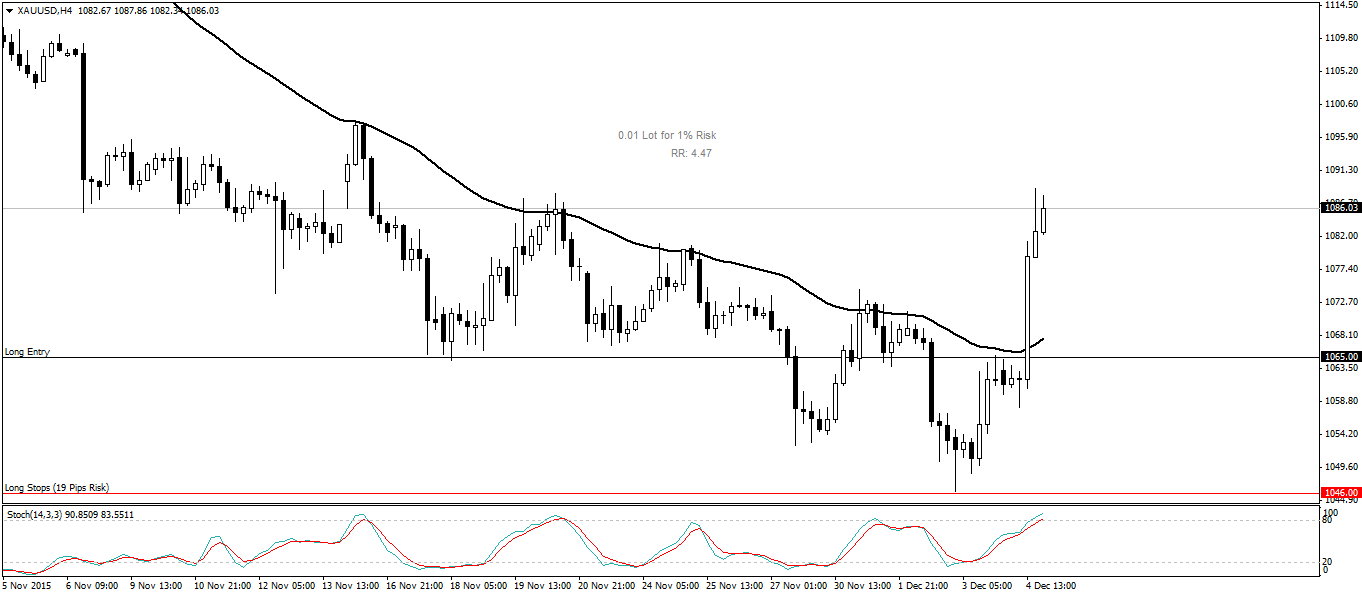

Trade #4: XAUUSD Long at 1065, TP 1150, SL 1046 (0.01 Lots, RR: 4.47)

- Gold has been trending lower but there is a strong bullish divergence being formed

- Expecting a dip to 1065, marking the previous low for an eventual rally to 1150

- Stops at 1046 comes in at the most recent lows

- Daily and Weekly charts are bullish

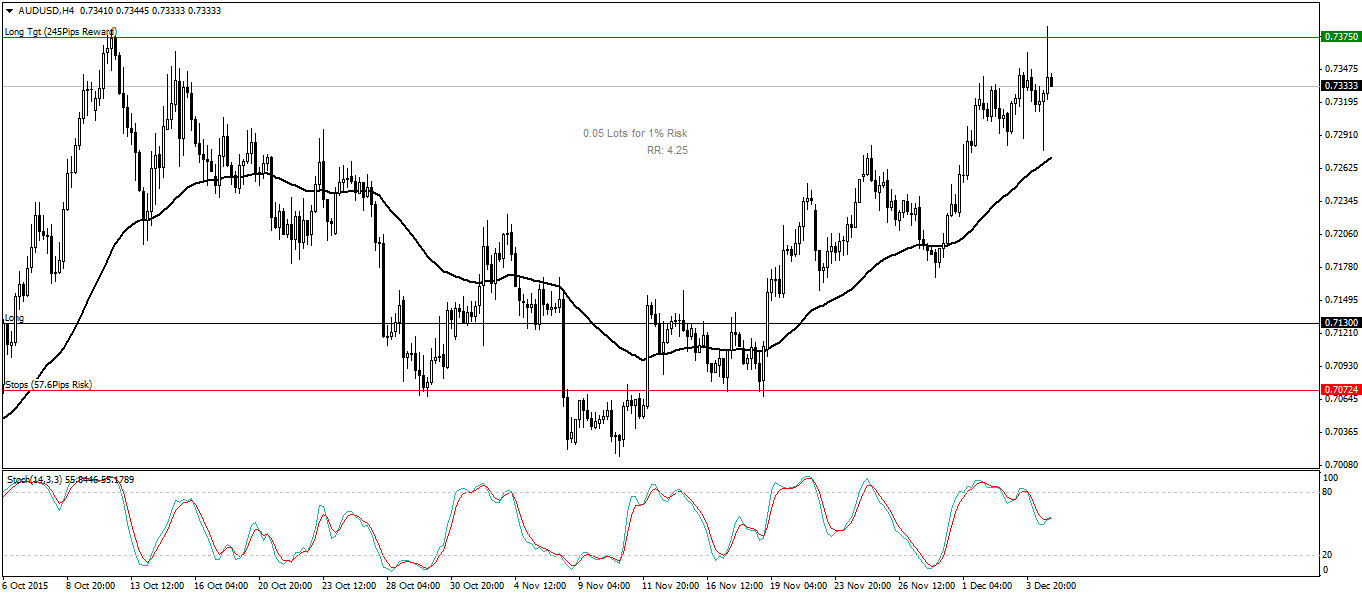

Trade #5: AUDUSD Long at 0.713, TP 0.7375, SL 0.70724 (0.05 Lots, RR: 4.25)

- Divergence on the 4-hour chart

- Daily has formed a strong outside bar, engulfing previous two daily sessions and closing with a spinning top pattern

- Could take this week or the next for the long position to trigger