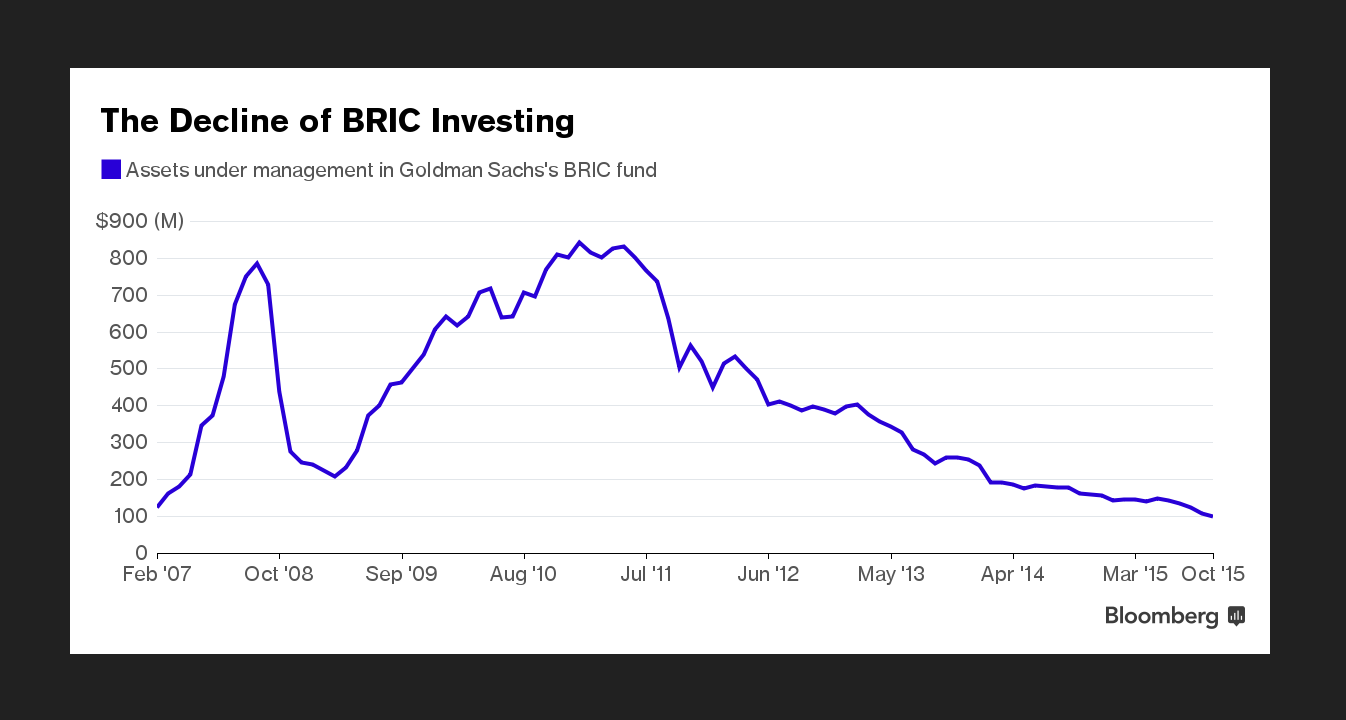

Goldman Sachs folded its long-in-decline BRIC fund,

which used to invest in Brazil, Russia, India and China, and merged it last

month with a bigger emerging-market fund.

Goldman decided to close its nine-year-old product because it doesn’t expect asset growth in the near future, according to a filing to the U.S. Securities and Exchange Commission.

The fund has lost 88 percent of its assets since 2010 highs.

China, long an engine of the global economic expansion, is on the verge of its weakest growth since 1990. Brazil is suffering from a corruption scandal and the worst recession in a quarter century, while Russian firms have no access to global capital markets because of international sanctions. Even in India, where economic growth intensified, Prime Minister Narendra Modi is scraping through to push through reforms.

The Emerging Markets Equity Fund has swallowed it up as part of Goldman Sachs’s attempts to optimize its assets and get rid of "overlapping products," the New York-based lender said in the September 17 filing.

They did not liquidate it, however. Goldman Sachs decided to merge the two funds, as it would provide investors with an access to a more diversified world of developing countries. The lender highlighted that the emerging-market fund has outperformed in the one-, three- and five-year periods.

The end of the BRIC fund not also highlights global worries over the four emerging economies, but also emphasizes how the strategy of grouping incommensurable countries into a single investment hub is losing its attractiveness

among investors.

Analysts admit that although the BRIC concept was popular, nothing is eternal, and BRIC's growth has been challenged during the last 5 years.

This year through November, investors have taken $1.4 billion away from funds investing in BRIC countries, deepening the outflow since the end of 2010 to more than $15 billion, says EPFR Global. That is more than unwinding all the inflows since 2005.

The BRIC investing strategy is flawed and has been criticized recently because markets are now driven more

by country-specific factors than global trends, causing a diverging performance. Some analysts admit that this acronym does not make any sense because it is just a randon bundling completely different countries. Similar kind of funds will collapse, as you cannot restrict your investment universe too much.