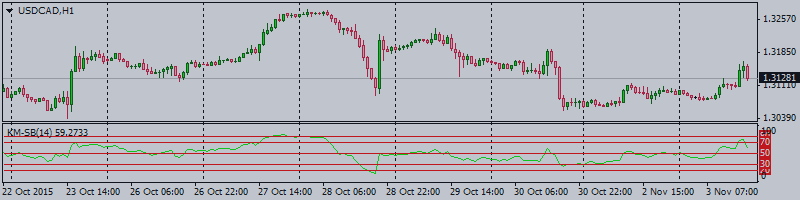

After climbing near 1.3160, or session highs, USD/CAD

has now returned to the 1.3120 area following the US

releases.

USD/CAD trims gains on US results

Spot

has surrendered part of the earlier gains after US Factory Orders have surprised

investors to the downside during September, contracting 1.0% MoM vs. 0.9%

initially estimated although improving from the previous 2.1%

drop.

Further results showed the Economic Optimism index tracked by

IBD/TIPP coming in at 45.5 vs. 47.5 expected and 47.3 previous.

The

selling interest remains around CAD in spite of the rally in crude oil prices,

pushing the barrel of WTI above the $47.00 mark, or more than

2%.

USD/CAD levels to consider

As of writing, the

pair is advancing 0.22% at 1.3128 with the next resistance at 1.3171 (55-day

sma) followed by 1.3217 (38.2% Fibo of 1.3459-1.2827) and then 1.3241 (downtrend

from 1.3458). On the other hand, a break below 1.3069 (61.8% Fibo of

1.3459-1.2827) would open the door to 1.3040 (100-day sma) and finally 1.2966

(5-month uptrend).