The Australian dollar has posted modest losses on Wednesday, as AUD/USD lost ground following a weak Australian CPI release. The pair is trading at the 0.7140 in the North American session. This is the second straight day that the pair has softened, and the Aussie has now lost close to 100 points this week. In the US, the markets are nervously awaiting the key event of the week, the Federal Reserve policy statement, which will be released later in the day. In other economic news, the US trade deficit narrowed in September and easily surpassed expectations. The weekly crude oil inventories came in at 3.4 million, shy of the estimate. On Thursday, the US releases two key events – Advance GDP and Unemployment Claims.

The markets are bracing for another dovish statement from the Federal Reserve, which could hurt the US dollar. Will the Australian dollar take a hit? The Federal Reserve is not expected to raise interest rates, but any hints about a rate hike (which is unlikely) could send the US dollar sharply higher. What the markets would really appreciate is some clarity about its monetary plans. Gone are the days of the indecipherable Fedspeak from Alan Greenspan, whose statements looked like they were written in English but were ambiguous and obtuse in the extreme. At the same time, the current Federal Reserve has failed to communicate effectively with the markets, which continue to receive conflicting signals from Fed policymakers regarding the timing of a rate hike. These mixed messages are no accident, but rather reflect the divisions between voting Fed members with regard to a rate hike. This has led to volatility in the currency markets based on the public remarks of Fed members, even though such comments may be no more than the personal view of that individual, and do not represent actual Fed policy.

US durables, which helps gauge the strength of the manufacturing sector, were dismal in the September reports. Core Durable Goods Orders fell 0.4%, compared to the forecast of 0.0%. It marked the indicator’s first decline in six months. There was no relief from Durable Goods Orders, which posted a sharp decline of 1.2%, although this was within expectations. This was the indicator’s second straight decline, and these weak figures underscore a weak manufacturing sector, which continues to be hampered by weak global demand for US goods. Meanwhile, CB Consumer Confidence softened in October, coming in at 97.6 points, well off the estimate of 102.5 points. Weaker consumer confidence could translate into less spending by the US consumer, which would be bad news for the economy.

In Australia, CPI, which is released quarterly, softened to 0.5% in the third quarter, compared to 0.7% in the previous quarter. This weak reading points to a weak Australian economy, a casualty of the global slowdown. There was some talk of the RBA lowering rates earlier this month in order to kick-start the economy. That didn’t happen, and the minutes of last week’s policy meeting shed some light on the central bank’s thinking. Policymakers noted that the economy had shown some improvement, crediting this to the lower value of the Australian dollar, which has boosted exports, as well as the RBA’s ultra-low interest rate levels. The RBA also expressed concern about the Chinese economy, but said that despite this, there was no need to lower rates for some time.

AUD/USD Fundamentals

Wednesday (Oct. 28)

- 00:30 Australian CPI. Estimate 0.7%. Actual 0.5%

- 12:30 US Goods Trade Balance. Estimate -64.9B. Actual -58.6 B

- 14:30 US Crude Oil Inventories. Estimate 3.7M. Actual 3.4M

- 18:00 FOMC Statement

- 18:00 Federal Funds Rate. Estimate <0.25%

Upcoming Events

Thursday (Oct. 29)

- 12:30 US Advance GDP. Estimate 1.6%

- 12:30 US Unemployment Claims. Estimate 264K

*Key releases are highlighted in bold

*All release times are GMT

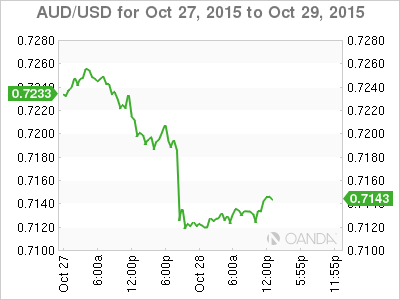

AUD/USD for Wednesday, October 28, 2015

AUD/USD October 28 at 16:15 GMT

AUD/USD 0.7141 H: 0.7196 L: 0.7111

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.7000 | 0.7060 | 0.7100 | 0.7213 | 0.7440 | 0.7664 |

- AUD/USD posted sharp losses in the Asian session but has partially recovered in the European and North American sessions.

- On the downside, the round number of 0.71 is under pressure.

- 0.7213 is an immediate resistance line.

- Current range: 0.7100 to 0.7213

Further levels in both directions:

- Below: 0.7100, 0.7060 and 0.70

- Above: 0.7213, 0.7440, 0.7664 and 0.7770

OANDA’s Open Positions Ratio

AUD/USD ratio is showing slight movement towards long positions on Wednesday, continuing the trend we saw a day earlier. Long positions have a solid majority (61%), indicative of trader bias in favor of the Australian dollar reversing direction and moving to higher levels.