The euro will remain under pressure until the December meeting of the ECB

As expected, the ECB, through its president M. Draghi not parted with the idea of expanding incentives. On the probability of increased asset purchase, as well as the extension of the program of quantitative easing, according to Draghi, will be known at the December meeting of the Central Bank.

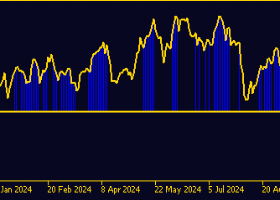

Markets expect from Draghi's news of additional stimulus, but had no idea that he would report on the timing of the decision on the program. And it was no surprise that led to the collapse of the single currency of the euro area at the time of more than 2% against the US dollar as it fell heavily and against the British pound and the yen.

Given the realities of the past, we can say that before the December meeting of the ECB, the European currency will remain under pressure, and any negative economic statistics will only strengthen expectations of a positive decision on the additional stimulus.

Today we have published important data on an index of business activity in the euro area, and that is especially valuable, the value of this indicator for Germany. The indicator showed a decline to 51.6 points in October against September values to 52.3 points. However, the index of business activity in the services sector has expanded, and bad - to 55.2 points against 54.1 in the previous value of the item. Also turned positive value and the composite index of business activity, which grew to 54.5 points in October against 54.1 points in September. On the data output of the German market did not react, as they have been mixed. But the numbers of these indicators for the euro area is much better. The index of business activity in the euro area came in at the September - 52 points, although he predicted decline to 51.7 points.Composite index and the index of business activity in the services sector exceeded forecasts.

The single currency has reacted to this information is only a slight increase, since too high a degree of probability of new stimulus measures hinders its consolidation.

Later figures will be published index of business activity in the manufacturing sector (PMI) US in October. It is expected that the indicator will drop to 52.8 points from 53.1.In our view, this is unlikely to have a strong influence on the major currency pair, as hopes that the ECB will extend the promotion, will put pressure on it, and thus compensate for the American film negative for the euro.

The forecast of the day:

The EUR / USD fell to the lower border of a short-term uptrend to 1.1065 and possibly against the backdrop of local oversold be corrected upwards or to the level of 1.1145 (23% retracement Fibonacci) or to 1.1190 (38% retracement Fibonacci) before you continue to attempt to reduce the 1.1000. A pair of push-up can be published today, the weak statistical data from the US.