German Ifo Business Climate, GDP data from the UK, the US and Canada, US Durable Goods Orders, Rate decision in the US, Japan and New Zealand. These are the top events on forex calendar. Here is an outlook on the market-movers for the coming week.

The euro crashed and the dollar regained its throne in an exciting week. Will this volatility continue? GDP data from the UK, the US and Canada, US Durable Goods Orders, and rate decisions in the US, Japan and New Zealand stand out. These are the top events on forex calendar. Here is an outlook on the market-movers for the coming week.

U.S. housing and jobs data were positive, keeping the door open for a Fed rate hike by the end of the year. Existing home sales surged 4.7% to an annual rate of 5.55 million units in September. The strengthening housing markets boosts household wealth and increases the pace of consumer spending. The upbeat domestic demand helps balance the downside risks from softening global growth. Furthermore, the number of jobless claims also points out the continuous improvement in the labor market, marking the 33rd straight week that claims were below 300,000. Will this positive trend continue?

Draghi dealt a deadly blow to the euro: expectations were already high but he certainly surpassed them with talk about extending and expanding QE, surprising talk about a rate cut and a “vigilant” hint of imminent action. The worries expressed by Draghi were exacerbated by the Chinese rate cut and this already made the dollar king. The US also enjoyed positive housing and jobs data, keeping the door open for a Fed rate hike by the end of the year. Elsewhere, the loonie suffered from lower forecasts and lower oil, the kiwi from falling dairy prices and only the pound seemed sound, Will this positive trend continue? Let’s start:

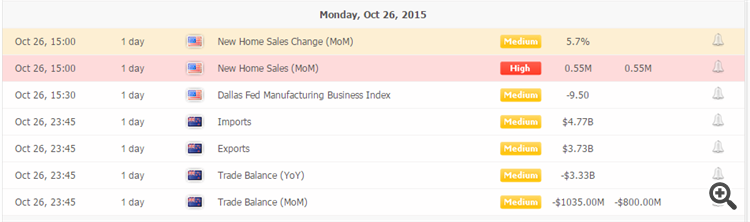

- German Ifo Business Climate: Monday, 9:00. German business sentiment edged up unexpectedly in September, reaching 108.5 after a revised 108.4 in August. The reading suggests that the slowdown in China had no immediate effect on German exporters. Economists expected a 107.8 reading. Companies were less positive about their current business situation compared to August. However, sentiment in October is expected to drop following the Volkswagen scandal. Analysts expect business climate to reach 108.1 this time.

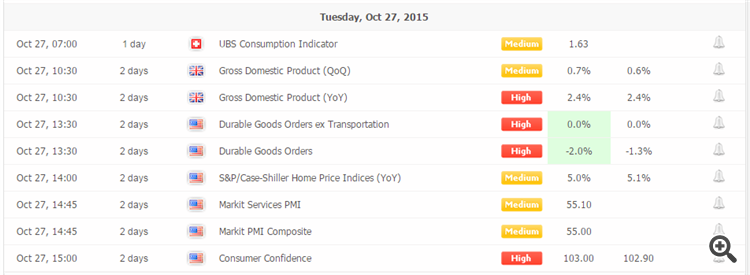

- UK GDP data: Tuesday, 9:30. The UK’s economy expanded 0.7% in the second quarter, compared to a 0.4% growth in the previous quarter. Economic output was 2.6% higher than in the same period a year ago. This was the tenth quarter of sustained economic growth. Industrial output figures registered the biggest increase since late 2010, rising 7.8%. Domestic demand is rising due to low inflation boosting consumer spending. However, there are still risks in the world economy with instability in the Eurozone and in China. UK GDP is expected to reach 0.6% in the third quarter. Recent data has been positive.

- US Durable Goods Orders: Tuesday, 12:30. The positive trend in the number of orders for long lasting equipment stalled in August amid volatility in financial markets and concerns that global growth is slowing. Orders excluding transportation equipment remained flat after rising 0.6% in the previous month. Orders for all durable goods plunged 2% mainly due to declines in defense and aircraft. Nevertheless, both capital goods orders and shipments are expected to rebound in the third quarter. Durable orders are forecasted to decline 1.1%, while Core orders are expected to remain flat.

- US CB Consumer Confidence: Tuesday, 14:00. The Conference Board’s Consumer Confidence Index edged up to 103 in September, exceeding estimates of 96.2. The reading followed a 101.3 reading in August. Consumers who said business conditions are “good” increased 23.7% to 28.0%, while those claiming business conditions are “bad” declined from 17.8% to 16.7%. Short-term outlook expectations remained flat in September. The percentage of consumers expecting business conditions to improve over the next six months increased from 16.6% to 17.9%. Consumer Confidence is expected to reach 102.5.

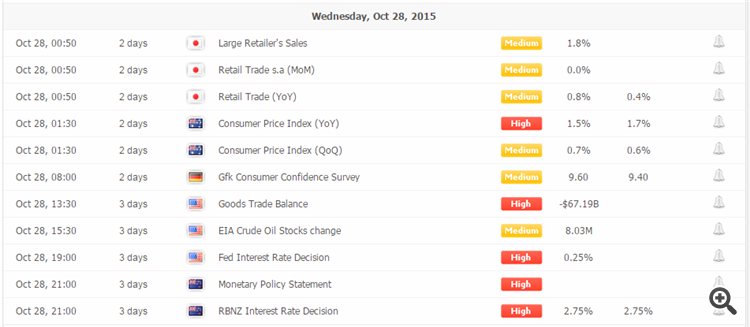

- US Rate decision: Wednesday, 18:00. The Fed is expected to leave policy unchanged in this meeting, which doesn’t consist of a press conference nor fresh forecasts. Markets will focus on the statement for hints about a move in December. Since the last meeting in which the Fed erred on the side of caution, we had more upbeat Fed statements, but these were met with a poor NFP. Other figures were mixed: stronger inflation but weak retail sales. There is a good chance that the Fed will leave us a bit confused, leaving all options open. Perhaps we can derive the potential outcome of the GDP on the following day from the tone of the statement, given the Fed probably has the figures before we do.

- NZ rate decision: Wednesday, 20:00. New Zealand’s central bank cut its benchmark interest rate in September, noting that further cuts may be done in order to boost growth after the sharp fall in export prices and the slowdown in earthquake reconstruction activity in Christchurch. Despite the easing measures, policymakers still expect further weakness in the currency, adjusting to the recent sharp fall in export commodity prices. The RBNZ also lowered their growth expectations. This time, the jury is out: a strong economy faces lower prospects. The uncertainty implies a strong reaction in any case: a hold or a cut. It’s important to remember that if the RBNZ doesn’t cut this time, it will probably do so next time.

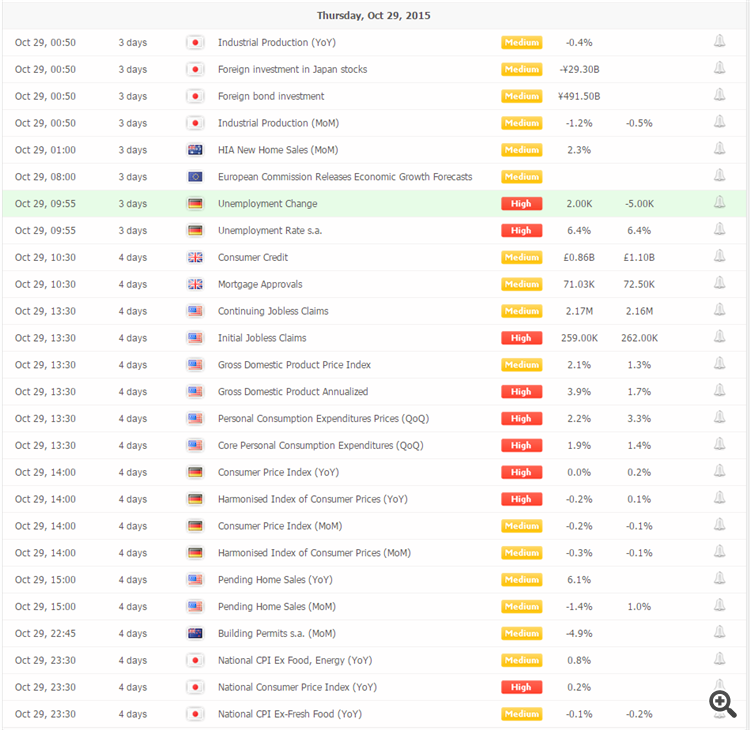

- US GDP data: Thursday, 12:30. America’s economy gathered momentum in the second quarter, expanding 3.9% on an annualized basis according to the most recent data. Economists believe the US economy has slowed down in Q3, with forecasts standing at a rate of only 1.6%, given the recent data. It’s important to remember that the first release is usually heavily revised in the following two publications.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits inched up to 259,000 last week from 256,000 in the prior week. The reading was better than the 266,000 forecast by analysts, indicating the labor market remained strong. The four-week moving average of initial claims declined to 263,000, the lowest level since 1973.

- Japan rate decision: Friday. The Bank of Japan kept its monetary policy on hold in its first October meeting, acknowledging risks from a slowdown in emerging markets but optimistic regarding the strength in the domestic economy. The Central Bank noted it would continue to buy Japanese government bonds at a pace of Y80tn a year. And now, the BOJ also makes its semi-annual outlook, and this is seen as the best timing to act. Will they or won’t they? Hints sent by the Japanese government point to no action. However, given the easing in the euro-zone and in China, the BOJ might hop on with some more easing of its own, a negative rate or QE.

- Canadian GDP: Friday, 12:30. The Canadian economy expanded for a second straight month in July indicating a positive shift from the first six months of 2015. GDP grew by 0.34% in July after a 0.44% growth posted in June. The low oil prices and harsh winter caused a 0.9% decline in the first 5 months. Economists believe the third-quarter GDP is expected to range between 2.5% and 3%, well above the 1.5% projected by the Bank of Canada in its recent forecast in mid-July.

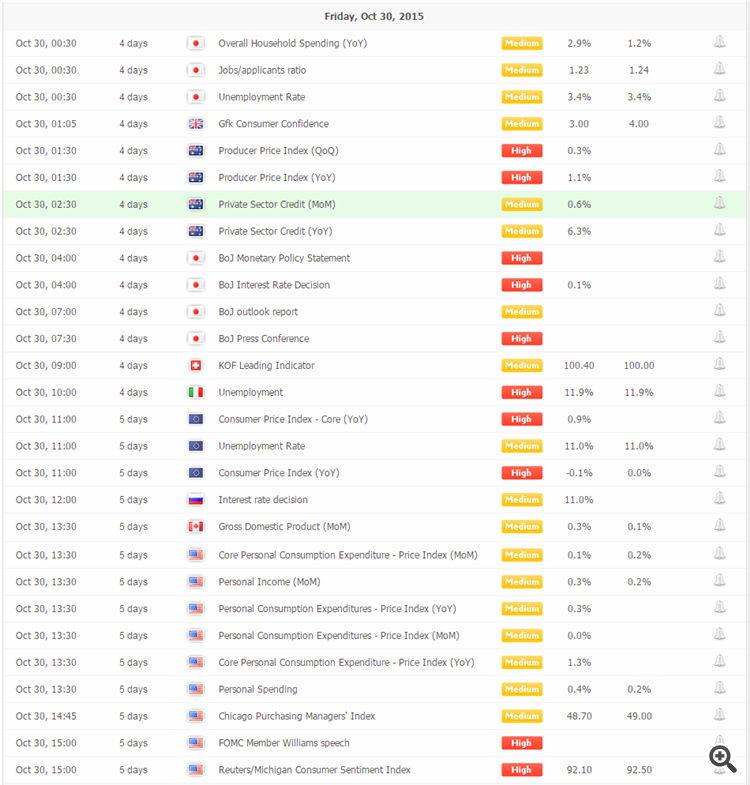

*All times are GMT.