Morgan Stanley is expecting for EUR/USd to be in breakdown below

1.1120/1.1100 level with 1.0850 as a next target with the possibility to

break resistance levels in spike way in short-term situation for

example:

-

"A more risk positive environment appears to be

developing for currencies markets which should continue to provide some

short-term relief for commodity-related currencies and selective EM

currencies."

-

"However, the reaction in currency markets, so far, has been more muted than

may have been expected. This may cause some questioning of the

relationship between currencies and the risk environment."

- "We think it does, although it has been challenged on occasions recently. Indeed, monetary policy expectations are also having a strong influence on the EUR. Our FX drivers analysis suggests that front-end rates are having an equally strong positive relationship with the EUR as the negative risk relationship."

- "Hence, while we believe that the relationship between the EUR and the global risk picture remains intact, it has loosened and is now more prone to challenges and shift in policy expectations."

-

"Overall, in the current environment we expect the EUR to put

pressure on the lower end of the range, with a break below 1.1120/00

opening the way for a EURUSD decline towards 1.0850. But risk-off events

should still generate EUR spikes higher."

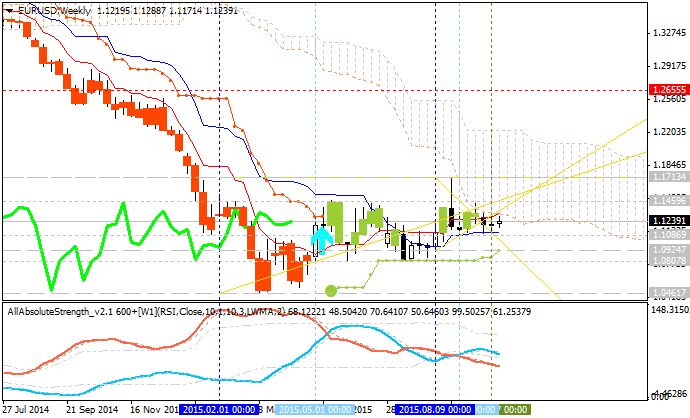

As we see from the chart above - the price is on bearish with the ranging within the following support/resistance levels:

- 1.1459 resistance level located inside Ichimoku cloud in the ranging area of the chart, the next target in this case is 1.2655 'reversal' resistance level located in the primary bullish area of the chart, and

- 1.0924 support level located in the bearish area with 1.0807 as a next bearish target.